If you’re reading this, you’re old enough to remember the last time Credit Suisse contributed to a meltdown in the market. And trust us, it was not as long ago as you might think. 🤔

Last September, the Swiss Bank’s shares fell more than 20% on news that it was raising fresh capital for the fourth time in seven years. Then about a week later, a deleted tweet from an ABC Australia reporter started rabid speculation that the bank was on the verge of collapse. And for an entire weekend, everyone became an expert on credit default swaps (CDS), systemic risk in the banking sector, and Credit Suisse.

But once markets opened for trading on Monday morning, both the broader stock market and Credit Suisse shares rose. Crisis averted. 😏

Later that month, shares fell again after executives unveiled significant losses and a three-part turnaround plan. And in February, shares cratered again after the bank reported record annual losses and warned of more to come.

Then, just last week, the bank postponed issuing its annual report after a ‘late call’ from the U.S. Securities & Exchange Commission. The SEC had concerns over how it reported certain events and figures in prior financial statements. Finally, yesterday, the company published its annual report but indicated it found ‘material weaknesses’ in its financial reporting. 📝

That news, plus the recent turmoil in the U.S. banking sector, had Credit Suisse investors on the edge of their seats. And then today’s news happened…

With the amount of trading in the stock, its shareholder base has turned over many times over the years. But recently, it received a boost of confidence when the Saudi National Bank became its largest shareholder. And although that sounds like a great thing, it backfired a bit on the company today.

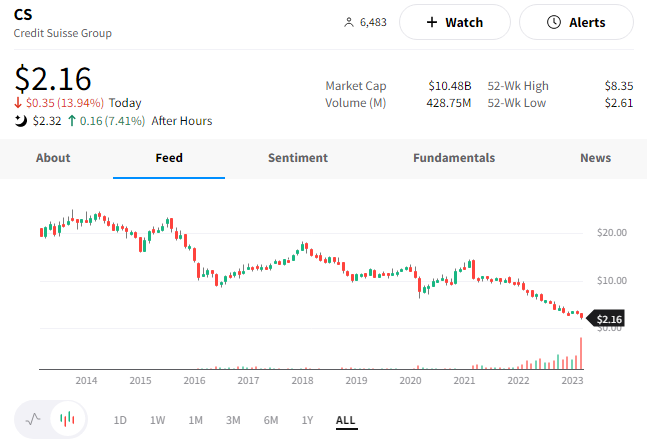

That’s because the Saudi National Bank said it cannot provide any additional capital because it can’t own more than 10% of the bank. The news sent Credit Suisse shares plummeting about 25% to a fresh all-time low. And at one point, its 5-year credit default swaps (CDS) were pricing in a 38% chance of the bank failing. 😱

Like other bank executives, Credit Suisse CEO Ulrich Koerner tried to calm the market by saying the bank’s liquidity base remained strong and was well above all regulatory requirements. That didn’t have its desired effect.

But what did help late in the day was the Swiss Financial Market Supervisory Authority and the Swiss National Bank finally speaking up. 🗪

They tried to restore confidence by stating that:

- $CS “meets the capital and liquidity requirements imposed on systemically important banks;”

- And the Swiss National Bank would provide additional liquidity if necessary.

Ultimately, $CS shares pared their losses and closed down *just* 13% on the day. They’ve also extended their gains after hours, rising roughly 10%. 📈

It’s too early to tell if the Swiss regulators’ words will help buy the company more time to stage a successful turnaround. But, as we discussed in our previous coverage of the bank, it’s become an increasingly difficult environment for poorly-run businesses to turn around. And that was before this past week when three U.S. banks failed, and a loss of confidence spread through the sector. 😬

As a result, calling this a “Credit Suisse Crisis” appears a bit silly to anyone that’s been paying attention to how many times the company has been on the brink. However, our flippant attitude does not suggest that the market should not care about Credit Suisse’s health at all. After all, it is one of just 30 global financial institutions that the international Financial Stability Board designates as systemically important.

It just seems like Credit Suisse is an easy target amidst the market’s fixation on the banking sector. 🎯

Unfortunately for the bank, that’s the name of the game in financial markets. We’ll just have to wait and see whether or not the current crisis at Credit Suisse is actually a crisis for the broader market and global financial system after all… 🤷