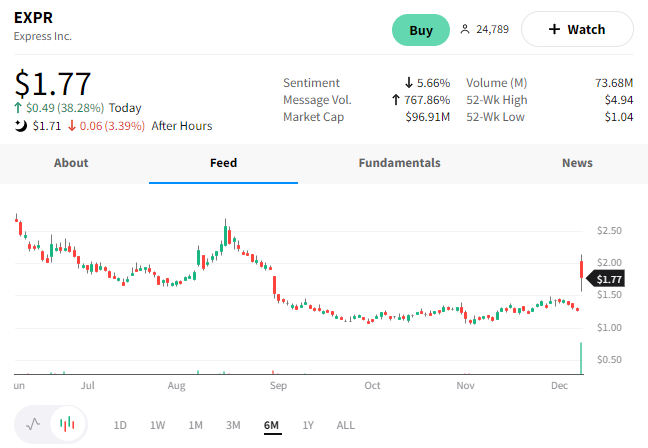

Express has been barreling down the tracks in the wrong direction for some time. But today, the stock is popping after reporting earnings and inking a new joint venture with WHP.

On the revenue front, the retailer saw Q3 sales fall 8% YoY to 434.1 million, falling short of the $451.77 million expected. Comparable sales, including Express stores and eCommerce, were down 11%, as online demand fell 17%. Comparable outlet store sales were flat as consumers traded down to lower price points. 🔻

Operating expenses rose 6.8% YoY, with gross margins falling 540 bps to 27.8%. This led to a wider-than-expected loss per share of $0.50 vs. the $0.29 expected.

The earnings left a lot to be desired. But what caught investors’ attention was its “mutually transformative strategic partnership’ with WHP Global. According to a quick google search, the New York-based firm acquires global consumer brands and invests in high-growth distribution channels, including digital commerce platforms and global expansion. 🤝

WHP will invest $25 million to acquire roughly 7.4% pro format ownership in Express. And they will partner together in an Intelectual Property Joint Venture valued at roughly $400 million. Under the deal, WHP will own 60%, and Express will own 40%.

Based on today’s action, it appears investors are optimistic that this partnership can help put Express back on a better path. $EXPR shares rose 38% and closed near a 3-month high. 📈

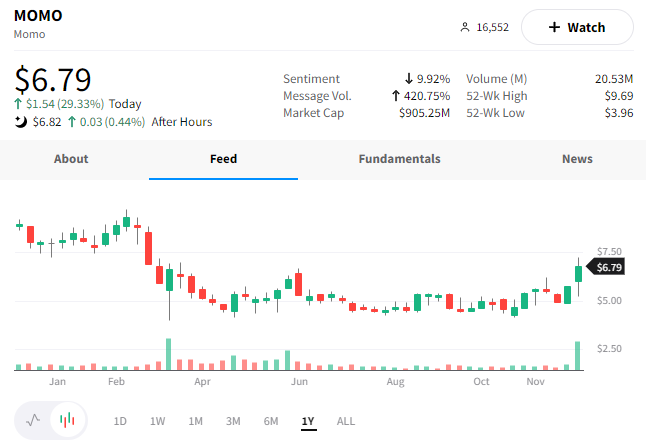

Meanwhile, Hello Group Inc. also rose 30% today after reporting better-than-expected earnings. 👍

Its earnings per share of $0.37 beat expectations of $0.29. Meanwhile, the software company also beat revenue estimates by 2.93% at $454.49 million.

The results pushed $MOMO shares to an eight-month high. But we really just needed to mention it so we could use the ticker in the title. 😄