Tale of the Tape

Hey folks, markets closed down for a second straight day. 📉

Nifty and Sensex tumbled half a percent tracking weak global cues. Midcaps (-0.7%) and Smallcaps (-1.3%) continued to underperform. Over 3 stocks fell for every 1 gainer. 🔻

Most sectors ended in the red. IT (-1.9%) and Pharma (-1.5%) were the key sources of weakness. FMCG stocks (-1.3%) witnessed profit booking. 💸

Zomato was the star of the day. The stock rallied +15%, the highest single-day gain since listing, after solid Q4 results and positive management outlook. Read more below. 🔥

Ashok Leyland jumped +3% after a double upgrade by CLSA. The global brokerage has a “buy” rating on the stock and sees a 27% upside from current levels. 🚀

Rupa & Co tanked 15% after its CEO Dinesh Kumar Lodha announced sudden resignation. 🚨

Sugar stocks fell sharply on reports that Government may limit exports. Dalmia Bharat, Balrampur Chini, and Dhampur Sugar slipped between 5%-7%. 🤕

Marico (-1%) will buy a 54% stake in D2C healthy snacks brand, True Elements for an undisclosed amount. 🥣

Delhivery surprised the street with decent listing gains. The stock closed at Rs 536 p/sh; +10% from its issue price. 💪

Olectra Greentech (+5%) won a Rs 3,675 cr order to supply electric buses to Brihanmumbai Electric Supply & Transport (BEST). ⚡

Aether Industries IPO opened for subscription today. More details below. 😎

Cryptos were back in the red. Bitcoin and Ethereum were down ~4%. Solana and Cardano tanked over 7% each. 👎

Here are the closing prints:

| Nifty | 16,125 | -0.6% |

| Sensex | 54,052 | -0.4% |

| Bank Nifty | 34,290 | +0.2% |

Earnings Roundup

Zomato rallied +15% intraday after blockbuster Q4 results. The food delivery business, which accounts for 83% of its overall revenue, witnessed a sharp turnaround in Q4. Gross Order Value (GOV) grew 6% over the previous quarter led by increased ordering. Average monthly transacting customers hit a new all-time high of 15.7 million, up +60% YoY. Strong topline growth plus lower discounts reduced operating losses. Here’s its report card: 📊

- Revenue: Rs 1,212 cr; +9% QoQ (vs Est: Rs 1,175 cr)

- Net Loss widened to Rs 359 cr (vs net loss: Rs 67 cr QoQ) boosted by a one-time gain of Rs 316 cr in Q3.

Going forward, Zomato does not expect any reopening-related impact and has guided for double-digit topline growth in Q1. The company is confident of reducing operational losses despite rising costs. Zomato received a lot of flak for its recent investments but as things stand the company will not pursue any more acquisitions. ✅

Zomato’s narrowing losses in the core food delivery business, prudent capital allocation and favorable risk-reward ratio post recent slump drew quite a few thumbs up. PS. global brokerage firm Jefferies sees a 53% upside from current levels! 🤑

Another One

Specialty chemical maker, Aether Industries IPO kicked off today. The price band is fixed at Rs 610-642 per share. The company plans to raise Rs 808 cr from the markets. 💸

Founded in 2013, Aether Industries is one of India’s fastest-growing specialty chemical companies. It is the largest and sole producer of several chemicals used across pharma, paints, and home & personal care industries. Aether has a diversified client base and gets 56% of its business from exports. The company has two manufacturing plants, both in Gujarat. Aether will use the IPO money to set up a new production unit, pay off debt, and fund working capital requirements. 💯

Financial Snapshot:

- 9MFY22 Revenue: Rs 443 cr (FY21: Rs 450 cr)

- 9MFY22 Net Profit: Rs 83 cr (FY21: Rs 71 cr)

Big picture: The Indian specialty chemical industry is expected to grow 12% CAGR by 2025. Strong demand from agrochemicals, pharma, and associated industries plus the hugeee export opportunity are key factors. 💰

Aether’s niche product portfolio, mind-blowing financials, decent valuations, and high industry growth potential are sure to excite investors. But, volatility in equity markets may restrict listing gains. Watch out for this one. 🔥

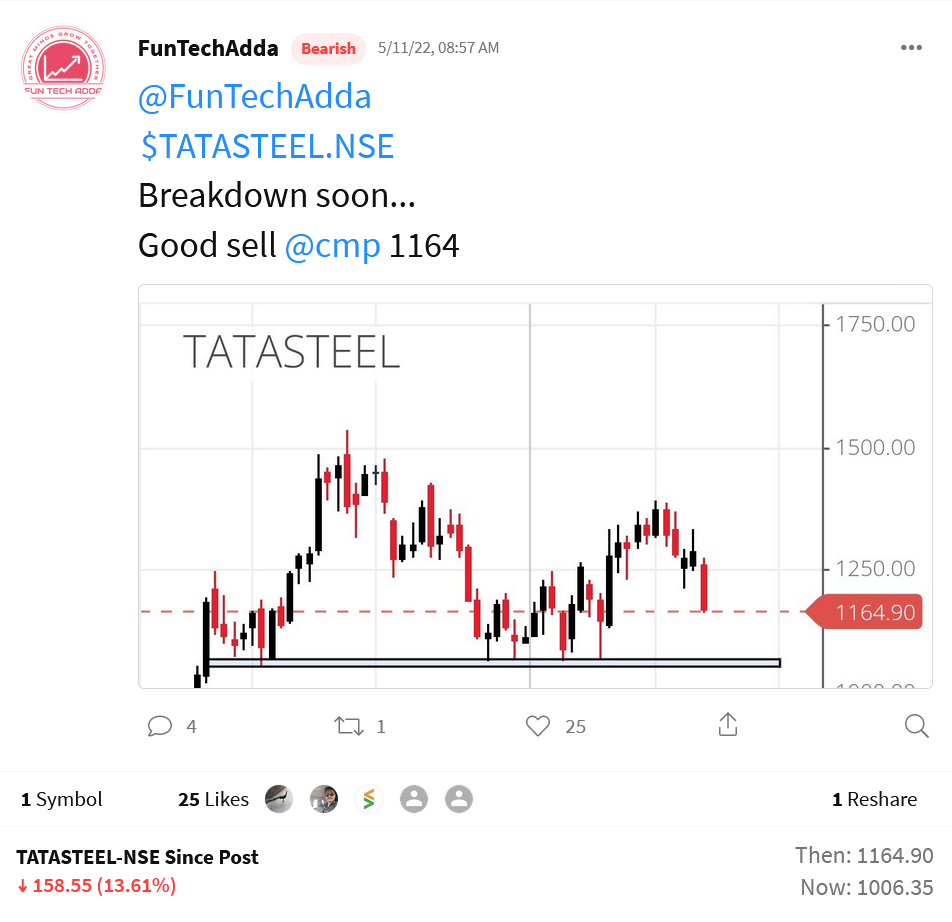

Stocktwits Spotlight

Tata Steel is down 13% in less than 2 weeks. Huge shout-out to FunTechAdda for catching the reversal waaay before everyone else. Follow them for more amazing trade ideas and add $TATASTEEL.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3LA4poc.

Earnings Highlights

- Shilpa Medicare: Revenue: Rs 341 cr; (+64% YoY) | Net Profit: Rs 30 cr; (+2.7X YoY)

- Graphite India: Revenue: Rs 844 cr; (+49% YoY) | Net Profit: Rs 95 cr; (+48% YoY)

- Bharat Electronics: Revenue: Rs 6,340 cr; (-8% YoY) | Net Profit: Rs 1,154 cr; (-16% YoY)

- Bank of India: Net Interest Income: Rs 3,986 cr; (+36% YoY) | Net Profit: Rs 606 cr; (+1.4X YoY)

- Balrampur Chini: Revenue: Rs 1,280 cr; (+26% YoY) | Net Profit: Rs 241 cr; (+2% YoY)

Calendar

Be sure to know when your stocks report earnings. Here’s the results calendar:

Links That Don’t Suck

☮️ Ukraine’s Zelenskiy Says He Would Meet With Putin To End The War

🤳 Snap Plunges 30% After CEO Warns Company Will Miss Revenue And Earnings Estimates, Slow Hiring

👢 French Luxury Brand Balenciaga To Accept Bitcoin, Ethereum As Payment

💯 Watch: This Viral Video Of A ‘Guard Dog’ Chilling By The Pool Will Brighten Your Day

🙏 68-Yo Dedicates A Lifetime To Turn Ancestral Land Into Forest With 5 Crore Trees

🍿 Here’s Everything You Need To Know Before Watching Stranger Things 4′