Bank earnings continued today with Bank of America and Bank of New York Mellon reporting. 📰

So far, we’ve seen consumer banking shine while investment banking, asset management, and mortgage lending lag.

Let’s see if today’s reports confirmed more of the same.

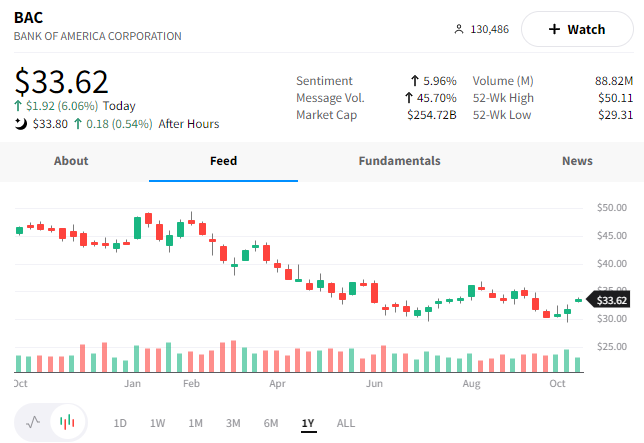

Bank of America reported better-than-expected earnings and revenue. Its adjusted EPS of $0.81 and revenue of $24.61 billion beat expectations of $0.77 and $23.57 billion, respectively.

Like other banks focused on consumer banking, it saw net interest income jump 24% on higher rates and loan balances. However, it also saw third-quarter profit fall 8% due to its $898 million in loan loss reserves. Investment banking revenue was down 46% YoY, and equities trading fell 4%. Both were offset by a 27% rise in fixed-income trading revenue.

The bank’s CEO, Brian Moynihan, says that the consumer remains healthy, with late-payment metrics well below pre-2020 averages. Moreover, account balances remain higher than before the pandemic began, indicating dry powder to support spending. With that said, the bank is still taking precautions by raising its loan loss reserves, given the weakening macroeconomy.

$BAC shares continued their rally today, up more than 12% over the last three days. 💪

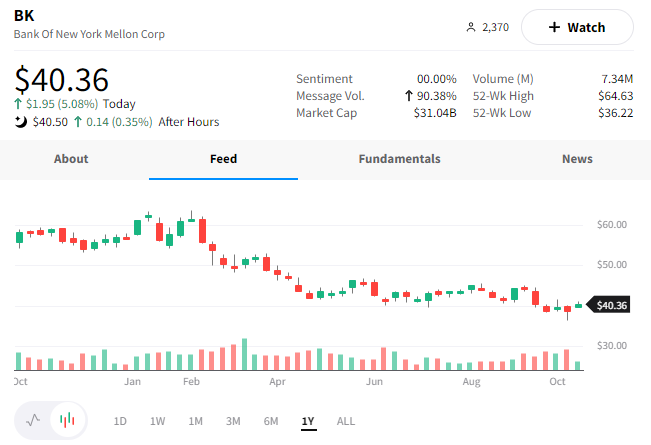

Bank of New York Mellon reported similar results, beating on the top and bottom lines.

Net interest revenues were a bright spot, up 44.3% YoY, while its net interest margin expanded 37 bps YoY to 1.05%. However, total fees and other revenues fell 1.2% YoY, driven by a drop in investment management and performance fees and financing-related fees.

Like other asset managers, the global market rout has pressured its assets under management. AUM was down 22.9% YoY, while assets under custody/administration declined $6.8%, though it did see client inflows and net new business.

$BK shares rose 5.08% today. 📈

Goldman Sachs reports tomorrow before the bell. In the meantime, it’s worth noting that there are rumors it’s planning a major business reorganization. 👀