China and its markets remain in focus this week. We covered news on Friday, Monday, and Tuesday and will add to that today. So let’s dive in.

The first update is that China’s factory activity hit its lowest level since April, as lockdowns and protests weigh on business activity. As a result of the last few weeks, China’s Zhengzhou, which is home to the world’s largest iPhone factory, ended its Covid lockdown. Others, including the financial hub of Shanghai, are following suit as the country tries to curtail unrest and reboot its economy. 🏭

That news helped lift China’s stock market broadly, but several stocks moved heavily on earnings. 📝

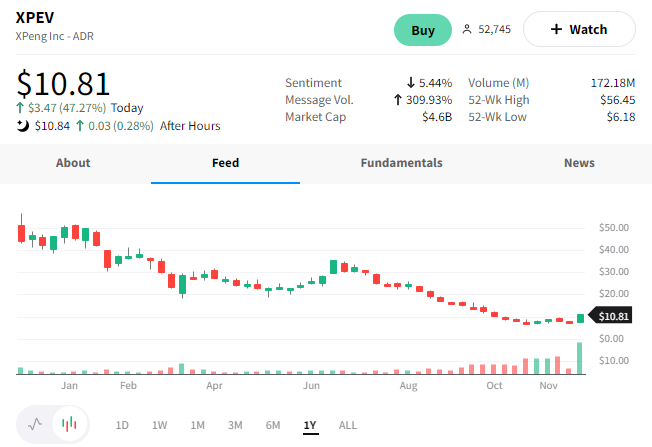

Chinese EV maker XPeng Inc. posted a larger-than-expected loss, with revenue falling short.

Revenues rose 19.3% YoY, but at 6.82 billion Chinese yuan, it missed the 7.26 billion expected. Meanwhile, it reported a net loss of 2.38 billion yuan this quarter. While this beat the 2.09 billion yuan expected, it was up 1.59 billion yuan reported in the same quarter last year. 🚗

The company delivered 29,570 electric vehicles, up 15% YoY but a 14% decline from the second quarter. Looking forward, it expects to deliver 20,000-21,000 cars in the fourth quarter, representing a YoY decline of around 50%.

It pointed to supply chain issues, rising competition, and a more challenging macroeconomic environment as the driver of its results. However, the company hinted at a potential bottom in deliveries soon. It also noted the completion of its internal restructuring and believes it has a strong strategy for the future.

Shares of $XPEV still rallied nearly 50% as investors look ahead to a hopefully stronger future. 🤷

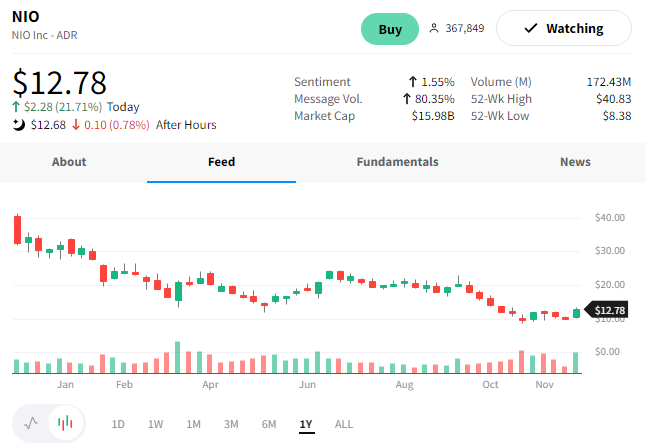

That strength in XPeng and the broader market spilled into other electric vehicle makers like Nio, which rose 22%. ⚡