Tale of the Tape

Greetings, everyone! The weekend is upon us. 🎉

Markets slipped for a fourth straight day as Q2 earnings continued to disappoint. Midcaps (-0.9%) and Smallcaps (-1.3%) witnessed deep cuts. Two stocks fell for every one gainer. 📉

Most sectors ended in the red. Metals (-3%) were the top losers after global prices dropped sharply on easing supplies. Pharma, IT, and FMCG stocks fell over 1% each. Real Estate (+2.6%) stocks snapped their three-day losing streak. 👍

TVS Motor (+7%) posted its best single-day gain since April 28 on strong results. HDFC Life Insurance dropped 1% on muted earnings. Read more below 📊

Reliance Industries (+0.1%) will report its Q2 earnings later today. Analysts estimate the company’s Sales and Net Profit to grow by 4% and 2%, respectively. Here’s the full earnings preview. 💸

The Bombay High Court will give its verdict in the Zee-Invesco dispute on Oct 26. Zee Entertainment closed -4%. 👩⚖️

ITC dropped over 3%. Reports indicate the Government is likely to increase the tax on cigarettes next week. 🚬

Rakesh Jhunjhunwala increased his holding in Indiabulls Real Estate to 1.1% in Q2. The stock closed up 2% after opening higher. 😎

Tata Chemicals (-2%) is rumored to sell its US soda ash business for $1 billion. 💰

Container Corporation of India raised its FY22 volume guidance to 15%. ✌ The stock closed +2%.

IRB Infra was locked in a 20% upper circuit. The company will consider raising funds at its Board meeting on Oct 26. 💰

KEC International (+5%) bagged new orders worth Rs 1,829 cr. 😇

Cryptos took a breather after their recording-breaking run. Bitcoin and Ethereum dropped over 4% each. Dogecoin slipped 3%. Solana (+7%) bucked the trend and crossed the $200-mark. 😍

Here are the closing prints:

| Nifty | 18,115 | -0.4% |

| Sensex | 60,822 | -0.2% |

| Bank Nifty | 40,324 | +0.7% |

Earnings Roundup

TVS Motor (+7%) hit a four-month high on strong results. Revenues and Operating Profit hit an all-time high in Q2. Higher exports, price increases, and cost savings boosted overall performance. 📊 Here are the key stats:

- Revenue: Rs 5,619 cr; +22% YoY (vs Est: Rs 5,395 cr)

- EBITDA: Rs 563 cr; +31% YoY (vs Est: Rs 468 cr)

- EBITDA Margin: 10% (vs Est: 8.7%)

- PAT: Rs 278 cr; +42% YoY (vs Est: Rs 225 cr)

Markets are also pricing in a strong end to the calendar year. Strong domestic demand aided by the festive season and increased exports may drive volumes. Rising commodity prices may pose a risk to margins. 🙈

TVS Motor is +25% YTD.

HDFC Life Insurance (-1%) posted a mixed set of results. Revenues beat estimates aided by a healthy uptick in annuity and higher renewals. But, a sharp jump in claims (i.e. customers using their insurance) hurt the company’s bottom line. Assets under management (AUM) rose 27% over the previous year to Rs 1.9 lakh cr. 📈 Check out its report card here:

- Annual Premium Equivalent: Rs 2,551 cr; +21% YoY

- Value of New Business (VNB): Rs 1,086 cr; +30% YoY

- VNB Margin: 26.4% vs 25.1% YoY

HDFC Life is bullish on the future outlook. The company cited rising penetration, innovative products, and digitization boom as key growth drivers. HDFC Life’s acquisition of Exide’s insurance business may receive all necessary approvals by Jan 2022. ✅

HDFC Life Insurance is +2% YTD.

Overheard on Stocktwits

Here’s an interesting chart setup by Vishal Mehta on Stocktwits that you should check out. Add $PNB.NSE to your watchlist and track its performance. PSU Banks are on a tear lately. Want to know how to ride high momentum stocks? Check out our YouTube video here – https://youtu.be/iucpygonjiM

Lookin’ Pretty

Nykaa sets its date with Dalal Street. The highly anticipated IPO will open on Oct 28. The price band is fixed at Rs 1,085-1,125 per share. The company plans to raise Rs 5,200 cr from the markets. 💸

Founded in 2012, Nykaa is a leading multi-brand beauty & personal care platform. The company operates under 2 major verticals: a) Beauty and personal care and b) Apparel and accessories. It has a robust omnichannel business model providing customers with both online and offline shopping experience. 💄

Financial Snapshot:

- FY21 Revenue: Rs 2,441 cr; +38% YoY

- FY21 Net Profit: Rs 62 cr vs Net loss of Rs 16 cr YoY

The $13 billion Indian cosmetics market is expected to grow 16% compounded annually over the next 5 years. A big chunk of this growth will be driven by online retail. 📱

The Indian beauty e-commerce industry is still in its early days with only a handful of large players. Nykaa’s loyal customer base, strong growth trajectory, and solid promoter backing is sure to excite investors. We are expecting this one to be a big hit. 🔥

Crypto Special

There’s no doubt that Indians love crypto. Earlier this month, CoinSwitch Kuber joined the unicorn club and became the largest cryptocurrency exchange in the country.

In an email interview, CEO Ashish Singhal shared how ‘Digital India’ could become Crypto India:

ST: How did CoinSwitch Kuber become India’s largest crypto platform in just 15 Months?

AS: Simplicity and ease of buying crypto is a key feature of the CoinSwitch Kuber app. This has contributed greatly towards user acquisition as even those who have never invested in crypto, especially those from tier 2 and tier 3 cities, have been able to do so seamlessly. Additionally, we’ve been running strategic marketing campaigns that promote exactly these app features, helping in spreading the word.

ST: Don’t you think the crypto companies in India have grown up to another level where there’s a race for who is first or biggest unicorn, or which Bollywood celebrity is endorsing which brand?

AS: Crypto companies have definitely seen exponential growth in India all around. CoinSwitch receiving funding from the likes of a16z and Coinbase shows the trust and belief they have in the company to scale and in the Indian crypto ecosystem to grow in adoption. Bollywood celebrities as brand ambassadors are an indication of crypto going mainstream.

ST: But amid the growth in the crypto sector, a massive number of the population don’t understand crypto. How will you bridge the gap?

AS: We have educational resources built in the app itself so that investors can gain knowledge about crypto and industry developments on the app they use to invest easily. We have also partnered with various publications to deliver knowledge about crypto in various forms.

ST: You mentioned that you’re waiting for a ‘demonetization moment,’ which encouraged people to shift toward digital transactions. How long do we have to wait for that moment for the crypto industry?

AS: Crypto is already seeing great adoption in India, with the country ranking second in a report by Chainalysis. A digital-first country like India with an encouraging digital payments ecosystem is already witnessing momentum with crypto.

ST: What are some of the critical points that government needs to understand right now?

AS: Crypto is not an alternative to fiat currency but rather is an asset class for investment that can democratize the financial system and wealth building. Positive regulations will foster not just the crypto economy but also innovations in blockchain technology

India’s love affair with crypto has only just begun. Crypto investments are up 20x from $200 million to $40 billion in the past year alone. And if all goes well, India might soon surpass the USA to become the largest crypto market in the world. 🤞

Movers and Shakers

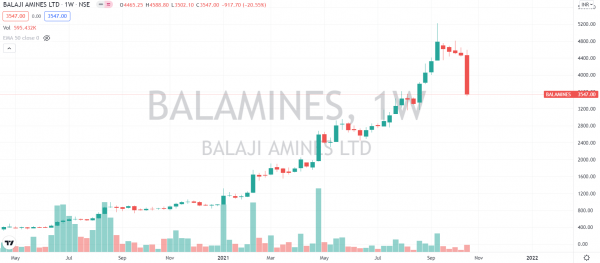

Here’s a look at this week’s top movers from the Nifty 500. Rail Vikas Nigam took the pole position after rallying +40%. 🥇 IRB Infra (+39%) posted its highest-ever weekly gain. DCM Shriram (-22%) posted its worst weekly drop since April 2018. Balaji Amines (-20%) dropped for a fifth straight week. 😓 Check out their charts below:

Links That Don’t Suck

😎 Indians Hike Crypto Holdings As Market Soars

✌ Google Slashes Commission For In-App Purchases To 15% From January 1

👀 What Will Happen When Queen Elizabeth II Dies?

🎡 World’s Largest Ferris Wheel Opens In Dubai

🏏 T20 World Cup: Pakistan’s T20i Record In The Last Decade Gives India The Edge

💯 Manchester United Vs Liverpool: What Is Cristiano Ronaldo’s Record Against The Reds?

🤷♂️ Scientists Temporarily Attached A Pig’s Kidney Into A Human, And It Worked