The pressure is $ON for companies like On Semiconductor. The company reported 26% revenue growth in Q3, with strength in its electric vehicle and industrial end markets. ⚡

However, like many other companies in the space, it saw guidance fall short of expectations. It now expects Q4 revenue between $2.01 to $2.14 billion vs. the $2.10 billion expected. Its non-GAAP earnings per share expectation are $1.18 to $1.34 vs. the $1.25 consensus expectation.

While certain segments of the semiconductor industry are seeing solid demand, there’s clearly a broader slowdown in progress. The magic question remains how deep will the downturn be and how long will it last… 🤷

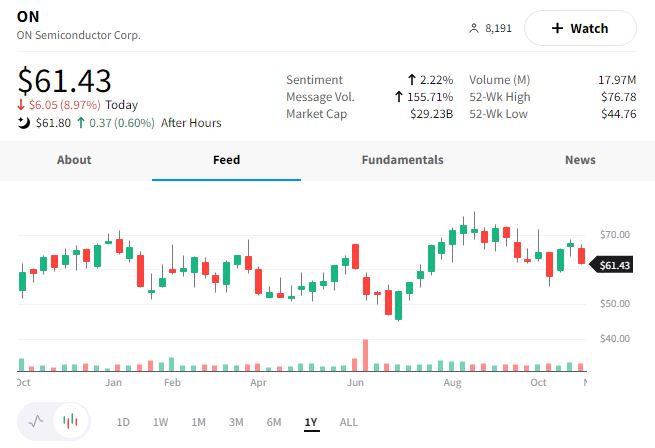

For now, investors send $ON shares down 8.97% today due to its weak guidance.