Advertisement|Remove ads.

Coinbase, Robinhood Stocks Upgraded By Barclays On ‘More Sensible’ Valuations Amid Bitcoin Slide: Retail Sentiment Mixed

Shares of Coinbase (COIN) and Robinhood Markets (HOOD) received a lift from Wall Street on Friday as Barclays upgraded both stocks, citing “more sensible” valuations and maturing business models.

Barclays upgraded Coinbase and Robinhood to ‘Equal Weight’ from ‘Underweight,’ adjusting its price targets to $169 (down from $206) for Coinbase and to $20 (up from $18) for Robinhood.

The brokerage noted that both companies have shown significant growth over the past year, improving profitability through cost rationalization and expanded product offerings, despite inherent risks in their business models.

The firm highlighted potential sales catalysts stemming from new products and regulatory developments, arguing that the risk/reward balance has become more favorable.

Coinbase: Steady Growth Amid Market Volatility

Coinbase, the largest U.S. cryptocurrency exchange, recently posted Q2 earnings of $0.14 per share, with revenue doubling year-over-year to $1.45 billion, exceeding analyst expectations.

For Q3, the company forecasts subscription and services revenue between $530 million and $600 million. Despite a challenging market, Coinbase continues to generate a significant portion of its income from trading fees, though lower Bitcoin prices of late have seen some retail traders pull back.

Robinhood: Diversifying Beyond Trading

Robinhood recently posted strong Q2 results with total net revenues rising 40% year-over-year to $682 million.

Since its early days as a trading platform, Robinhood has diversified into retirement products and credit cards. It also supports buying, selling, and receiving Bitcoin (BTC.X), as well as other cryptos and stablecoins.

CEO Vlad Tenev recently emphasized the company’s commitment to building for a future where crypto is integral to the financial ecosystem.

Deutsche Bank, which has described HOOD’s potential as “exceptionally attractive,” expects long-term earnings to be driven by transaction revenue and strong cost management, along with expanding its business beyond cryptocurrencies into equities, options, and other investment products.

Market Reaction and Retail Sentiment

Despite the positive ratings from Barclays, both stocks faced a pullback on Friday — Coinbase shares fell over 4%, and Robinhood dropped more than 3% as Bitcoin slipped below $54,000 following U.S. jobs data that missed forecasts.

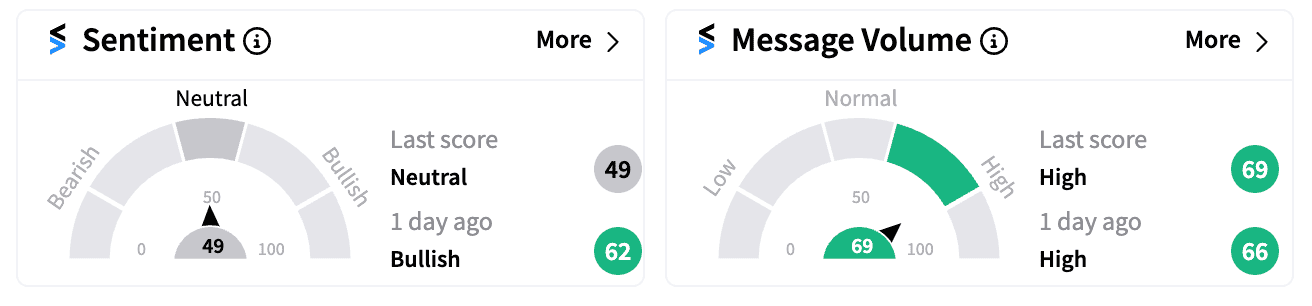

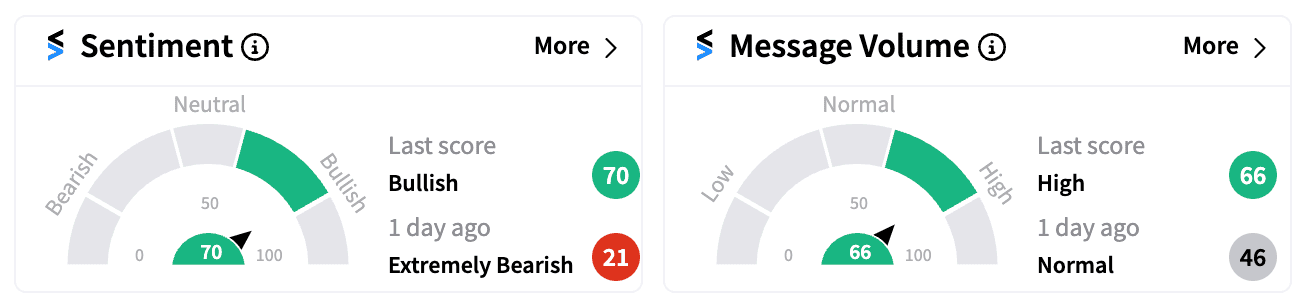

However, retail sentiment on Stocktwits remained stable, with COIN rated ‘neutral’ and HOOD receiving a ‘bullish’ outlook.

Cryptocurrencies continue to move in tandem with broader market trends, influenced heavily by Federal Reserve policy signals. With expectations of a potential rate cut this month after a series of hikes to combat inflation, market participants are watching closely to see how significant the upcoming adjustments will be.

Read next: Warren Buffett’s Big Bank Of America Sell-Off Approaches $7B Mark: Retail Finally Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)