Several electric vehicle (EV) stocks were moving today, so let’s look at all the *shocking* news. 🤯

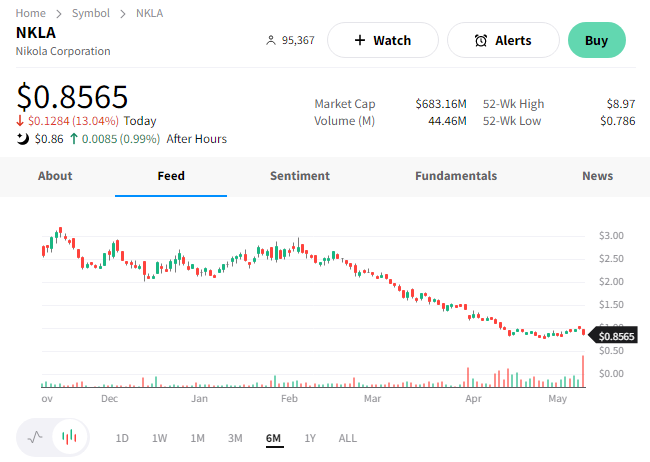

First up is startup Fisker, which reported worse-than-expected results:

- Loss per share $0.38 vs. $0.30 expected

- Revenue $198k vs. $14.4 million expected

- Will build 32k-36k Oceans in ’23, down from 42.4k guidance

- 65k Ocean & 6k Pear reservations

Executives said that higher-than-anticipated research and development costs drove the earnings miss. With that said, they tried to keep things upbeat by saying they’re ready to go full speed on production next week. By the third quarter, they expect to reach a monthly run rate of about 6,000 vehicles. 🏭

They also tried to reassure investors of their cash position, holding $652.5 million as of March 31 and raising about $47 million via direct stock sales last quarter.

With that said, investors remain concerned about demand as other industry players slash prices to entice buyers. Production issues also remain top of mind, with the company continuing to overpromise and underdeliver in that category.

$FSR shares were down as much as 15%, but recovered to close -7%. 🔺

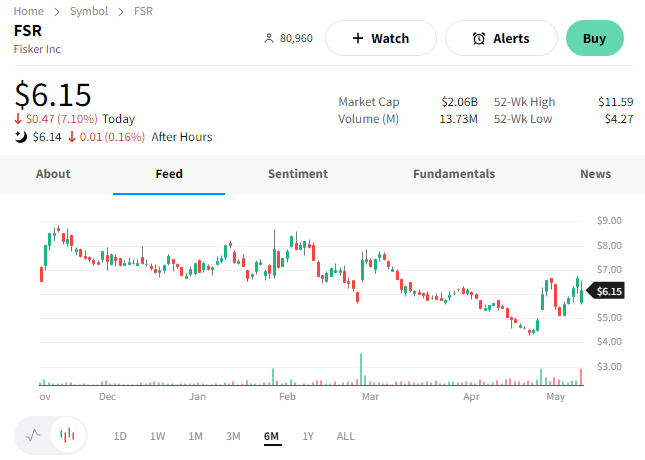

Meanwhile, Rivian Automotive reported a narrower-than-expected first-quarter loss. 🤏

The company’s adjusted loss per share of $1.25 on $661 million in revenue topped the expected $1.59 and $652.1 million.

Digging into the numbers, Rivian built 9,395 EVs and delivered 7,946 to customers during the quarter. Both numbers were down QoQ, primarily due to planned factory downtime to allow assembly line upgrades. It reiterated that it’s on track to hit its full-year production guidance for 50,000 vehicles and $2 billion of capital expenditures. 📝

CEO RJ Scaringe remained upbeat, saying, “Our core priorities for 2023 are unchanged. The team remains focused on ramping production, driving cost reductions, developing the [upcoming smaller] R2 platform and future technologies and delivering an outstanding end-to-end customer experience.”

$RIVN shares continued their rebound from all-time lows, rising 6% after hours. 🔋

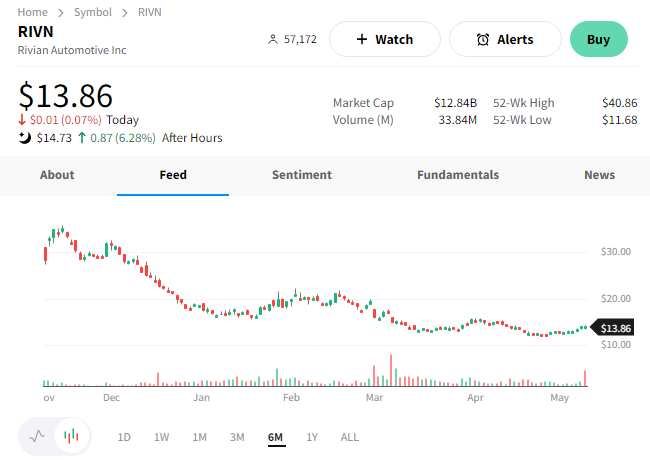

Lastly, electric heavy truck maker Nikola reported mixed results. 😬

The company’s adjusted loss per share of $0.26 matched expectations. However, revenue of $11.1 million fell shy of the $12.5 million consensus view.

It produced 63 battery-electric trucks during the quarter. It delivered 31 to dealers, who sold 33 to end customers. Executives say they currently have orders for 140 fuel-cell trucks from 12 customers. 🚚

With that said, the company is temporarily suspending production of the battery-electric truck while reconfiguring the assembly line to accommodate both battery-electric and fuel-cell trucks. It’s ultimately expecting its fuel cell truck to become its primary product.

Nikola’s cash balance was down about $112 million QoQ to $121.1 million and remains a key focus for investors. Executives are taking drastic steps to conserve cash and further their runway. ⏳

A major part of that is selling their share of a European joint venture to longtime partner Iveco Group for $35 million in cash and 20.6 million Nikola shares. Iveco will continue to supply chassis and related components to the company. And Nikola will remain an investor in Iveco, but it’s shifting its business focus back to the North American market. 🌎

$NKLA shares fell 13% on the news after rebounding marginally from all-time lows. 🔻