It’s been a rough year for retailers, but sentiment has gotten bad enough for some of them to beat expectations. That seems to be the case for Foot Locker, which rallied heavily after reporting better-than-expected earnings.

Though the $1.10 per share it earned was down 50% YoY, it was still ahead of the $0.81 Wall Street expected. On the other hand, revenues were just shy of expectations, down 9%, while same-store sales fell 10.3%. 🔻

Despite beating expectations this quarter, the company updated its 2022 profit forecast to $4.25-$4.45 per share, down $0.15 from the higher end of its guidance. 📉

Most notable was the company’s announcement that CEO Richard Johnson will retire on September 1st. Mary Dillon, a former Ulta Beauty executive and e-commerce expert, will take over.

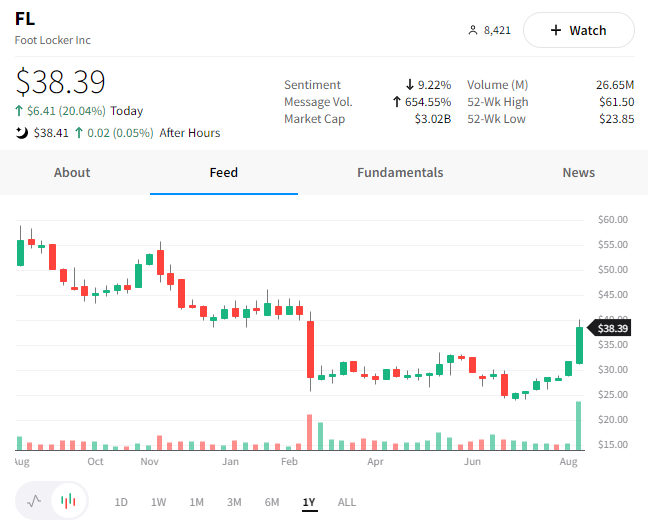

Investors appear optimistic about the move and the company’s turnaround story, since the stock rallied 20% today. 👍

Here’s to hoping Richard enjoys his retirement as much as investors are… 😂