Whew. The crypto market survived the weekend. The Sunday-Slaughter, Red-Sunday, Sunday-Selloff, whatever you want to call it, didn’t happen this weekend. But that doesn’t mean it’s all sunshine and rainbows, either. Why? Because now the market is inside the Cloud.

Pro-tip: Read our introduction to the Ichimoku Kinko Hyo system here.

This is it. The Cloud. The place you don’t want to be.

Oh, sure, that all-you-can-eat buffet sounds great, right? Even though you get sick after eating there, you keep going. You’re not sure if it was the mushy, no-longer-crispy-chicken or the mac and cheese that’s been sitting out for three days, but you know you gambled and lost.

That is exactly what the Cloud is in the Ichimoku system. Things look tempting, but you get stung in the end. The Cloud is a place of regret, bad decisions, bad choices, and overall misery. It’s the place where trading accounts go to die.

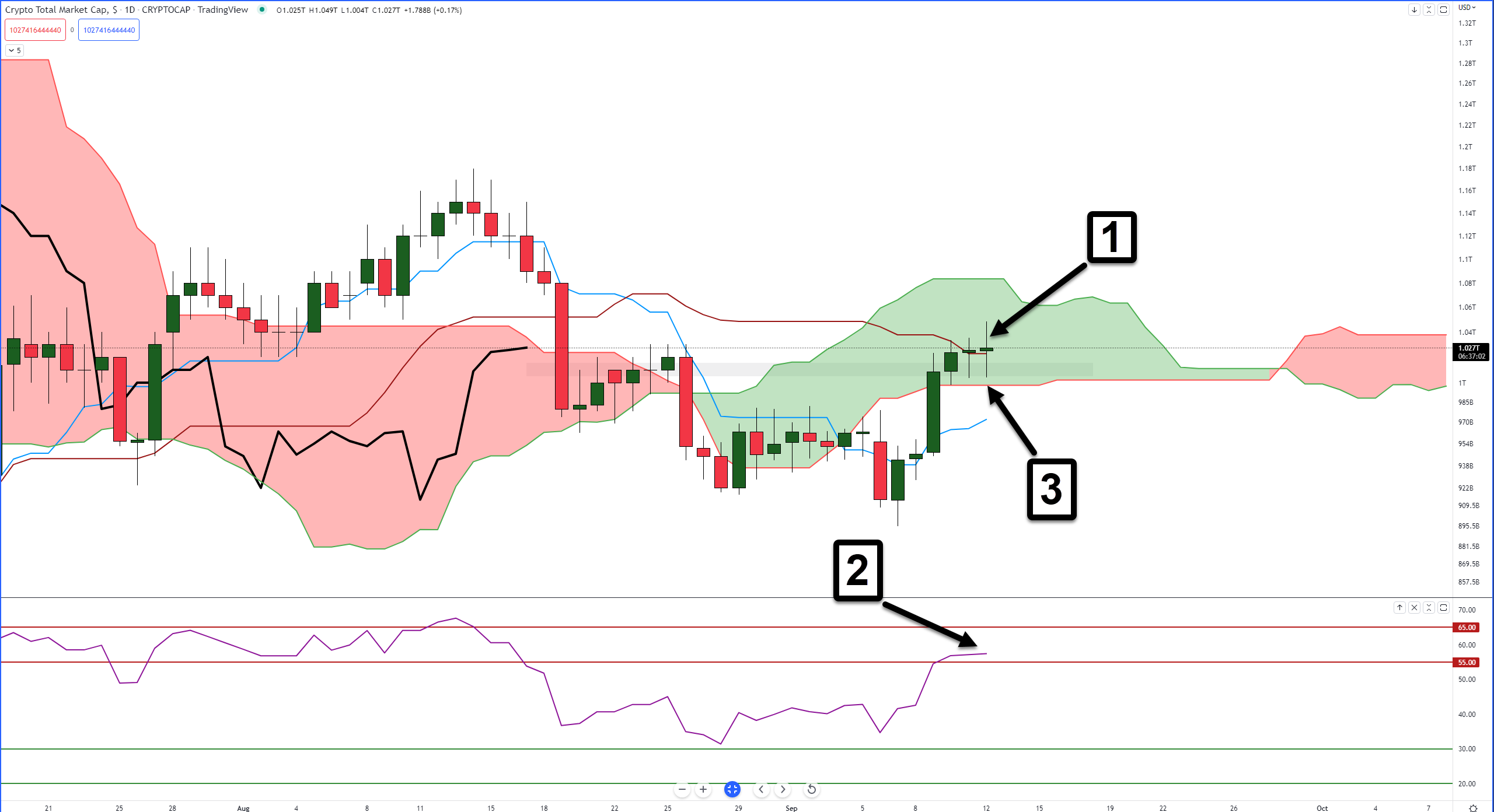

So, while the Total Market Cap has closed above the strongest resistance level in the Ichimoku Kinko Hyo system, Senkou Span B (#3), and it closed above the Kijun-Sen (#1), it’s still smack dab in the middle of that green Cloud of bad stuffs.

Now, that’s not to say something positive can’t come out of where the Total Market Cap chart is at – this is something that happens before a clear trade direction occurs. The RSI (#2) didn’t get rejected at 55 but has flattened out – so it’s hard to read the market here.

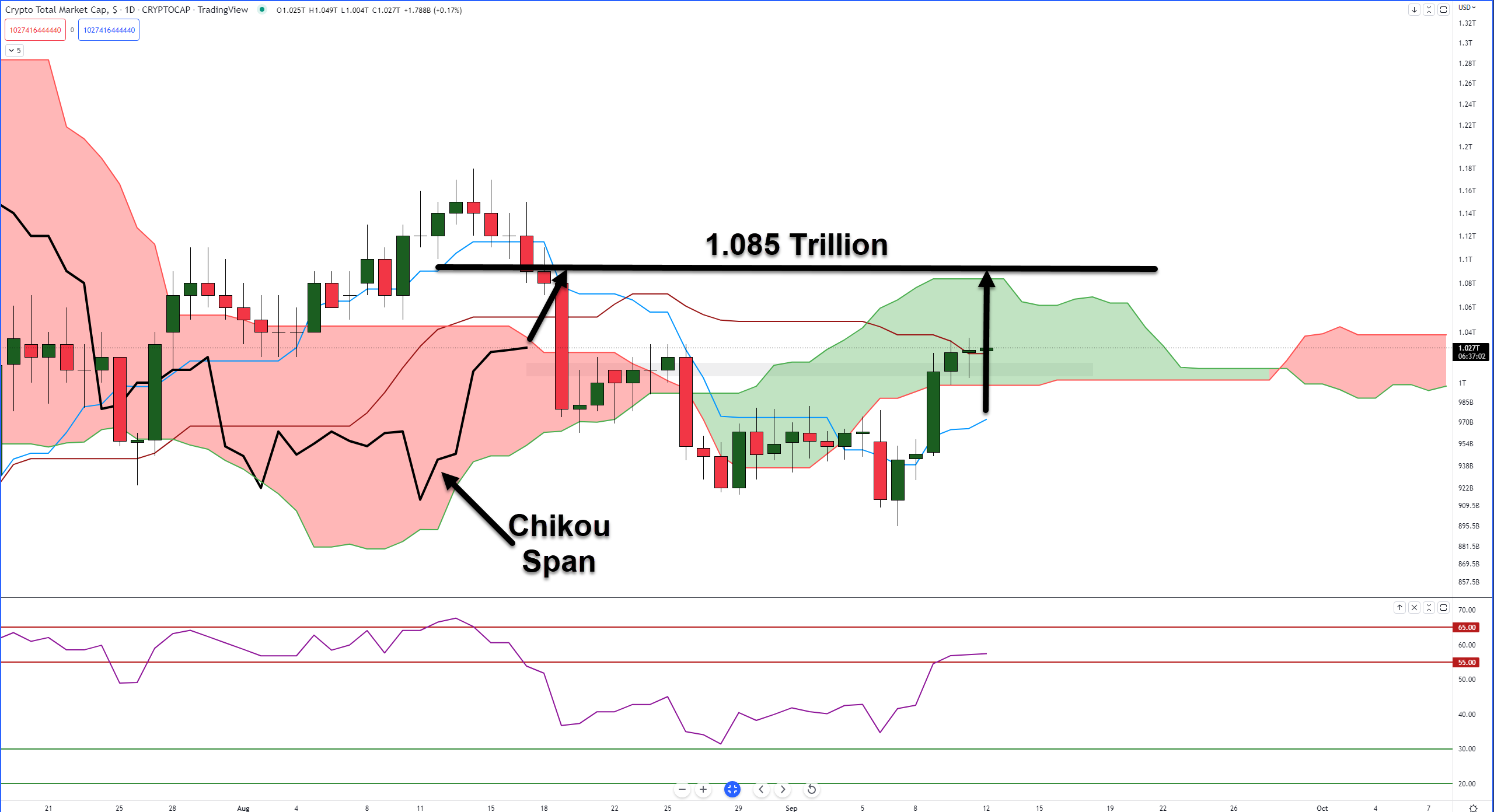

If we refer back to last Friday’s Litepaper, you’ll note that in order for there to be a very strong chance of a new bullish breakout, two things have to occur:

- The daily close needs to be above the Cloud.

- The Chikou Span needs to be above the bodies of the candlesticks.

By tomorrow, that would mean the Total Market Cap needs to close at or above $1.09 Trillion. Or $1.08 Trillion on Wednesday.

It’s going to be one hell of a crazy next couple of weeks, especially with the Ethereum ($ETH.X) Merge in a couple of days and Cardano’s ($ADA.X) Vasil hard for shortly after.