Numerous cryptocurrencies have a concentrated supply owned by a small number of entities, and only a few have the majority supply owned by retail investors. ✋

If we look at Ownership by Whales from on-chain analytics firm IntoTheBlock, the data shows a disturbing reality: the total supply of some of the world’s most popular and followed cryptocurrencies is very centralized.

Percent Of Supply Owned By Whales

- $CRO – 91.37% (5 = number of whales)

- $GRT – 53.60% (6)

- $LINK – 57.19% (20)

- $FTM – 75.98% (9)

- $AVAX – 49.93% (18)

- $IMX – 90.10% (7)

- $AAVE – 63.44% (13)

- $MANA – 50.53% (13)

- $DOGE – 45.11% (8)

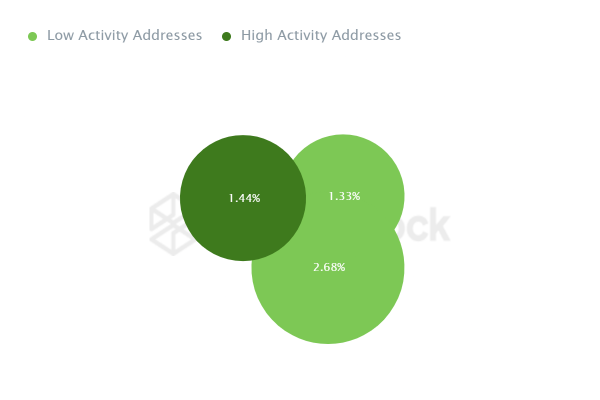

Cardano has a low whale concentration, with few whales and a low percentage of ownership controlled by them compared to other cryptocurrencies:

Whales number only 3 and control only 5.33% of Cardano’s supply.

The majority concentration of ownership of Cardano’s supply is also very different from most of the crypto market. 👍

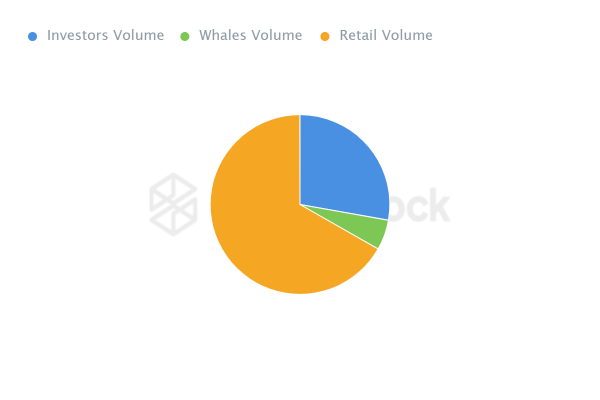

Ownership Percentage Of Total Supply

- Retail – 66.76% (22.66 billion ADA)

- Investors – 27.79% (9.43 billion ADA)

- Whales – 5.44% (1.85 billion ADA)

The fact that the majority of Cardano’s supply is owned by ‘normal people’ could be a significant factor contributing to its popularity.

Binance.US conducted a Twitter poll that garnered over 26,000 votes from the cryptocurrency community, asking which cryptocurrency Twitter should change its logo to next.

Which #cryptocurrency should Twitter change its logo to next?$BTC $ETH $ADA $DOGE 👇

— Binance.US 🇺🇸 (@BinanceUS) April 3, 2023

$ADA emerged as the top choice, with 34.6% of the votes, followed by $BTC (21.6%) and $ETH (4.7%).

This poll followed Twitter’s recent change of its icon to $DOGE.

While many cryptocurrencies have a concentration of their supply held by a select few, Cardano stands out for having a majority of its supply distributed among a larger group of investors. 🧠