Advertisement|Remove ads.

Microsoft Stock Downgraded To ‘Neutral’ From ‘Buy’ By D.A. Davidson: Retail Sentiment Sours

Microsoft Corp. (MSFT) shares were in focus on Monday after a D.A. Davidson analyst downgraded the stock to ‘Neutral’ from ‘Buy’ while maintaining a price target of $475.

Analyst Gil Luria reportedly wrote in his note that competition has largely caught up with the firm on the AI front, which reduces the justification for the current premium valuation.

“We believe that Microsoft’s lead is now diminished in both the cloud business and code generation business, which will make it hard for MSFT to continue to outperform,” the analyst reportedly stated.

Luria also highlighted the fact that the software-maker is guiding for an operating margin contraction, after a notable rise last year, to pay for its data center capex that is rising to 12% of revenue to 21% of revenue. “This is a higher rate of increase compared to Amazon and Google, a result of Microsoft’s greater reliance on NVIDIA,” the analyst noted.

The analyst reportedly believes that Microsoft’s lead has now diminished in both the cloud business and code generation business, which will make it hard for the firm to continue to outperform.

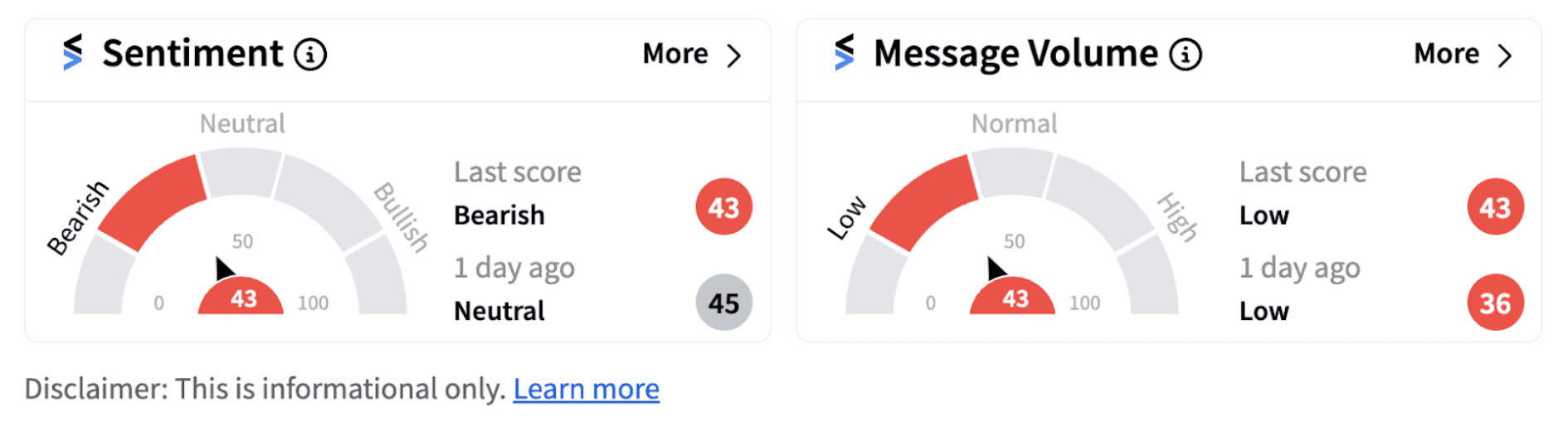

Following the report, retail sentiment on Stocktwits declined into the ‘bearish’ territory (43/100) from the ‘neutral’ zone.

Despite the bearish sentiment, some Stocktwits users believe the stock may hit the $440 mark soon.

Shares of the firm had rebounded from the $400-mark after a brief correction. However, the stock appears to be taking a breather after hitting the $440-mark recently, forming a “higher-low” on its daily chart. In July 2024, Microsoft shares hit a record high of about $467.

The company has made some important announcements in recent weeks. Earlier this month, the firm raised its quarterly dividend and announced a new share repurchase program. Its board of directors declared a quarterly dividend of $0.83 per share, reflecting a 10% increase over the previous quarter's dividend.

The tech major also announced a new share repurchase program worth $60 billion. Microsoft said the new share repurchase program has no expiration date but added that it may be terminated at any time.

Investors will be keenly analyzing how much steam is left in mega cap tech stocks after the strong momentum they witnessed since the beginning of 2024.

Also See: Intel Stock Rises Pre-market On Apollo Global Offer Report: Retail Sentiment Soars

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)