Advertisement|Remove ads.

Faraday Future Stock Soars 26% In Friday’s Pre-Market On Nasdaq Compliance Letter, $30M Financing Announcements: Retail Remains Bullish

Shares of electric-vehicle maker Faraday Future Intelligent Electric Inc (FFIE) jumped over 26% in Friday’s pre-market session as of 6:52 a.m. ET after the company disclosed two important developments.

Faraday Future said in a late filing on Thursday that it has received a written notice from Nasdaq Stock Market LLC stating that the firm has regained compliance with all Nasdaq continued listing criteria. At the same time, the company notified it has received $30 million in financing commitments from investors in the Middle East, the United States, and Asia.

The EV-maker said the new financing commitment includes a previously funded $7.50 million coupled with $22.50 million of new investment in the form of convertible notes and warrants to acquire additional shares of the company. The conversion price for the convertible notes and exercise price for the warrants stand at $5.24 and $6.29 per share, respectively.

The firm also highlighted the involvement of Master Investment, an investment firm belonging to Sheikh Abdulla Al Qassimi from Ras Al Khaimah, UAE in the financing round.

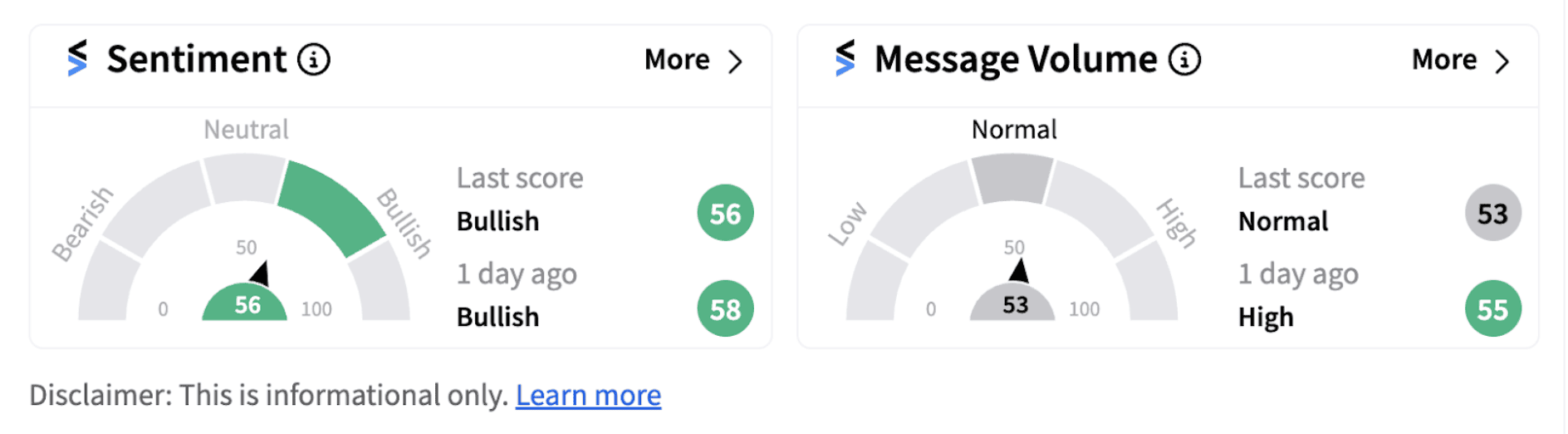

Following the disclosures, retail sentiment on Stocktwits continued to trend in the ‘bullish’ territory (56/100).

The company had established a Middle Eastern sales entity in Dubai in April 2024 and the firm believes it now operates a “third pole” geographic strategy expanding its reach beyond the U.S. and China.

Under its Global Automotive Industry Bridge Strategy, Faraday Future now expects to integrate the strengths of the U.S. automotive industry and markets with those of Chinese original equipment manufacturers (OEMs) and parts suppliers focusing on the $20,000 to $80,000 price segment.

Majority of Stocktwits followers of the ticker are expressing optimism on the stock, with one user named ‘London718’ praising the firm’s leadership.

Another user is positive about the company's efforts to integrate strengths of the U.S. auto industry with that of Chinese OEMs.

Notably, the stock is down over 78% this year and has lost over 99% of its value in the last one year. If Friday’s pre-market optimism continues through the day, it could help the stock regain some of its lost glory. Investors, however, will continue to watch how the firm’s strategies are panning out in the coming times.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_newsmax_resized_jpg_3a813181b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)