With thousands of stocks in the U.S. and many more internationally, tracking them all is tough, especially those that won’t seem to go away. So today, we’re looking at a couple of zombie stocks that occasionally pop up on investors’ radars again around earnings. 🧟

Let’s start with the Finnish telecom company, Nokia. 📱

The company reported a net profit of 332 million euros, which was well below the 386 million euros expected. However, sales of 5.86 billion euros topped the expected 5.73 billion. Gross margins suffered, falling from 39.8% to 33.8%. And operating margins declined from 7.5% to 5.3%.

Executives expect margin pressures to continue through the year’s first half and expect net sales growth of 2% to 8%. In addition, they’re beginning to see signs that a weakening economic environment is impacting customer spending. 🫠

That warning caused investors to send $NOK shares down 9% on the day. 📉

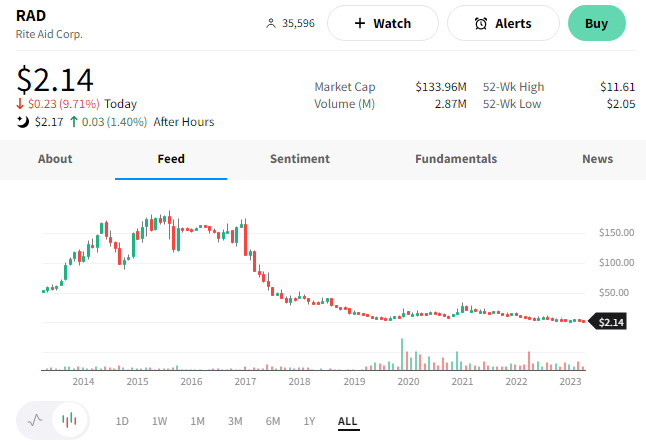

Shares of drugstore chain Rite Aid are approaching a fresh all-time low after reporting weaker-than-expected results. 🏪

An adjusted loss per share of $1.24 was wider than the $0.78 loss consensus view. Meanwhile, revenues of $6.09 billion beat the $5.63 billion expected.

In addition to its earning miss, soft guidance also plagued the stock. For fiscal 2024, executives expect revenue of $21.7 to $22.1 billion and a net loss of $439 to $366 million. Both of those missed the $22.88 billion and $199 million expected by analysts.

$RAD shares fell 10%, settling just above the all-time lows set in March. 🔻

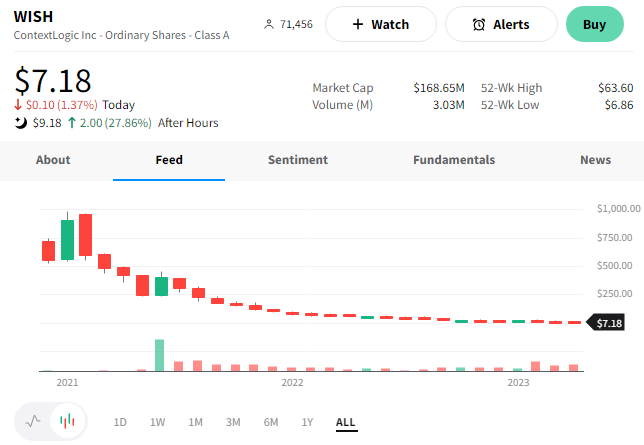

Lastly, ContextLogic shares ($WISH ) soared 25% after the company announced a $50 million buyback.

It recently completed a 1:30 reverse split which did not inspire confidence among investors. However, today’s move is likely an attempt to restore some of that confidence by showing the company believes it’s undervalued. Whether or not that will work remains to be seen… 🤷