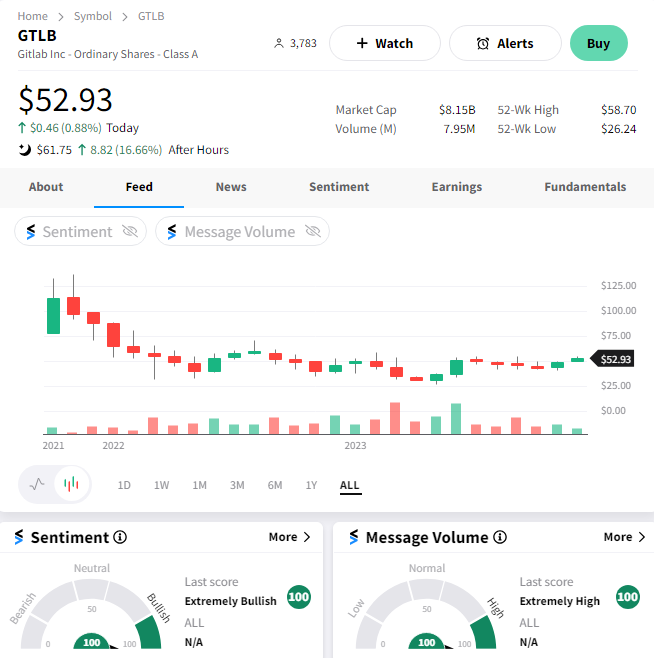

On Friday, we discussed growth stocks getting back on the right path due to a variety of factors. Today, that trend continued with GitLab. 👍

The developer-tools company is jumping after posting better-than-expected earnings, revenues, and guidance. Adjusted earnings per share (EPS) of $0.09 on revenues of $149.7 million topped the $0.01 per share loss on $141.5 million in revenues that analysts anticipated.

Notably, this is the first time the company has posted an adjusted operating profit. CFO Brian Robins touted 2,200 basis points on non-GAAP operating margin expansion after it cut costs and focused on responsible growth. Also, GitLab’s revenues rose 32% YoY, with its customer count rising 37%. 📊

Executives said the company is experiencing strength in large customers but noted small and medium-sized customers remain cautious about the economic environment. Nevertheless, they forecasted fourth-quarter adjusted EPS of $0.08-$0.09 on revenues of $157-$158 million. Analysts were again looking for a $0.01 per share loss on $150.20 million in revenues.

$GTLB shares rose 17% after the bell as the trend of beaten-down tech stocks beating low expectations continues. 😍