The Federal Reserve continues to fight inflation by crushing demand, but this year, the labor market has escaped its grasp. August’s job data rolled in this week and showed continued strength in a historically volatile month for jobs data. 💪

So far this week, the ADP Payroll report showed a weaker estimate of job growth but noted that annual pay was up 7.6% YoY (and 16.1% for job switchers). Initial and continuing jobless claims remained near record lows. Lastly, the second estimate of Q2 GDP showed that worker productivity fell 4.1%, hours worked increased by 2.7%, and unit labor costs were up 10.2%. 😮

Today’s nonfarm payroll data added to the “strong labor market narrative,” showing the economy added 315,000 jobs in August. Although that number is down from the 526,000 in July, it’s still above the 300,000 expected. And while these numbers are a notable slowdown compared with last year, they remain well above their pre-pandemic trend.

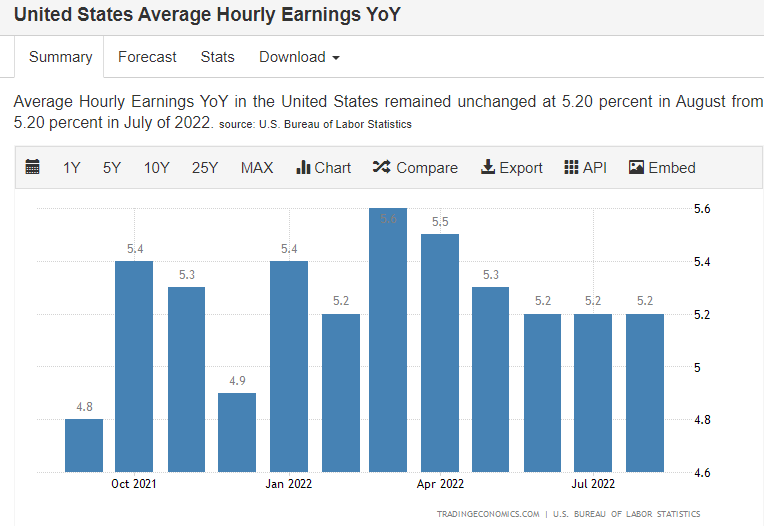

Additionally, average hourly earnings rose 0.3% MoM but are up 5.2% YoY (same as July). Wage inflation tends to be sticky, so these high readings remain a key concern for the Fed in its fight against inflation.

Nominal average hourly earnings growth has leveled off over the last few months, but like its other inflation measures, the Fed is looking for meaningful downward progress. 👀

An interesting final stat is the labor force participation rate, which increased to 62.4% from 62.1%. Unfortunately, the increase caused the unemployment rate to rise to 3.7% from 3.5%. 🔺

Bulls say this is a positive sign in a tight labor market. Job openings currently outweigh available workers by nearly 2:1. More workers joining the labor force would ease that trend and potentially reduce wage inflation. However, bears say that people are entering the labor market again because they have to. Inflationary pressure, diminished savings, and anxiety over the economy’s health are pushing people back to work.

As with every forecast, all we can do is wait and see who’s right. 🤷♂️

For now, though, despite some of the stats slowing marginally, it appears the overall labor market has largely escaped the Fed’s wrath. Nevertheless, a tight labor market and wage inflation continue to push the Fed’s price stability mandate further out of reach. As a result, many market participants believe it will likely push them towards a more aggressive hike at their September meeting. 🗓️