Tale of the Tape

Happy Monday everyone. 😇

Nifty and Sensex pulled back sharply after opening lower to hit a new all-time high. Read more below. Midcaps (+0.7%) and Smallcaps (+1.2%) also moved in sync. The advance-decline ratio (2:1) stood in favour of the bulls. 🐂

Most sectors ended in the green. Energy (+1.3%) topped the list of gainers. Auto (+0.6%) stocks closed up for a fifth straight day. Metals dropped 1% amidst concerns over China. 📉

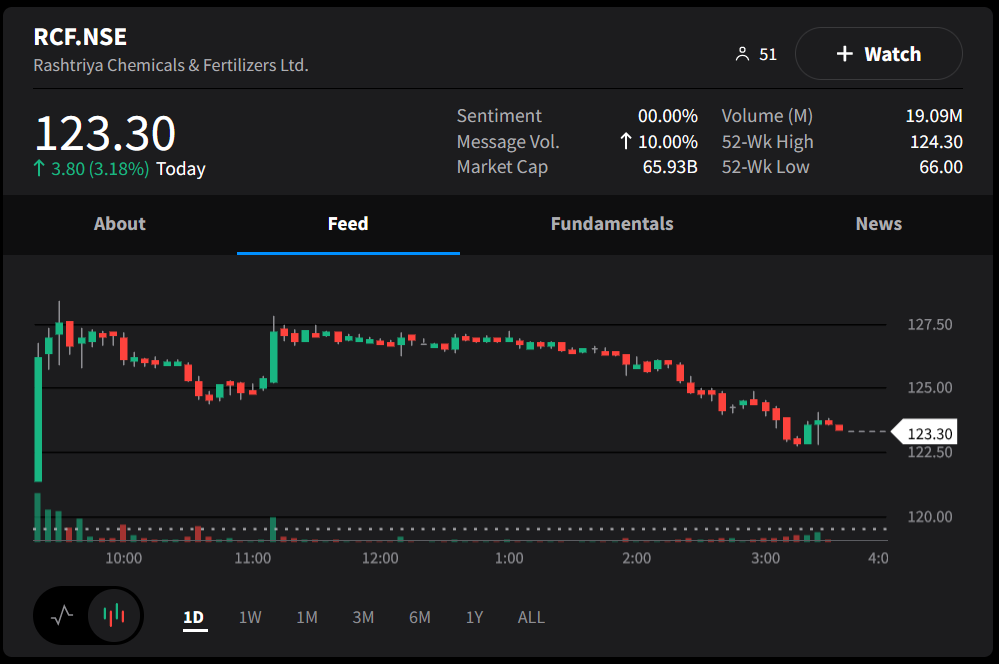

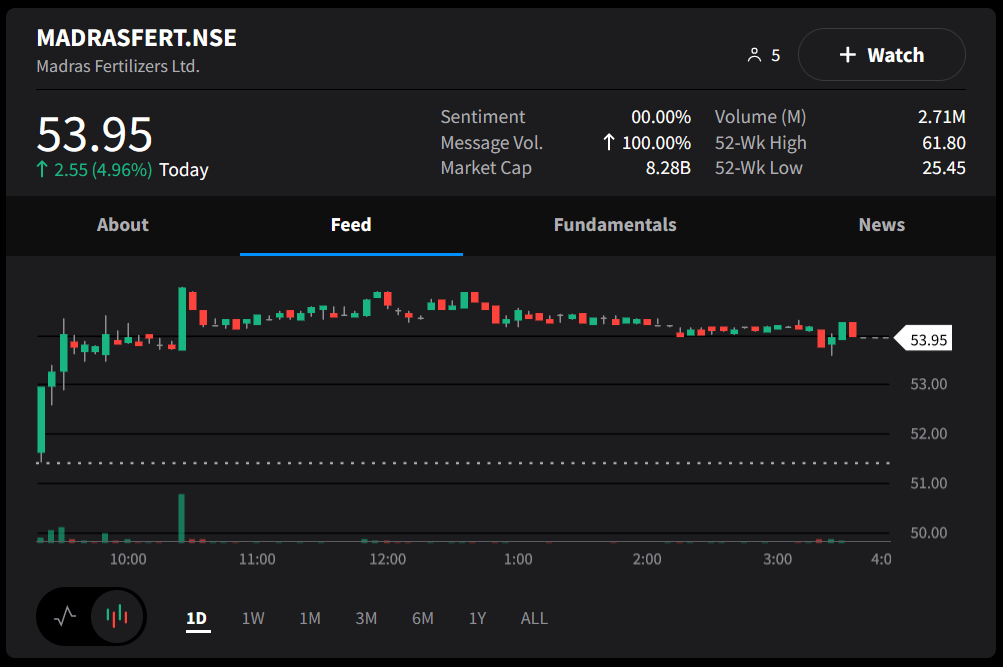

Fertilizer stocks broke out in trade. Fertilizers & Chemicals Travancore (FACT), Rashtriya Chemicals and Fertilizers (RCF) and Madras Fertilizer rallied between 3%-6% each. Check out their charts below. 🔥

Hero MotoCorp zoomed +3% intraday. They will increase prices by up to Rs 1,500 from Dec 1. 🛵

Paytm dipped 4% intraday after the Reserve Bank of India (RBI) barred its payment unit from onboarding new online merchants. 🚨

Va Tech Wabag jumped +4%. Global brokerage firm Nomura sees a +50% upside from current levels. 💰

RVNL was locked in a 10% upper circuit after 1.1 cr shares (0.5% equity) changed hands in a block deal. 🤝

IEX will buy back 49 lakh shares at Rs 200 per share from the open market. 😏

Dharmaj Crop Guard IPO got fully subscribed on day 1. 💸

Cryptos continued to grind lower. Bitcoin was down 2%. Ethereum slipped over 3%. Ripple, Matic and Solana fell ~4% each. 🙈

Here are the closing prints:

| Nifty | 18,562 | +0.3% |

| Sensex | 62,504 | +0.3% |

| Bank Nifty | 43,020 | +0.2% |

All I Do Is Win!

It’s a historic day for the Indian stock market as the benchmark Nifty50 Index hit a new lifetime high of 18,614!!! 🚀

A deadly trio of soaring energy and food prices, interest rate hikes, and geopolitical tensions threatened to derail the bull run in October last year. But, after 275 trading sessions (+13 months) we are back at the summit! 💪

A whole lot has changed since the last time we were at 18,600. For starters, Covid is a thing of the past. Oil prices are down 40% from their 2022 peaks, the US Federal Reserve is expected to slow down its pace of interest rate hikes and Foreign Institutional Investors (FIIs) are buying Indian stocks in bulk! 💰

Speaking of stocks, ITC was the standout performer in this recovery. The FMCG giant was the top Nifty gainer, up 40% since last October. Automakers Mahindra & Mahindra (+37%) and Eicher Motors (+27%) also witnessed healthy gains. On the other hand, IT stocks like Wipro (-43%) and Tech Mahindra (-29%) were the top laggards. Divi’s Lab also dropped 35% during the same period. 💯

Going forward, most experts are optimistic about India’s growth prospects. Pickup in consumption, easing supply constraints and favourable Govt policies are expected to drive stocks higher. But, pricey valuations and improving global economic factors may restrict significant upside. PS – Goldman Sachs has a target of 20,500 by Dec 2023, +10% from current levels. ✌️

Chartbusters

Fertilizer stocks extended their gaining streak. The farming sector is expected to have a solid 2022-23 rabi season thanks to healthy monsoons. PS – Wheat, the main winter crop, sowing has increased 50% over the previous year, as per the latest report. Fertilizer subsidy is expected to hit an all-time high of Rs 2.5 lakh crore for the ongoing year, which is a huge positive. ✅

Stake sale buzz plus speculation that GOI may announce incentives for the Agri sector in the budget added fuel to the fire. Fertilizers & Chemicals Travancore (FACT), Rashtriya Chemicals and Fertilizers (RCF) and Madras Fertilizer rallied between 3%-6% each. Check out their charts below: 📈

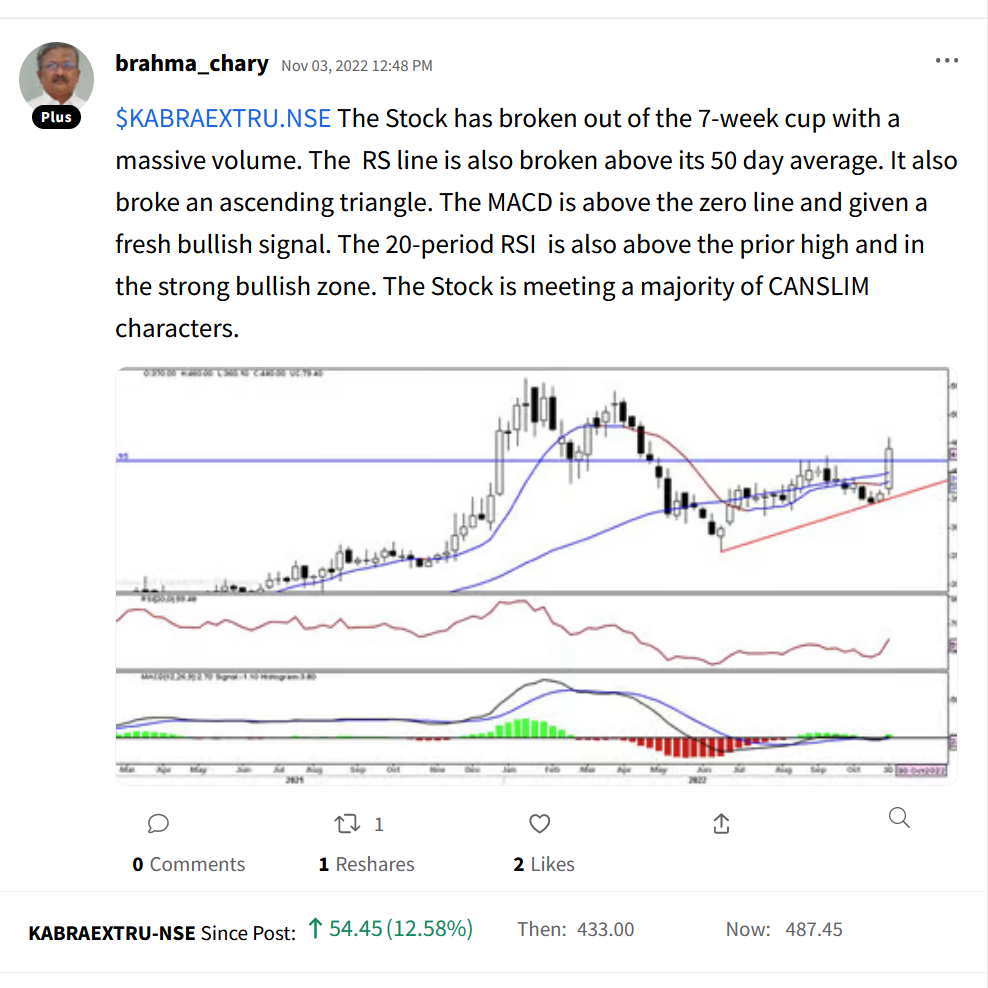

Stocktwits Spotlight

Kabra Extrusion Technik is up +14% in the past month. Thank you Thoviti Brahmachary for the awesome call. Follow him for more amazing trade ideas and add $KABRAEXTRU.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3Vs3bk6.

Links That Don’t Suck

💯 All-time High This Week? | Oil Sector Stocks to Watch Out | Stock Room Sunday

📈 SIPs Eating Into Luxury Car Sales: Mercedes

🤔 The US Congress Is Starting to Question This Whole Crypto Thing

🎧 The ‘Bose of Sound’ Who Created the World’s First Noise-Cancelling Headphones

😋 15 Weird Food Combinations That Surprisingly Work

⚽ Messi MLS Bound? Inter Miami Close To Sealing Record-Breaking Deal For PSG & Argentina Superstar