Advertisement|Remove ads.

Emergent Bio Stock Soars After Securing $400M In Mpox, Smallpox Vaccine Orders: Retail Gets Extra Dose Of Optimism

Shares of Emergent BioSolutions, Inc. (EBS) jumped over 9% in pre-market trading Wednesday, after the company revealed it has secured nearly $400 million in vaccine orders for 2024 and 2025. These include contracts for its smallpox and mpox product line-up.

The orders consist of a U.S. government contract modification to procure ACAM2000 (Smallpox and Mpox Vaccine, Live) and CNJ-016 [Vaccinia Immune Globulin Intravenous (Human)] (VIGIV).

Emergent said it has already delivered around $210 million in vaccines in 2024, with an additional $185 million in confirmed orders for delivery through 2025.

A major catalyst for the stock came in August when the FDA approved an update to ACAM2000's label, allowing its use in preventing mpox, alongside smallpox.

Discussions are also underway with the WHO regarding potential emergency use listings for ACAM2000 in global mpox outbreaks.

President Joe Biden announced this week the donation of 1 million mpox vaccine doses and $500 million in aid to African nations, where mpox cases are surging — particularly in the Democratic Republic of Congo, which is reportedly facing a shortage of tests.

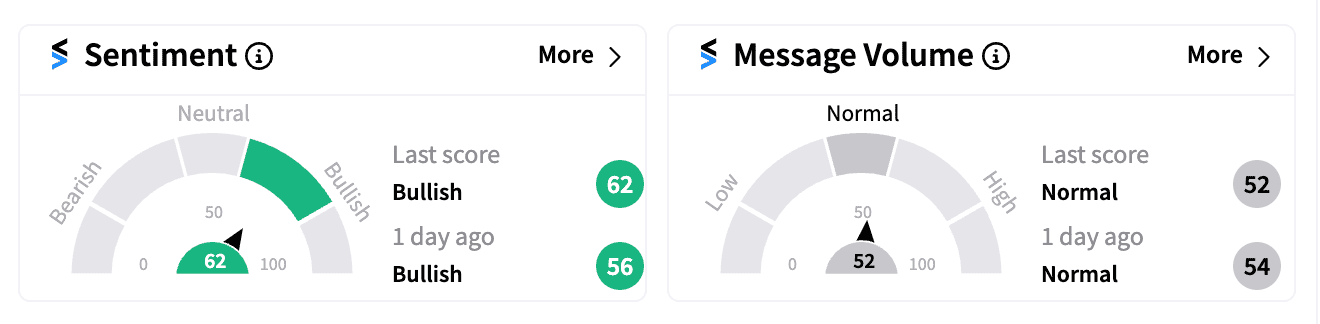

On Stocktwits, retail sentiment for EBS turned more ‘bullish’ (62/100) from a day earlier.

One user highlighted the importance of the $400 million order, noting that it was more than the company’s current market cap.

EBS has gained 135% this year amid the mpox outbreak, and retail interest has soared, with a 560% increase in followers on Stocktwits over the past three months. Message volumes have surged as well, signaling heightened enthusiasm around the stock.

Read next: Rivian Stock Dips After Morgan Stanley Downgrade: Retail Sentiment Slumps Too

/filters:format(webp)https://news.stocktwits-cdn.com/large_vertiv_logo_original_jpg_93aa8d4e65.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_el_paso_international_airport_jpg_bc5d9673f7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pony_ai_jpg_456f0e3d9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Madrigal_pharma_4d3b712d4f.webp)