The first two stocks we discussed were a mess, so let’s top it off with some positive news. 🙂

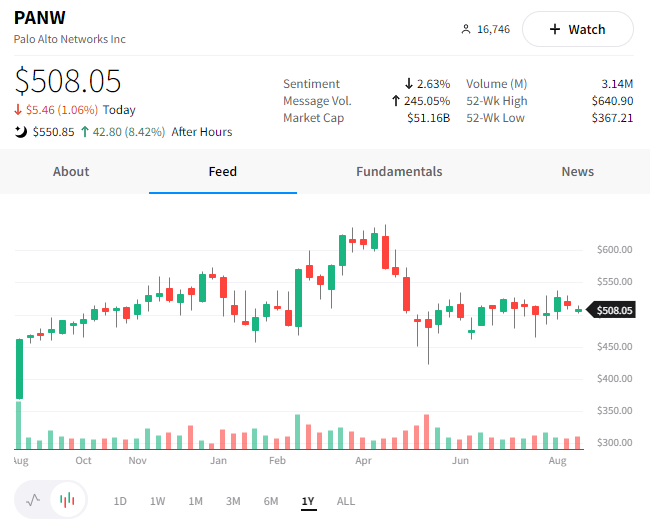

Palo Alto Networks shares are popping 8.42% after hours, following the company’s better-than-expected earnings report.

Current quarter earnings and revenue beat expectations, with total revenue growing 27% YoY. Additionally, its EPS swung into positive territory, marking its first quarter of GAAP profitability in four years. 📈

Management seems optimistic about the overall business environment and the company’s position, raising its guidance for the October quarter and full fiscal year. 💪

Lastly, the board of directors approved the company’s 3:1 stock split, which they’ll execute as a stock dividend. Stockholders at the close on Sept. 6th will receive two additional shares after the close on September 13th. The stock will then begin trading on a split-adjusted basis on Sept. 14th. 🖖

Based on the after-hours action, investors appear pleased with the news. 👍