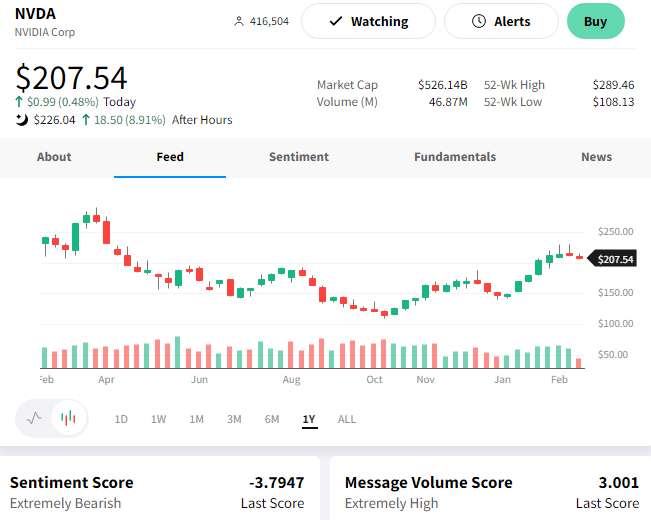

Shares of chipmaker Nvidia are rising after reporting earnings and revenues that beat expectations.

Its adjusted earnings per share of $0.88 and revenues of $6.05 billion beat the expected $0.81 and $6.01 billion. Sales fell 21% YoY in the quarter, and fiscal-year revenue of $27 billion was flat YoY. 📝

Regarding the drivers of its beat, the company reported the following segment results:

- Data center revenue was $3.62 billion, up 11% YoY and down 6% QoQ;

- Gaming revenue was $1.84 billion, down 46% YoY and up 16% QoQ;

- Professional visualization revenue was $226 million, down 65% YoY and up 13% QoQ; and

- Automotive and Embedded revenue was $294 million, up 135% YoY and 17% QoQ.

In terms of outlook, executives expect first-quarter 2024 revenue of $6.50 billion (+-2%) and GAAP and non-GAAP gross margins of 64.1% and 66.5%, respectively (+-0.50%). 🔮

Like its competitors, the company is cutting costs to weather the short-term storm while still investing in the future. Despite the slowdown in the gaming and personal computer (PC) markets, automotive demand continues to rise, and the difficult YoY comparables from the pandemic are beginning to roll off.

Investors are apparently optimistic about the company’s outlook, as $NVDA shares are up 9%. 👍

Meanwhile, its competitor Intel is slashing its dividend by 65% as it shores up cash to survive in the current climate. Clearly, the environment for semiconductor companies remains challenging, but how an individual company manages in this environment still comes down to its execution. ✂️

We’ll have to wait and see whether Nvidia continues to execute. 🤷