Electric vehicle (EV) news continues to come in, with Lordstown Motors reporting earnings today. ⚡

The EV maker reported a $0.45 per share loss on revenues of about $194,000. It had no revenue and a $0.42 per share loss in the same quarter of 2021.

Through the end of February, it built roughly 40 Endurance trucks but had to halt production on February 23rd to address performance and quality issues. Lordstown delivered just three pickups to customers during the fourth quarter, bringing its total to six.

As a result, the Ohio-based startup is beginning to pivot to a new EV program, collaborating with Foxconn. The Taiwanese contractor manufacturer bought Lordstown’s plant and invested in the startup last year in a potentially $170 million deal. 🤝

Roughly $30 million of the investment is for its new EV platform, which the company says is key to its long-term strategy. CEO Edward Hightower had this to say, “Our asset-light business model and collaboration with the Foxconn EV ecosystem, including MIH, will provide the opportunity for Lordstown Motors to create winning EVs that are tailored to the needs of customers that use them for various work applications, while gaining the cost benefits of scale.”

Overall, Wall Street seems unimpressed with the company’s progress. Investors are closely watching Lordstown’s cash balance, which sat at roughly $220 million as of December 31st, as that indicates how much runway the company has to figure out its issues. 🛫

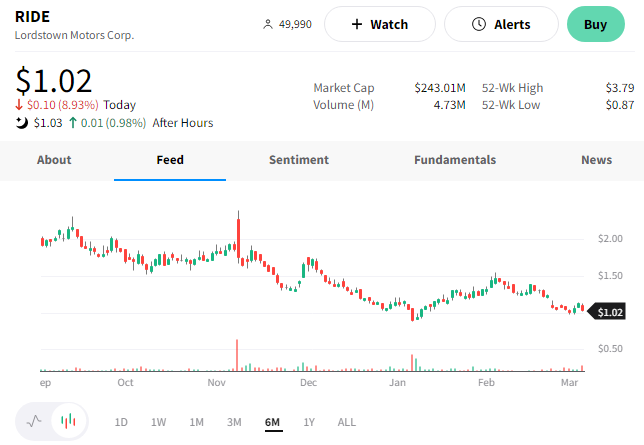

$RIDE shares fell 9% on the news, nearing their all-time lows set in January. 📉