Advertisement|Remove ads.

Southwest COO Warns Employees Of ‘Tough Decisions’ Going Ahead: Retail On Wait-And-Watch Mode

Southwest Airlines (LUV) has warned its employees that the airline may have to take some tough decisions going ahead to increase profits, according to a CNBC report. The development comes in the wake of increasing pressure from activist investor Elliott Investment Management.

Notably, Southwest Airlines has been busy making a lot of changes to its decades-old business model to shore up revenues. The steps reportedly include introducing seats with more legroom with a higher fare, commencing red-eye flights, getting flights listed on Google Flights and Kayak and targeting young customers.

However, COO Andrew Watterson said in a video message to staff last week that these steps may not be enough and that the firm has to change its network.

“We have a couple of difficult decisions heading our way. It’s not station closures. But we need to keep moving the network to help us drive back to profitability,” Watterson said, according to CNBC. “And so I apologize in advance if you as an individual are affected by it.”

Although Southwest isn’t planning any furloughs, it could reduce its footprint in some cities and transfer staff to different locations, the report added.

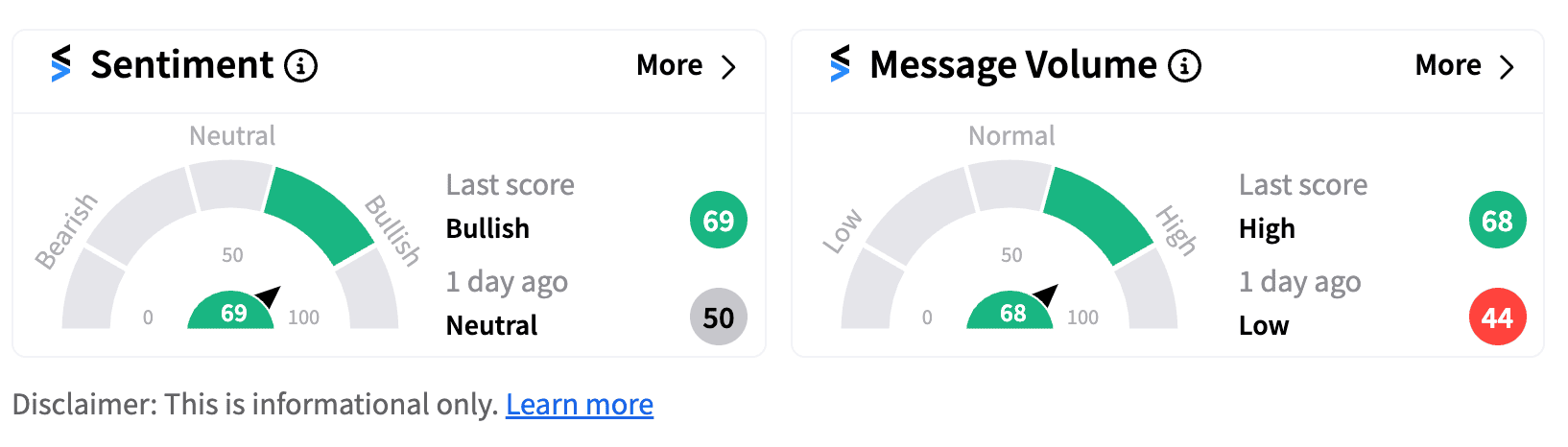

Following the announcement, retail sentiment on Stocktwits continued to remain in the ‘neutral’ territory (53/100), albeit with a higher score.

Some Stocktwits users believe the “tough decisions” will bring in more headwinds in the times to come.

Southwest chairman Gary Kelly recently said in a shareholder letter that he will step down from his position next year while six of the firm’s current directors will retire in November. The announcement came after Kelly and two other independent directors of the firm met with Elliott Investment Management at its New York Office.

Notably, funds managed by the activist investor own a 11% stake in Southwest Airlines. Elliott had earlier told Southwest Airlines investors that the firm needs a new outside leadership and that it is ready to engage with the company to discuss its future. The activist investor had said it intends to nominate ten independent, highly qualified candidates to the company's board and said it plans to move forward expeditiously to formally nominate the candidates. It had also sought the ouster of CEO Bob Jordan.

However, Kelly argued that the added component of leadership change in the middle of Southwest’s largest transformation to date is simply a risk that the firm and its shareholders do not need and cannot afford.

Southwest Airlines shares have returned just over 2.5% this year so far — a paltry gain compared to what the benchmark indices recorded on a year-to-date basis. Going forward, a lot will depend on the outcome of the firm’s revamp measures as well as the changes that it brings under the shadow of Elliott Management.

Also See: Microsoft Stock Downgraded To ‘Neutral’ From ‘Buy’ By D.A. Davidson: Retail Sentiment Sours

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)