Chinese fresh grocery e-commerce company Dingdong delivered worse-than-expected results that sent shares tumbling. 🔻

Non-GAAP earnings per American depository share of $0.00 aligned with expectations. However, revenues of $727.7 million fell 15.3% YoY and missed consensus estimates by $93.19 million. Gross merchandise value (GMV) of $793.8 million fell 6.8% YoY. 🛒

Here are how revenues and expenses broke down:

- Product revenues of $719 million (-8.1% YoY)

- Services revenues of $8.7 million (-12.9% YoY)

- Cost of goods sold of $504.2 million (-10.7% YoY)

- Fulfillment expenses of $174.2 million (-19.4% YoY)

- Sales and marketing expenses of $12.7 million (-50.3% YoY)

- General and administrative expenses (G&A) of $12.6 million (-26.9% YoY)

- Product development expenses of $30.7 million (-10% YoY)

Executives blamed the sales decline on weaker consumer demand as China lifted its zero-COVID policy. They also incurred greater expenses and labor costs to fulfill holiday orders effectively. However, they highlighted their non-GAAP breakeven goal was achieved despite the headwinds. 📝

Like other global tech companies, Dingdong is adapting to the new environment. It’s working to drive sustainable growth without sacrificing its profitability and cash flow goals.

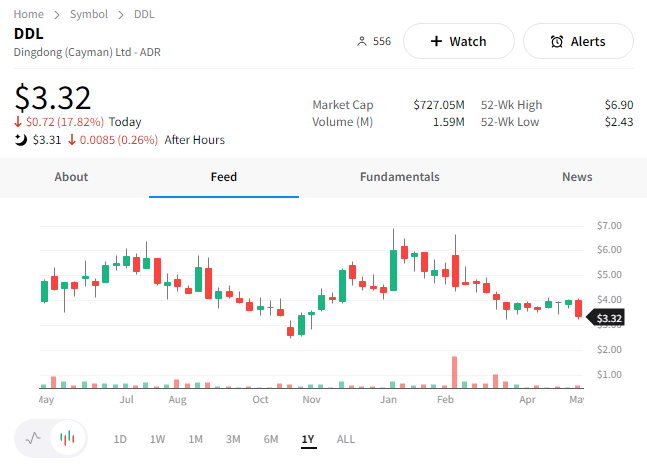

With that said investor concerns over the sales slump outweighed the company’s cost-cutting progress. $DDL shares fell 18% to roughly six-month lows. 📉