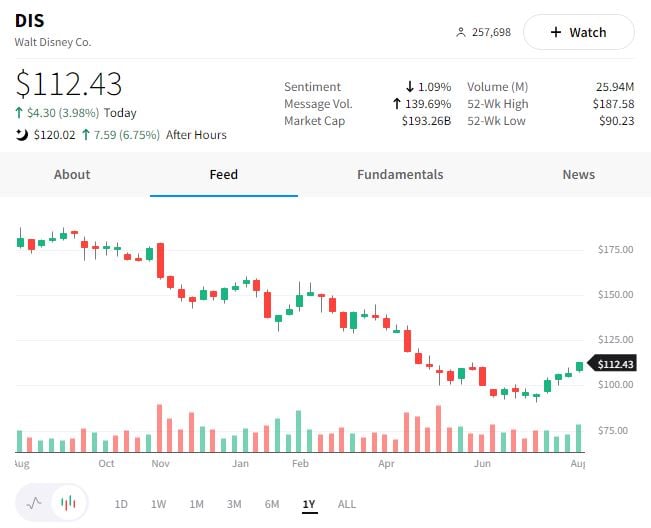

Disney posted better than expected top and bottom line results, driven by solid spending at its domestic theme parks (72% growth YoY). 💪

Additionally, Disney+ subscriptions rose to 152.1 million, significantly higher than the 147 million that analysts anticipated. Given that streaming will be a significant growth driver for the company, its strength helped quell concerns (for now) that the global streaming market is saturated.

With that said, its content costs are rising, and the company lost $1.1 billion across all its streaming services. In addition to its planned price increase for ESPN+, it is also increasing U.S. Disney+ prices in December as part of efforts to make its streaming business profitable by the end of fiscal 2024.

$DIS shares were up another 6.75% after hours. ☝️

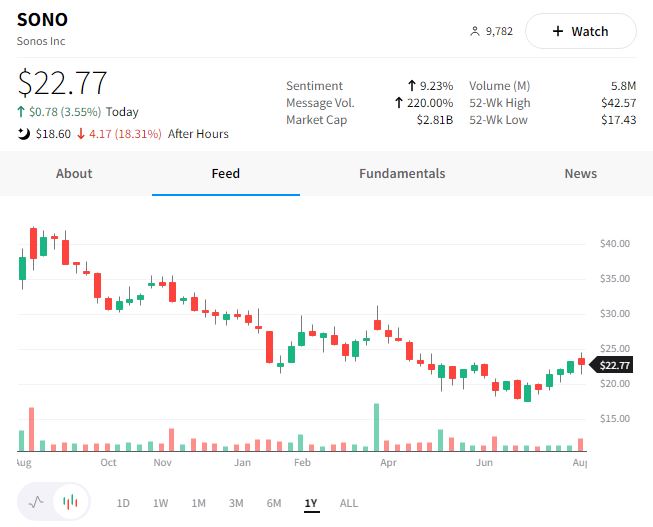

Sonos reported a dismal quarter as revenue came in well below expectations. 👎

The speaker and sound system company slashed its forecast in what it described as ‘significantly more challenging’ conditions, also noting that its CFO is leaving the company.

$SONO shares were down 18.31% after hours. 📉

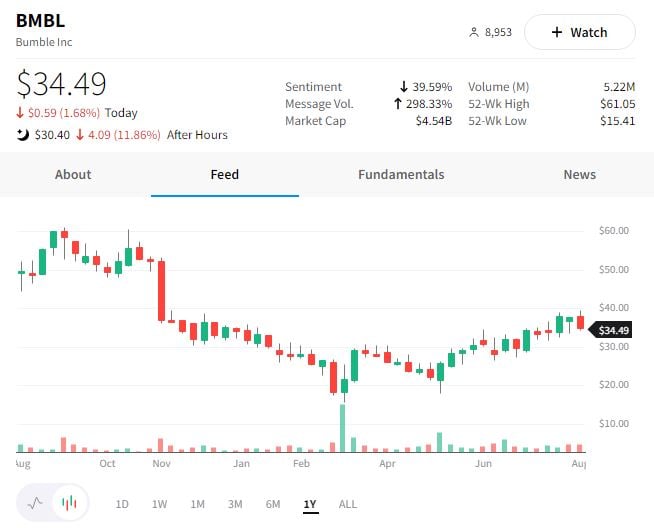

Bumble reported mixed results, with revenue topping expectations and earnings falling short.

Despite solid revenue growth (18% YoY), the company slashed its full-year guidance citing inflation and foreign exchange headwinds.

$BMBL shares were down 11.86% after hours. 🔻

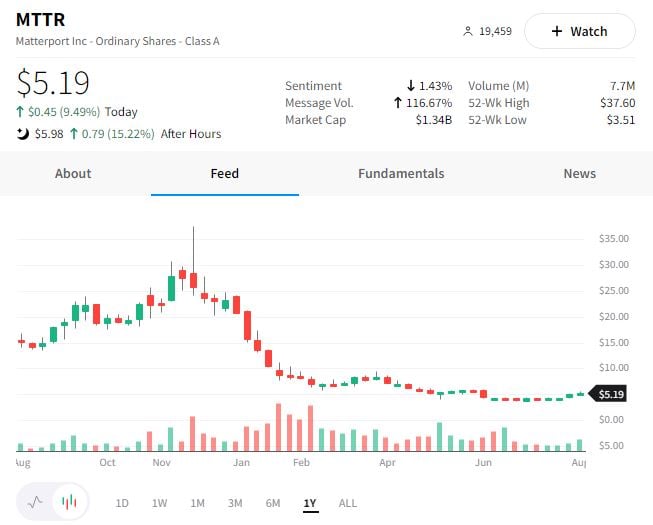

Lastly, Matterport reported results slightly below expectations but won investors over by issuing upbeat full-year guidance. 👍

The company’s subscription revenue rose 20% YoY, while services revenue was up 74%. As a result, the company now expects full-year revenue of $35 million – $37 million, above consensus expectations of $32.94 million.

$MTTR shares added another 14.64% to their rally after hours. 📈