Advertisement|Remove ads.

Caterpillar Stock Falls After UBS Downgrade On Tariff-Driven Earnings Risks, But Retail’s Still Bullish

Caterpillar stock fell 2.8% on Monday after UBS downgraded the stock to ‘Sell’ from ‘Neutral’ due to potential risks to earnings.

According to The Fly, UBS also cut the price target for the stock to $243 from $385. The new price target still implies a downside of 15.6% from the last close.

The stock has a consensus price target of $380.65, according to FinChat data.

As per The Fly, UBS believes that more downside earnings related to macroeconomic concerns are not yet priced.

The brokerage noted that the tariffs' macroeconomic impacts and continued uncertainty will lead to further deterioration in multiple sectors of the U.S. and global economies.

UBS believes that this will weigh on the more economically sensitive parts of Caterpillar's business, including some construction verticals, oil and gas, and mining.

Caterpillar is viewed as an economic barometer, as its equipment is used in a wide range of industries.

U.S. markets saw their biggest weekly decline since March 2020 last week after President Donald Trump imposed a base 10% tariff on all imports, with some countries facing even higher reciprocal tariffs.

Stocks were battered even further after China imposed reciprocal 34% tariffs on all U.S. goods, effective Thursday. On Monday, Trump warned about imposing further 50% tariffs on Beijing.

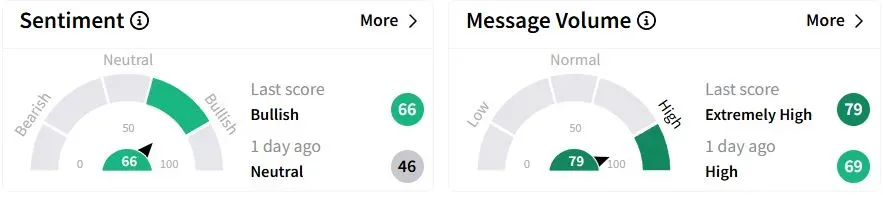

Retail sentiment on Stocktwits still moved to ‘bullish’ (66/100) territory from ‘neutral’(46/100) a day ago, while retail chatter rose to ‘extremely high.’

Some retail traders acquired Caterpillar shares after a 14.4% decline over the past week.

Caterpillar shares have fallen 23.4% year-to-date (YTD).

The company had projected a slight drop in sales in 2025 as companies are delaying purchases for better clarity on U.S. tariff policies.

Also See: Greenbrier Flags Trump Trade Uncertainty After Q2 Profit Miss: Retail On Wait-And-Watch Mode

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)