Advertisement|Remove ads.

Zydus Lifesciences: SEBI RA Sameer Pande Sees Action Only Above ₹1,010

Zydus Lifesciences is on analysts' radar. The stock rose nearly 2% on Wednesday after reporting mixed fourth-quarter results.

While the pharma company demonstrated strong operational performance, it reported a minor decrease in net profit.

For the March quarter, the pharma major reported a consolidated revenue of ₹6,528 crore, up 18% from ₹5,533 crore a year ago.

EBITDA rose sharply by 30.3% to ₹2,126 crore, pushing margins higher to 32.6% from 29.5% last year.

However, net profit dipped marginally by 1% to ₹1,171 crore from ₹1,183 crore YoY.

The company’s board also declared a final dividend of ₹11 per share, subject to shareholder approval at its upcoming AGM in August.

From a technical perspective, SEBI-registered analyst Sameer Pande noted that Zydus Lifesciences was facing a resistance zone between ₹940 and ₹1,000, which had repeatedly stalled in recent sessions.

The Relative Strength Index (RSI) hovered around 53, reflecting sideways momentum with no clear directional bias yet.

He observed that while the broader trend remains stable, the stock needs to decisively cross the ₹1,010 level to confirm a short-term uptrend.

Brokerages have revised their targets. Jefferies retained a Buy rating but cut its price target to ₹1,150 from ₹1,350, citing tempered expectations.

On the other hand, Motilal Oswal acknowledged the strong FY25 finish but flagged potential growth headwinds in FY26, assigning a Neutral rating with a target of ₹930.

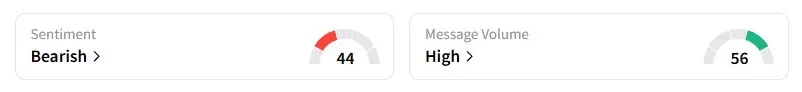

And data on Stocktwits shows a shift in retail sentiment from ‘neutral’ to ‘bearish’ in the past week, indicating caution among investors.

Zydus Life shares have fallen 8% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)