Taylor Swift and her “Swifties” are having their time in the sun, bringing rays wherever they go. 🌞

While the NFL is looking to take advantage of Swift’s new potential romance, movie theatre chain AMC also wants to get in on the action, and so far, it appears to be working.

That’s because AMC confirmed today that Swift’s The Eras Tour movie sold more than $100 million in advanced tickets. That marked the highest single-day ticket revenue in the company’s 103-year history. 🎫

Investors know a single event’s sales won’t be enough to save AMC on its own. But the fact that Taylor Swift and Beyonce’s movies have seen such strong appetite provides a sliver of hope that new types of content could help propel the movie theater industry into the future.

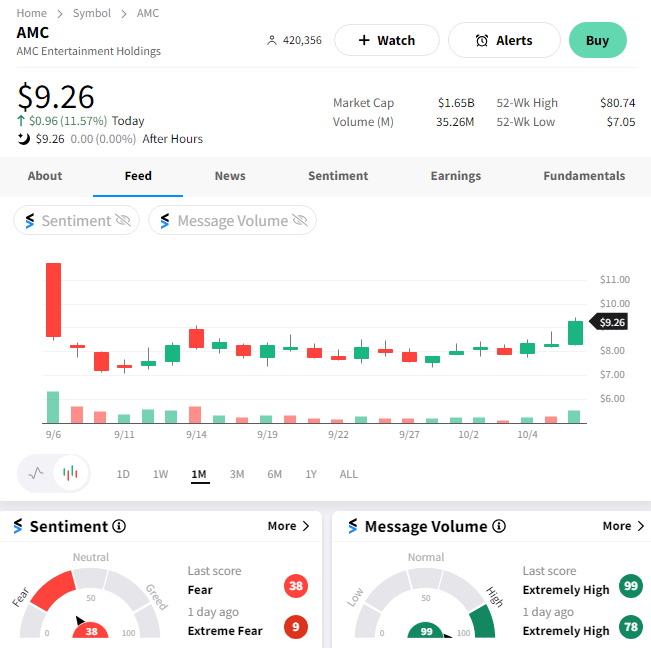

$AMC shares rallied roughly 12% on the day, with the sentiment on our platform ticking up from “extreme fear” levels. 🔺