Advertisement|Remove ads.

Avocado Stocks Ripen: Retail Goes ‘Extremely Bullish’ On Mission Produce, Calavo Growers After Strong Earnings

Shares of Mission Produce Inc. (AVO) and Calavo Growers, Inc. (CVGW) surged early Tuesday after both avocado producers posted impressive quarterly earnings, drawing enthusiastic retail interest.

Mission Produce reported Q3 revenue of $324 million, significantly outpacing the consensus estimate of $230.95 million, while earnings per share (EPS) of $0.23 easily surpassed analysts’ average estimate of $0.03.

The company marked a 24% year-over-year revenue increase and a 49% rise in adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) to $31.5 million.

“We are pleased to report another quarter of strong financial performance, marked by robust third-quarter revenues of $324.0 million,” said CEO Steve Barnard. He praised the company’s global sourcing network for maintaining customer demand amid a challenging production year in Peru, achieving per-unit margins that exceeded their targeted range.

Looking ahead, Mission Produce expects industry volumes to remain flat to slightly lower in Q4 compared to the prior year, with California and Peru harvests concluding and the company transitioning to a Mexico-centric sourcing model.

Lake Street analyst Ben Klieve noted that Mission Produce “obliterated our estimates” for Q3, driven by a 36% increase in per-unit avocado prices and cost structure improvements.

He maintained a ‘Buy’ rating on the stock with a $15 price target, citing an increasingly positive outlook due to exceptional results and an improving balance sheet. Shares of Mission Produce jumped 20% in Monday’s after-hours trading, which Klieve called "an appropriate reaction."

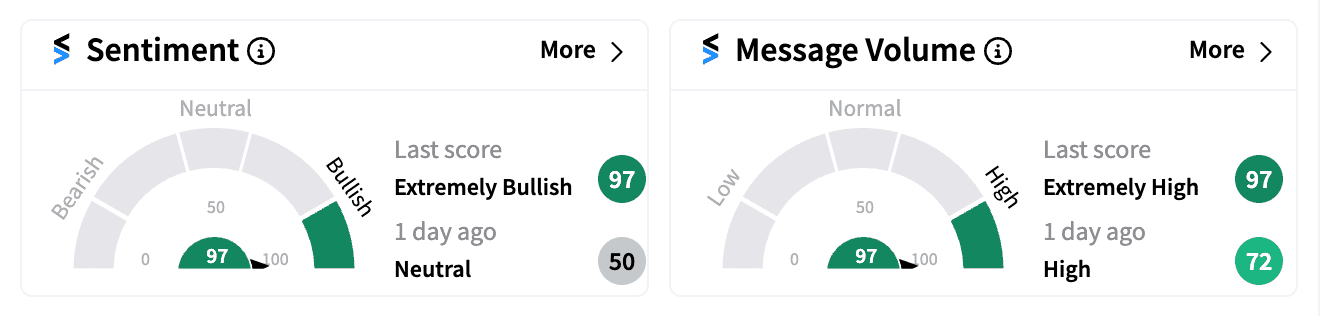

Retail sentiment for Mission Produce spiked to an ‘extremely bullish’ rating of 97/100 on Stocktwits — the highest score in a year — as message volume soared. The stock is up over 20% year-to-date.

Calavo Growers also posted strong fiscal third-quarter results, earning $0.57 per share, beating analyst estimates of $0.43 per share. The company doubled its quarterly dividend to $0.20 per share, signaling confidence in its financial health.

“We look forward to delivering solid financial results for the fourth quarter and fiscal year,” Calavo stated. The company plans to reinvest proceeds from the sale of its Fresh Cut business into its core avocado and guacamole segments while returning cash to shareholders over time.

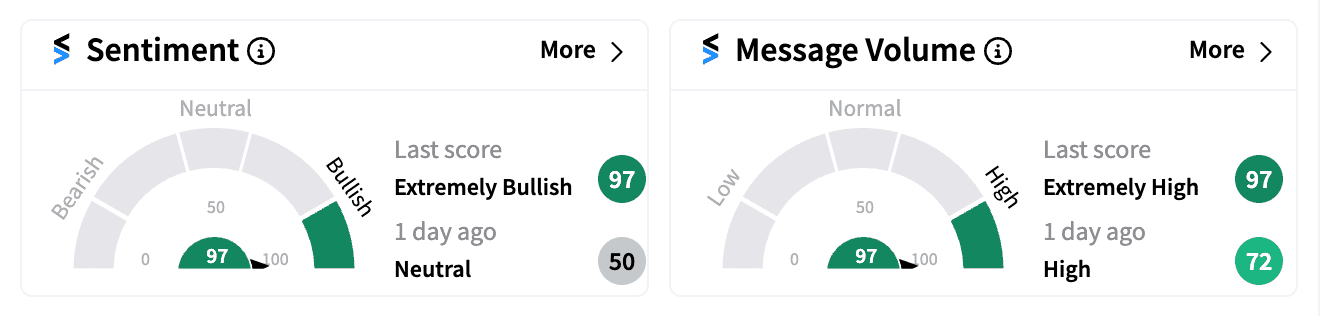

Retail sentiment for Calavo Growers turned ‘extremely bullish’ (88/100) on Stocktwits, with message volume reaching its highest level this year, reflecting strong investor enthusiasm.

Still, CVGW shares are down about 13% this year.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)