Morgan Stanley is the last major bank to report earnings. And although results did top estimates, the stock still fell sharply. Let’s analyze why. 👇

First off, the company’s adjusted earnings per share of $1.38 on $13.3 billion in revenues exceeded estimates of $1.31 and $13.2 billion. The bank’s return on average tangible common shareholders’ equity (ROTCE) of 15.5% was also in line with estimates.

Investment banking revenue fell 27% YoY, given the weak deal environment. Trading revenue was mixed, with a 2% increase in equities and an 11% decline in fixed income. 🔻

As expected, wealth management continued to be a bright spot. It saw a 5% YoY revenue increase but just $36 billion in net new assets for the quarter. This year’s slowdown in that value has worried investors, as competition for assets remains fierce. 💸

Besides that, investors remain anxious to know who will be taking over for CEO James Gorman, who announced in May he would hand off leadership to a successor within twelve months. However, there’s a clear lack of progress on that front, with Gorman saying there’s still not much in the way of definite answers.

Although Morgan Stanley and its peers are doing their best to operate in a challenging environment, investors continue to see headwinds ahead. Dealmaking is expected to pick up in 2024, but Wall Street wants to see the company squeeze more juice out of its wealth management business, which has been its crown jewel. 👑

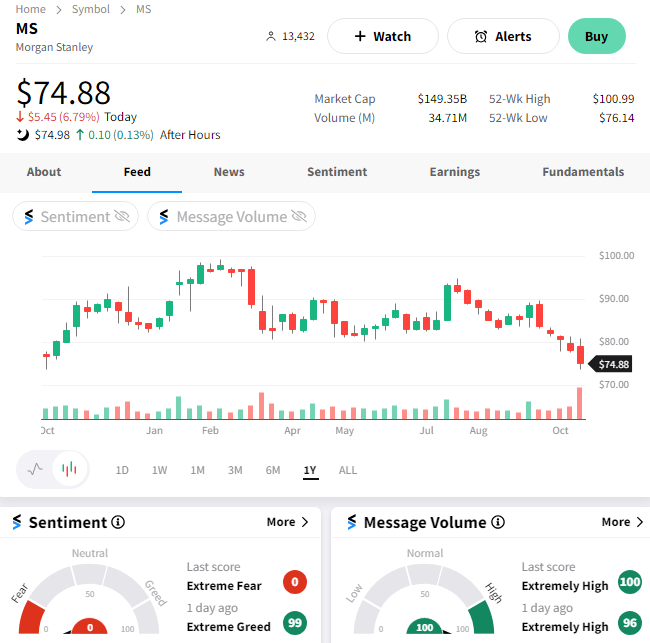

$MS shares fell about 7% on the day to roughly 15-month lows. 📉