Tale of the Tape

Happy Monday everyone. Markets extend their winning streak. 🥳

Another day, another milestone. Nifty and Sensex hit new all-time highs intraday before cooling off. ✌ Midcaps (+0.4%) and Smallcaps (+1.1%) fared better. The advance-decline ratio was evenly split.

Most sectors edged higher. Real Estate stocks (+3.2%) continued their sizzling rally. IT (+1.5%) saw a healthy pullback. 📈 Banks (-0.5%) and NBFCs (-0.3%) were the main sources of weakness.

Reliance Industries (+1.6%) hit a new all-time high. Yet again. The stock is up ~10% in the last three days. What’s fuelling the rally? 🔥 Read below.

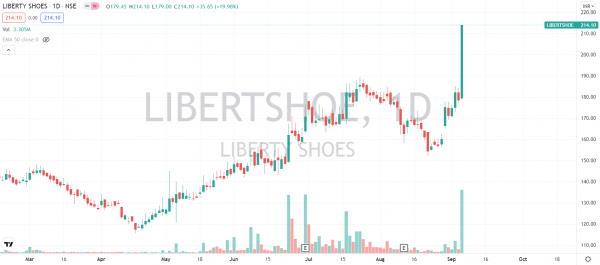

Footwear stocks were in high demand. Liberty Shoes was locked in a 20% upper circuit. Mirza International and SreeLeathers surged ~7%. Check out their charts below. 🤑

ICICI Lombard fell -4%. Insurance Regulatory and Development Authority of India (IRDAI) allowed ICICI Bank to reduce its stake in the company to 30% vs 52% currently. 👎

State-run miner National Aluminium (+5.6%) hit a 10-year high. Reports of aluminum prices skyrocketing due to the political turmoil in Guinea triggered buying. 💸

M&M Financial was up 2% on management citing improved growth and lower bad loans. 📊

Barbeque Nation (+1.6%) raised Rs 100 cr from large investors like the Massachusetts Institute of Technology (MIT), Motilal Oswal, and others. 💰

Global crypto market cap had a big weekend +3%. 💪 Bitcoin (+4%) hit the highest mark since May 13. Ethereum was flat. Ripple (+9%), Polkadot (+7%), and Doge (+6%) saw big gains. Solana rose ~3%.

Here are the closing prints:

| Nifty | 17,378 | +0.3% |

| Sensex | 58,297 | +0.3% |

| Bank Nifty | 36,592 | -0.5% |

Reliable Gains

Reliance Industries is on a hot streak. 🔥 The stock hit a new all-time high gaining ~10% in the last three days. The Company’s market cap crossed the Rs 16 lakh cr mark. 🥇 So, what’s the deal with RIL, and what are fundamental experts saying?

RIL’s refinery and retail businesses suffered from Covid in Q1. Hopes of improved earnings as the economy normalizes have boosted sentiment. Media reports of the Saudi Aramco deal progressing swiftly have also added to the cheer. 😊

But, there’s more. The Street is also excited for the launch of JioPhone Next, the world’s cheapest 4G enabled smartphone, on Sept 10. 📱 The new phone launch coupled with Vodafone’s struggles should strengthen its grip on the #1 telco spot. Some also are bullish on future price hikes as Bharti Airtel recently announced it was raising prices. ✅

On a side note, the Company announced that it’s buying genomic firm Strand Life Science for Rs 393 cr. Here’s ET with more details. 💸

The sharp surge in Reliance’s shares has added more dough to Ambani’s fortune. Asia’s richest man is just a stone’s throw away from entering the exclusive $100 billion net worth club. 😎

Reliance Industries is up 22% YTD.

ChartBusters

Footwear stocks were in high demand today. 👞 Reports of the Government extending the incentive scheme for the leather and footwear industry till 2025-26 cheered investors. The Rs 1,700 cr Indian Footwear Leather and Accessories Development Programme (IFLADP) is proposed to boost manufacturing, exports, and job creation. 📊

Liberty Shoes was locked in a 20% upper circuit. Mirza International and SreeLeathers surged ~7%. Here are their charts for your viewing pleasure. 📈

Mr. Worldwide

US equities are gaining momentum in India. Several platforms like Vested Finance, Stockal among others have seen multi-fold growth in the past year. Yet, for a large percentage of the population, it remains a cumbersome and costly affair. 😓

To capitalize, mutual funds have asked SEBI to increase the cap on overseas investing. Several feeder funds/ETFs focused on US equities have launched in 2021. Mirae Asset S&P 500 Top 50 ETF is the latest entrant to this list. 👶

This exchange-traded fund (ETF) invests in the top 50 US companies from the S&P500 index. Simultaneously, the fund house will launch a fund of funds (FoF) investing in units of the ETF. The FoF option is for those without a demat account to invest in the underlying scheme. PS. Demat accounts are needed to buy ETF units. 😇

Investing in global equities via ETFs is an efficient, low-cost way to diversify your portfolio. For reference, an ETF is a cheaper alternative to a mutual fund. ETFs (unless otherwise mentioned) are not actively managed by a portfolio manager and are designed to track the return of a particular benchmark index (i.e. S&P 500, NASDAQ, Nifty 50). 👍

Links That Don’t Suck

💯 Essential Lessons From O’Neil On Relative Strength, Volume, Charts (Marketsmith India)

💸 Dukaan Raises $11 Million To Help Merchants In India Set Up Online Stores

🍱 Why Food Tastes Different On Planes

😍 Christopher Lloyd Plays Rick Sanchez In New Rick And Morty Promo

🚨 Spoiler Alert! 8 Moments From ‘Money Heist’ S5 That Made Us Realize It’s The Beginning Of The End

🙅♂️ Argentina Footballers Accused Of Covid-19 Violation; Match Vs Brazil Suspended