Advertisement|Remove ads.

Walmart Stock Dips As Sam’s Club Announces Pay Hike For 100,000 Frontline Associates: Retail’s Not Worried

Walmart (WMT)-owned Sam’s Club, on Tuesday, announced a new plan under which nearly 100,000 frontline associates will see an increase in their hourly wages. Shares of Walmart were trading over 2% lower on Tuesday.

Sam’s Club said that associate hourly wages will progress faster in their pay range, expanding the increase to between 3% and 6% based on years of service. As a result, the average hourly rate for Sam’s Club associates is expected to be above $19, with the potential to earn thousands of dollars annually in bonuses, it said.

In the last five years alone, Sam’s Club’s average hourly wage has increased nearly 30%, the company claimed. The new pay plan for frontline associates will come into effect beginning Nov. 2, 2024.

Sam’s Club also highlighted that three of its four salaried managers began as hourly associates, and in the last five years, the number of hourly associates promoted to salaried positions rose nearly 400%.

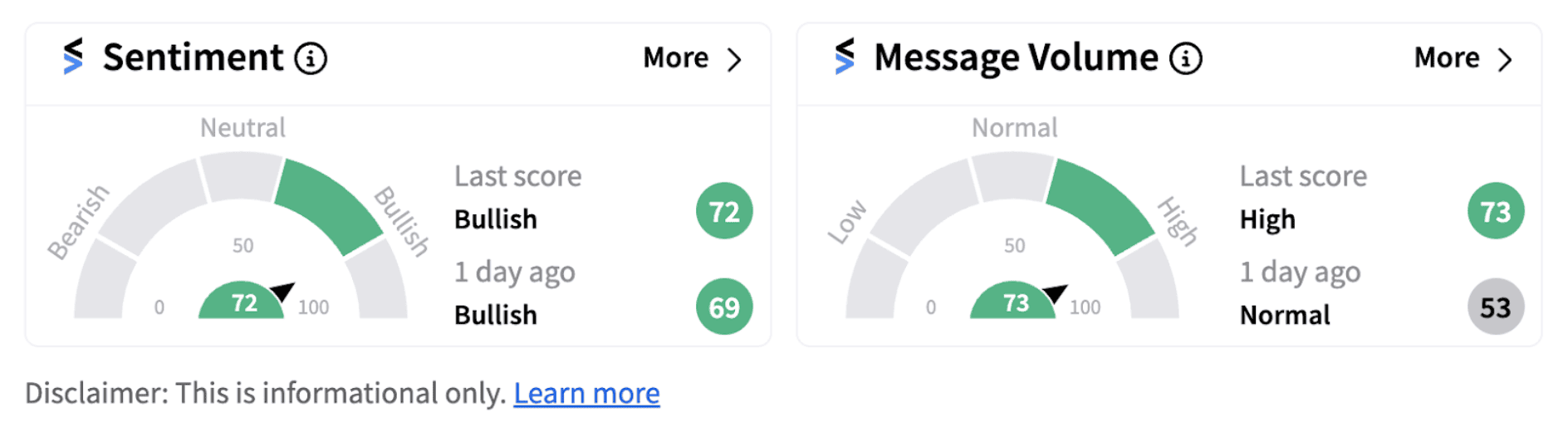

The announcement, however, failed to elicit any negative reaction from retail investors on Stocktwits who continued to remain ‘bullish’ on the stock.

During the second quarter, Sam’s Club witnessed a strong growth in membership income, up 14.4%, with record total membership. Net sales rose 4.7% year-over-year (YoY) to $22.90 billion while operating income grew 11.5% YoY to $0.6 billion.

Notably, Walmart shares have risen nearly 48% this year. The stock recently hit its lifetime highs and has always closed above its 200-day moving average this year.

Stocktwits users with a bullish view expect the stock to touch new highs in the near term.

Some believe the stock is undervalued and that buy on dips may be the appropriate strategy.

Going forward, potential rate cuts by the Federal Reserve are expected to provide a decent boost to retail firms. However, it will likely be at least a few quarters before the real impact of rate cuts reach the retail consumer.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jim_Cramer_82051b390e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_I_Shares_25784fa2dc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_891861286_jpg_f5527520c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ark_Invest_5fb0c3e42a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ethereum_dce41bddd3.webp)