United Parcel Service returned to the spotlight today, but not for a positive reason. The transportation stock slumped once again after failing to deliver on earnings. ☹️

The shipping giant earned $2.47 per share on $24.90 billion in revenues during the fourth quarter. Those were mixed versus estimates of $2.44 and $25.40 billion, but its operating profit also missed.

While its recent labor negotiations with the Teamsters union are partially to blame, the core trend of declining shipping volumes remains. Volumes in the U.S. fell 7.40% YoY and 8.30% internationally. Management had been sustaining margins by raising prices but had to slow further increases as customers pushed back. 📦

Since the demand side of the equation remains weak, the company is again turning to cost-cutting. It plans to reduce its workforce by 12,000 people in 2024 to help boost short-term results and buy time for incremental price increases to help restore margins. It’s anticipating a half-point rise in operating profit margins each year for the next three years.

Unfortunately, that recovery will occur much more slowly than Wall Street had hoped. Full-year 2024 guidance for operating margins, profit, and sales was well below consensus estimates. 👎

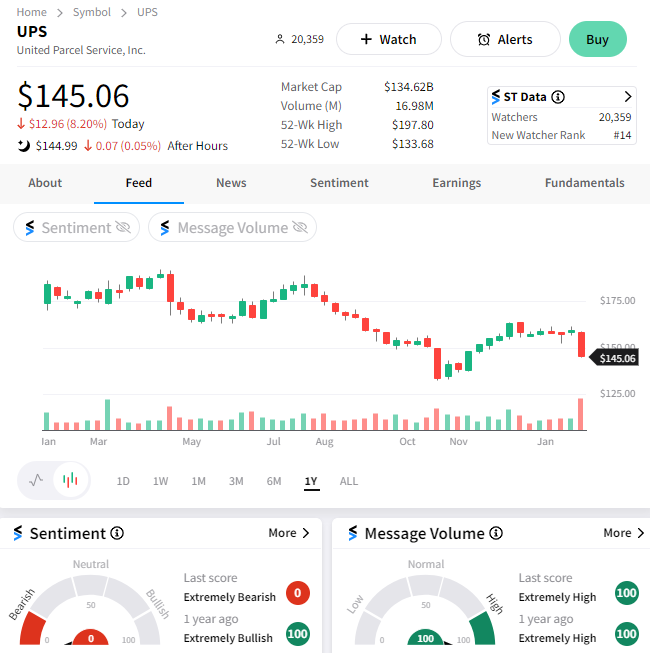

As a result, $UPS shares fell another 8% on the day. They’re sitting roughly 40% below all-time highs while the broader market indexes hit new highs daily. With the path forward unclear, the Stocktwits community is maintaining an “extremely bearish” view of the stock. 🐻