Shares of Delta Air Lines failed to gain any altitude despite third-quarter profits rising 60% YoY. 😮

The airline’s adjusted earnings per share of $2.03 topped estimates of $1.95. However, adjusted revenues of $14.55 billion vs. the $14.56 billion expected.

Like its peers, it cited strength in international travel as revenues grew 34% YoY in that segment. Overall, its fleet of planes flew 88% full during the quarter, up 100 bps YoY, even as it added additional domestic and international capacity. However, passenger unit revenue fell 1.5% YoY as ticket prices pulled back from their peaks. 🔺

Additionally, it’s seeing a sharp increase in demand for premium seats, with revenues rising 17% YoY vs. 12% for its main cabin tickets. Meanwhile, business travel is recovering still, about 80% of the way back to pre-pandemic levels.

As for negatives, higher fuel costs will continue to pressure results in the short term. And while overall demand remains strong, the company is cautious about consumers’ health and ability to keep up their spending levels as the economy slows. ⛽

Nevertheless, Delta expects strong demand in the final three months of 2023, estimating a 9% to 12% YoY revenue increase and $1.05 to $1.30 in earnings per share. That was roughly in line with estimates. 🔮

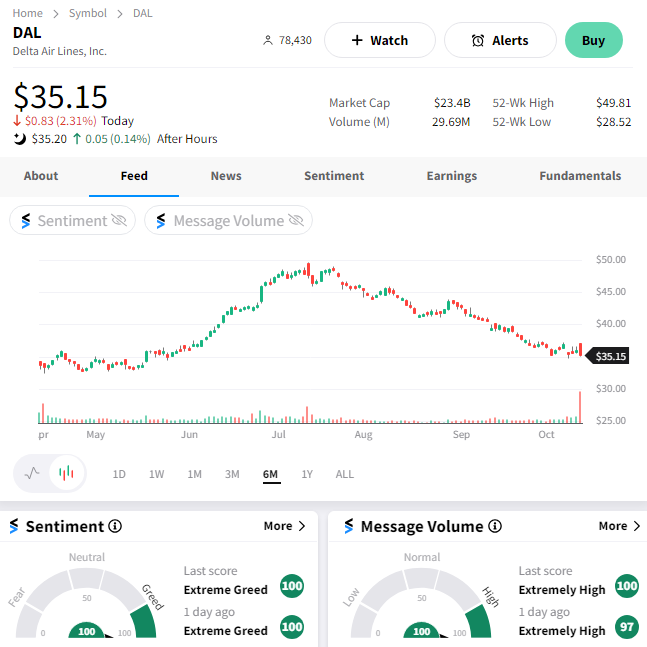

Despite the generally positive tone from executives, investors were quick to sell the pop in $DAL shares. They’ve fallen 30% from their July peak and are struggling to regain traction in the current environment. With that said, activity on our platform was high today, with sentiment still leaning towards “extreme greed.” 🤑