Cantor Fitzgerald analysts say they’re “increasingly confident,” the SEC will finally give the green light to a spot $BTC ETF. 🎉

The primary reason, according to the firms analysts Josh Siegler and Will Carlson, is the “comprehensive surveillance-sharing agreement” from new applicants could be the magic wand to make regulators’ fears disappear.

The analysts are calling it the “most-important short-term catalyst.”

Blackrock ($BRK), the Wall Street heavyweight, threw its hat in the ring back in June and has teamed up with $COIN to play referee on market shenanigans.

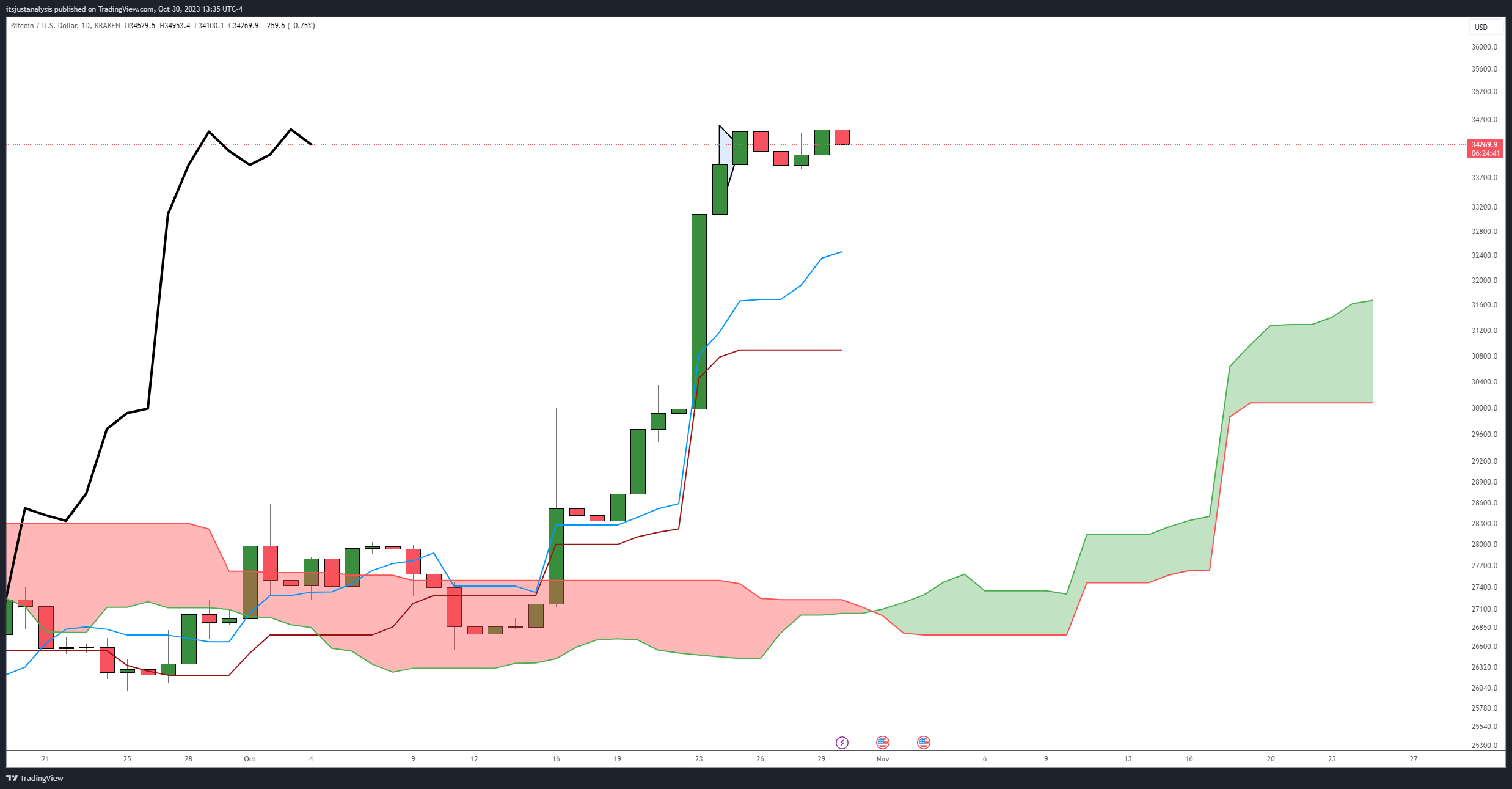

Bitcoin’s price is already acting like it got the invite to the VIP party, inching towards a cool $35,000. 🕺