U.S. markets were closed last Friday when March’s nonfarm payrolls data came in. As a result, the market reacted a bit today as investors adjusted their positions accordingly. 📝

The report showed growth of 236,000, about 2,000 lower than expectations. That was also below the upwardly revised 326,000 from February. Analysts expected the unemployment rate to stay at 3.6%, but it fell to 3.5%.

Average hourly earnings rose 0.3% MoM and 4.2% YoY, its lowest annual increase since June 2021. The average workweek also ticked lower to 34.4 hours. 🔻

The report affirmed some of the softening seen in last week’s JOLTs, ADP employment, and initial/continuing jobless claims data. While the labor market remains historically tight, it’s well off its peak. Leading indicators like job openings to available workers have slowly begun trending in the right direction. 📊

With that said, marginal progress in these readings is unlikely to impact the Fed’s decision at its May 2-3 meeting. Jerome Powell has said that a sustained softening in the labor market is needed to bring down inflation, particularly in the services sector, where it’s remained sticky. And we’re not there yet.

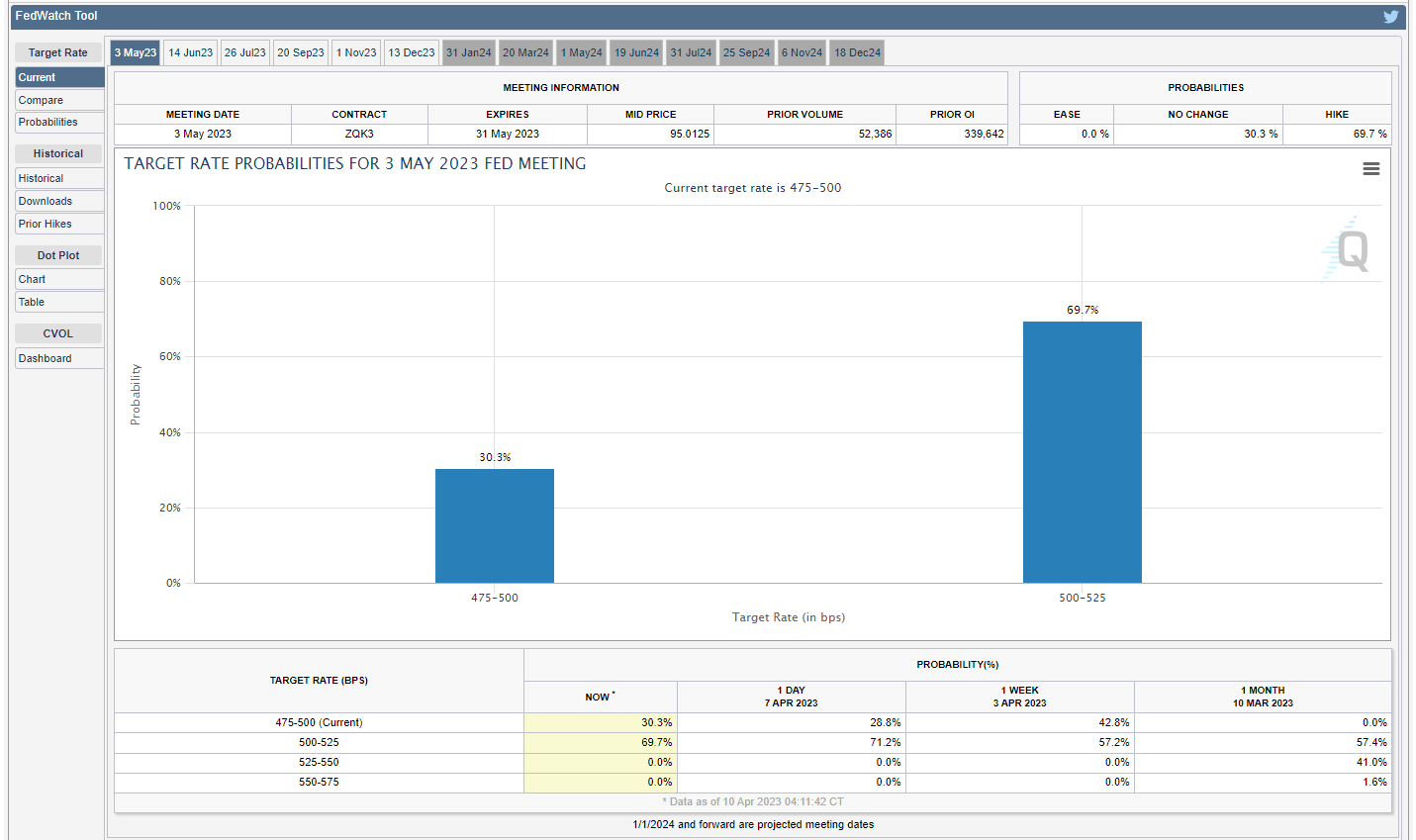

As a result, the bond market is currently pricing in a 70% chance of a 25 bp hike in May before the Fed pauses its rate hikes. That’s up from about a 58% chance last week before all of this job data came out. The other 30% is betting on the Fed stopping its rate hikes due to the recent labor market / inflation progress and banking sector turmoil. 🔮

We’ll continue to monitor how this changes as more data comes in. But as of now, unless inflation surprises significantly, then one more hike and a pause is the bet most are making. 🤷