Continuing the industrial sector trend, let’s recap what we heard from defense stocks. 🛡️

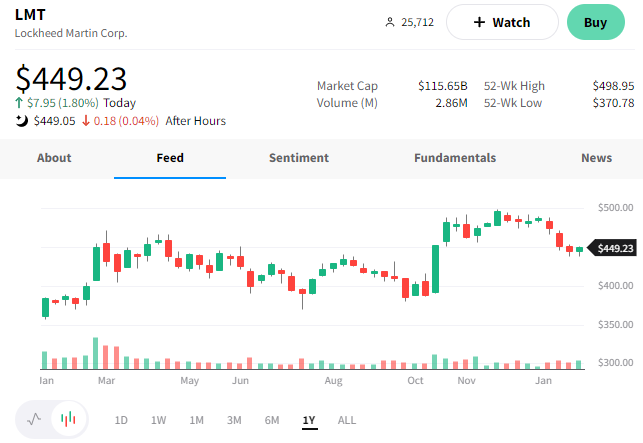

First off, stinger missile maker Raytheon Technologies beat earnings and revenue expectations.

Adjusted earnings per share of $1.27 beat the $1.24 expected. And revenues of $18.2 billion topped the $18.09 billion expected. 🔺

The company has benefited from the U.S.’s aid packages to Ukraine, and overall geopolitical tensions remain high. As a result, its missiles and defense unit sales rose 6.2% in the quarter.

However, it’s also benefiting from the strong tailwind that GE mentioned. Airlines flying older planes for a longer period helped boost the company’s high-margin after-market services, jet engines, and other related parts/services. ✈️

Management says costs will continue to rise in 2023 but offered an upbeat outlook. It expects a full-year adjusted profit of $4.90 to $5.05 per share, while analysts forecast $5.03. 📝

$RTX shares were up about 3% on the day.

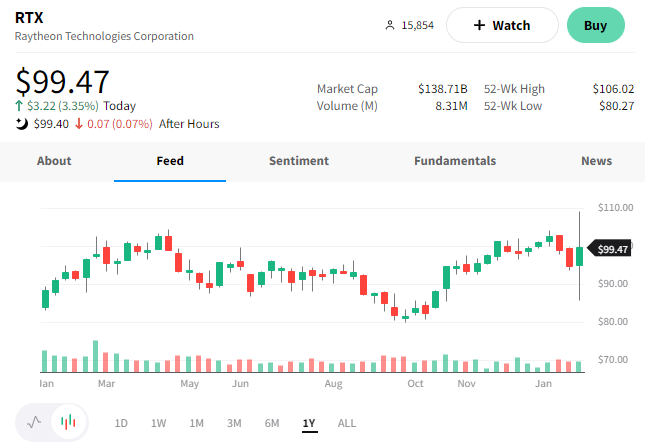

Lockheed Martin beat revenue expectations but missed earnings estimates by $0.01 per share.

The company said its backlog increased 11% in the quarter, driven by a 15% in its Aeronautics division. That business unit saw a 7% jump in revenue, largely due to a higher volume of F-35 production contracts. The Biden administration’s plans to request congressional approval for a $20 billion sale of new F-16 jets to Turkey would also benefit the company. 🏭

However, management still expects the fiscal year 2023 earnings of $26.60 to $26.90 per share on $65 to $66 billion in sales. This is marginally different than Wall Street’s expectations of $26.93 per share and $65.74 in revenue.

$LMT shares were up about 2% on the news. 📈