Many pandemic-era “growth” stocks were left for dead in the desert in 2022, but many of them have recently turned a corner. Over the last few weeks, we’ve discussed many stocks across sectors catching a bid, leading many to ask if they’re back on the right path. 🤔

The robotic process automation software company UiPath is the latest stock to stage a turnaround. Its third-quarter revenues rose 24% YoY to $326 million and topped its guidance and Wall Street’s expectations. Meanwhile, adjusted earnings per share of $0.12 nearly doubled the consensus view of $0.07. 🔺

Executives say that customers are still investing where there is a return on investment, which is where UiPath’s tangible and quantifiable benefit shines. CFO Ashim Gupta also noted that the company has been embracing artificial intelligence (AI) for years and will continue to.

Overall, investors were happy to see a company beat revenue expectations and marginally beat expectations with its fourth-quarter forecast. 👍

$PATH shares rose nearly 27% on the day to eighteen-month highs, with several traders and investors saying this breakout provides solid evidence that its long-term downtrend has run its course.

As for what’s driving the rebound in these stocks, there are several factors. Most notably, business fundamentals have started to meet or beat expectations for the first time in a while. Combine that with negative sentiment and overly pessimistic positioning in the stocks, and you get a recipe for a sharp rebound. 📊

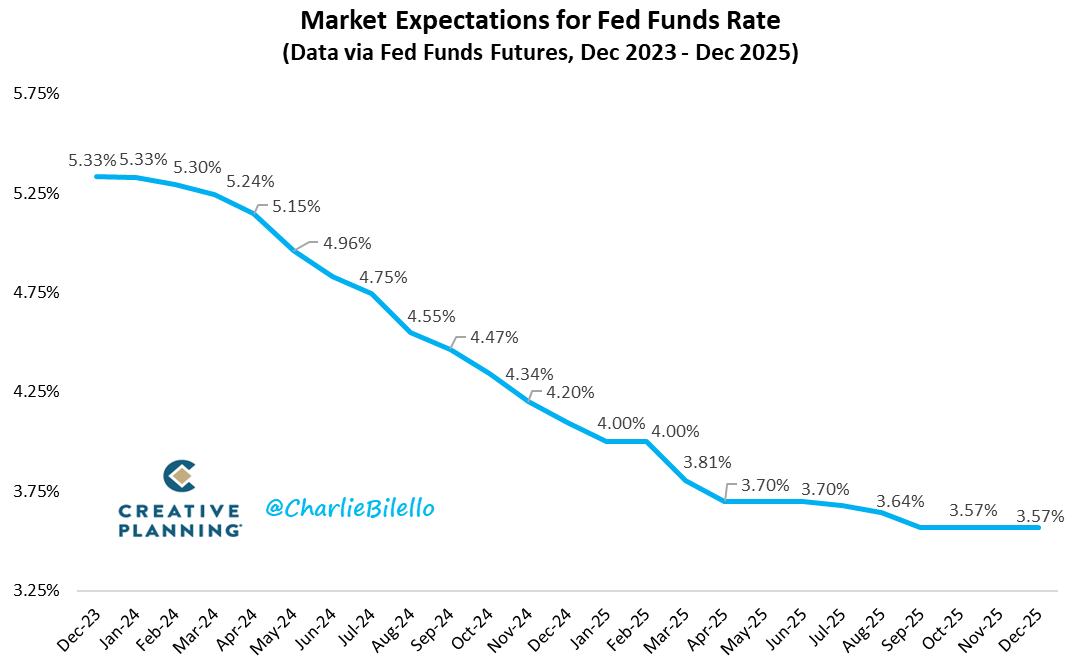

In terms of external factors, Charlie Bilello’s chart highlighting the market’s interest rate expectations also explains a decent portion of the move. The market continues to bet on the Fed cutting rates sometime next year, which should make it easier for these types of companies to operate and also incentivize investors to look at these “longer-duration” type stocks again.

As always, we’ll have to wait and see how these stocks’ turnarounds play out. But for now, it seems the market has gone from sour to sweet on many of these names. 🤷