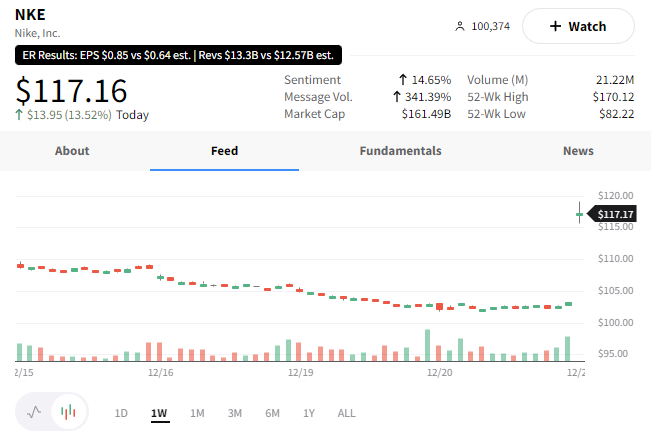

$NKE opened with a massive gap up (+12.11%) today as investors and analysts took time overnight to digest its earnings released last night. 🚀 👟

Earnings, sales, and gross profit margins were all a beat yesterday. Additionally, Nike further trimmed its inventory fat, declining by 3%.

Comments during the conference call cited strong November sales that have followed through into December.

Some concerns were the continued growth of its inventory (+43% YoY) and sales in China( -10% YoY), which analysts believe should get better depending on how quickly the Chinese Communist Party curtails its lockdown(s).

Interestingly, there have been no questions or comments about Nike’s involvement or progress in the metaverse with its planned NFTs. 🤷♂️