The Federal Trade Commission (FTC) and 17 states are suing Amazon in a landmark monopoly case that could change the future of “big tech” companies as we know them. 🧑⚖️

The 172-page complaint alleges Amazon unfairly promotes its own platform and services at the expense of third-party sellers who use its e-commerce marketplace for distribution. Despite the unfair practices, the company’s dominance in e-commerce gives sellers little choice but to accept its terms. And that ultimately results in higher prices and a worse consumer experience. 📝

FTC Chair Lina Khan told reporters that Amazon is “…squarely focused on preventing anyone else from gaining that same critical mass of customers.” and that, ultimately, the current case should set the foundation for how competition occurs in digital markets.

The complaint was filed, seeking a court order blocking Amazon from engaging in the allegedly anticompetitive behavior. The case is currently focused on proving Amazon’s liability under federal antitrust law and does not directly argue that Amazon should be broken up. 🛑

However, investors are reading into the historic lawsuit and seeing what’s potentially coming down the pike. European regulators have been having a field day with the U.S. tech giants while U.S. regulators have struggled to secure significant wins against the companies. Lina Khan and the FTC are looking to change that, taking Amazon’s monopolistic practices head-on and looking to set a precedent for future litigation.

Meanwhile, Amazon responded to the complaint, rejecting Khan’s logic. It said, “Today’s suit makes it clear the FTC’s focus has radically departed from its mission of protecting consumers and competition.” It also reiterated its view that its practices have helped spur competition, innovation, and selection across the retail industry, fostering lower prices, faster delivery, and better distribution for small businesses.

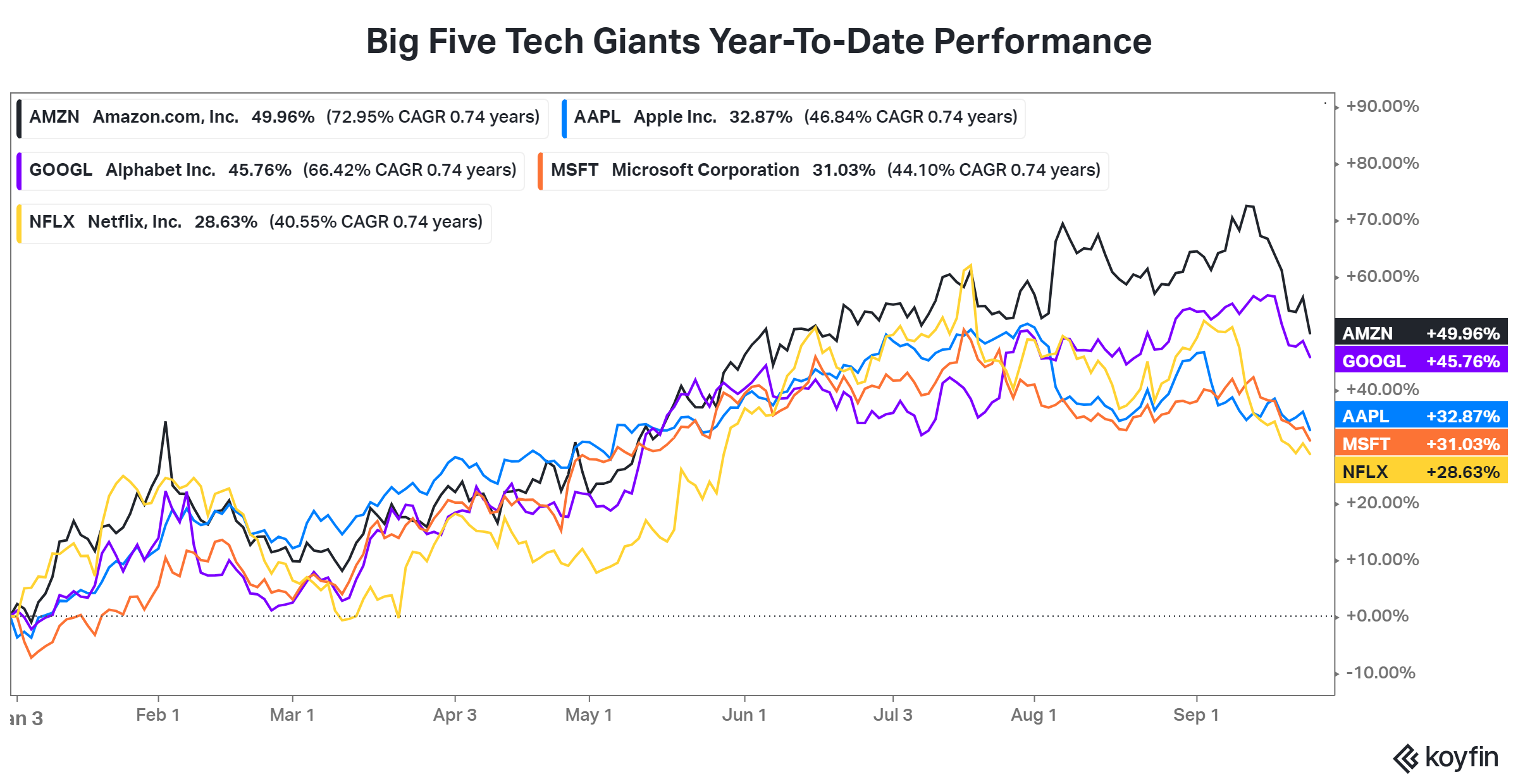

As a result of the potential implications of the lawsuit, the “big five” tech giants all traded lower. They’ve been driving much of the U.S. stock market indexes’ gains, so weakness here increased pressure on a market already falling because of the Fed’s hawkish tone and economic worries. 📉

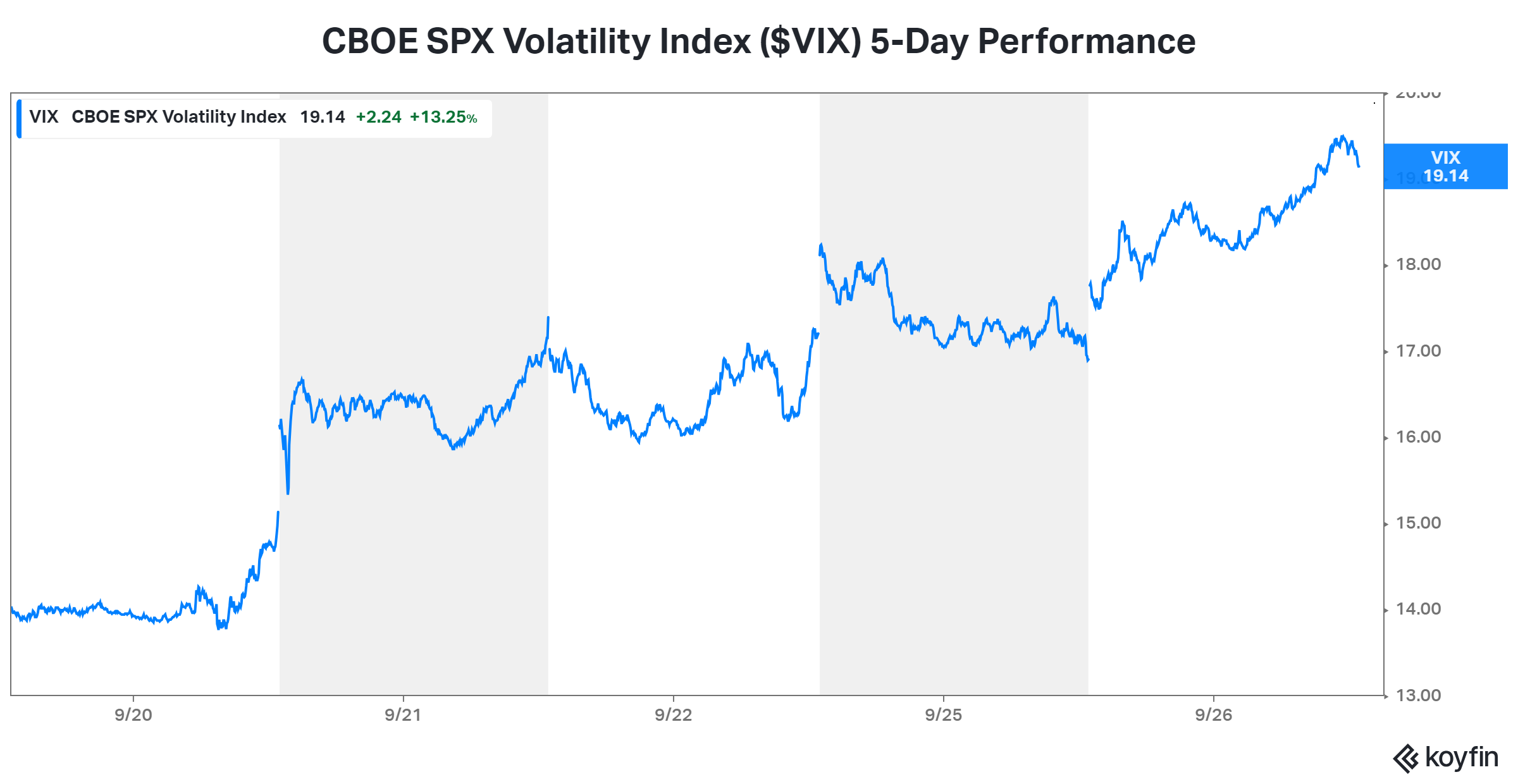

Given that market weakness, the S&P 500’s volatility index ($VIX) has risen nearly 50% over the last five days to four-month highs. After a few weeks of downside, the market is finally eliciting some fear from investors. 😨

Overall, governments and other stakeholders have scrutinized the world’s largest companies for years. However, consumers flocking to their products and services daily has trumped concerns over their grip on the economy and our reliance on them. 🤷

Whether or not this most recent attempt will result in changes remains to be seen. But U.S. regulators look serious this time, and the market is certainly reacting as if the case has some merit.

On a related note, another major rule could be back on the table after its defeat during Trump’s presidency. The Federal Communications Commission (FCC) plans to reintroduce net neutrality, requiring broadband providers to treat all traffic equally, providing no preference to business partners or their own services.

As always, we’ll keep you updated as this story develops. 📝