Tale of the Tape

Hey, guys. Markets barely moved. 〰️

Nifty and Sensex cooled off after opening higher to end flat. Midcaps and Smallcaps continued to underperform; down -0.4% each. Nearly two stocks fell for every gainer. 👎

Most sectors closed lower. PSU Banks (-1.4%) and Real Estate (-1%) stocks were the top losers. Autos (+1.3%) and IT (+0.8%) bucked the overall market weakness. 📈

Maruti (+3.3%) was the top gainer on Nifty after blockbuster Q3 results. 💯

Jindal Stainless increased their FY23 volume guidance from flat to 3%-5%. 📊

Max Financial was in focus on reports that private equity giants Bain Capital and CVC Capital Partners are in talks to buy the promoter stake. 🔍

Nykaa snapped its 8-day losing streak after appointing P Ganesh as the Chief Financial Officer (CFO). He was part of the top management at Godrej Group, Glenmark Pharma and Pidilite before joining Nykaa. ✅

Dilip Buildcon won a Rs 1,947 cr order from the Madhya Pradesh Government. 💰

Results reaction. Poonawala Fincorp (+6%) snapped its 3-day losing streak. Zensar Technologies (+5%) hit a 1-month high. 👍

Cryptos were back in the green. Bitcoin jumped +2%. Ethereum traded with minor gains. BNB, Ripple and DOT were up 3%-5%. 🚀

Here are the closing prints:

| Nifty | 18,118 | -0.1% |

| Sensex | 60,978 | +0.1% |

| Bank Nifty | 42,733 | -0.2% |

Earnings Roundup

Maruti Suzuki (+3%) hit a 1-month high on blockbuster Q3 results. India’s largest carmaker beat Street estimates on all counts! Maruti sold an insane 4,65,911 units in Q3; +8% over the previous year. This is a big deal because this year the festive sales were split between Q2 and Q3 vs last year when it was ENTIRELY in Q3! Operating margins hit a multi-year high thanks to price hikes, easing supply constraints and prudent cost control measures. Here’s its report card: 📊

- Revenue: Rs 29,044 cr; +25% YoY (vs Est: Rs 29,590 cr)

- EBITDA: Rs 2,833 cr; +82% YoY (vs Est: Rs 2,669 cr)

- EBITDA Margin: 9.7% vs Est: 9.3%

- Net Profit: Rs 2,351 cr; +2x YoY (vs Est: Rs 1,907 cr)

2022 was the best year EVER for Maruti. They sold a record 19.4 lakh cars in India and 2.6 lakhs through exports! Strong demand for their new launches (mainly in the high-growth SUV space) plus easing commodity price and supply chain issues are key positives. ✌️

Maruti Suzuki is +6% in the past year.

Budget Special #2

Hey, guys. Today we’ll take a look at India’s renewable energy sector. We’ll discuss the Govt’s ambitious vision for the sector, the latest updates, industry expectations and top stocks from the space. 🧐

India is the world’s third-biggest emitter and remains deeply reliant on coal to meet its energy demands. Going forward, the Government aims to change this and generate 50% of its power requirements from renewable sources. According to credit rating agency ICRA, the country needs to add annual capacity of 42GW over the next eight years to meet this target. ♻️

This would require huge investments. The GOI has provided financial incentives in the past to support the renewable energy sector. But, India still relies heavily on imports from China for key equipment like solar modules, battery cells etc. To reduce this, industry experts are hopeful that the GOI may announce the highly successful Production Linked Incentive (PLI) scheme for solar PV modules, and advanced cell battery storage. They would also watch out for additional benefits under the Green Hydrogen Policy. This is a positive for companies like RIL, Adani Green, JSW Energy, and NTPC, said experts. 💯

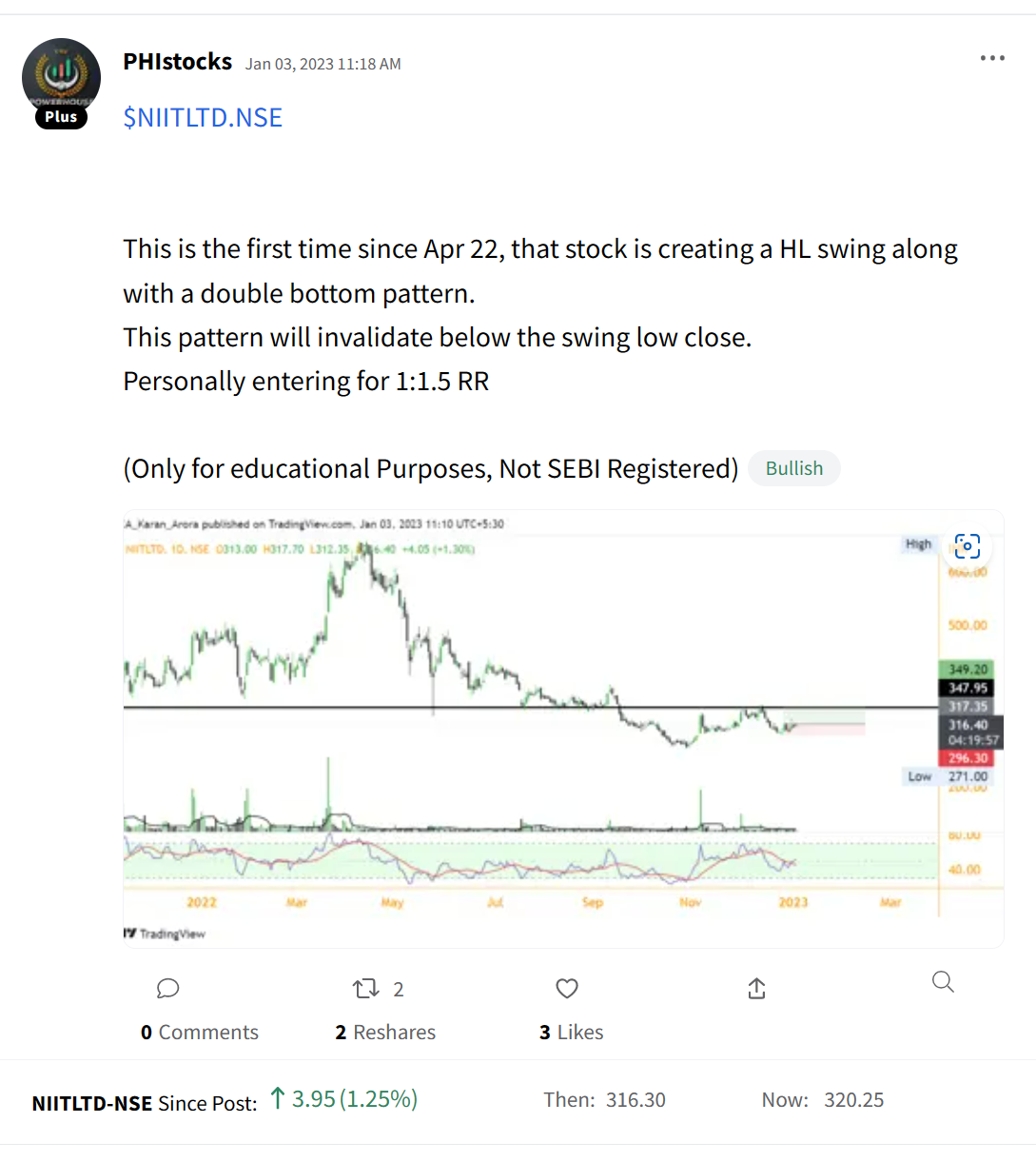

Stocktwits Spotlight

NIIT broke out in trade today. Here’s a bullish chart setup by The Powerhouse Ideas shared on Stocktwits. Add $NIIT.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3XvrzCQ.

Earnings Highlights

- Axis Bank: Net Income Interest: Rs 11,459 cr; (+32% YoY) | Net Profit: Rs 5,853 cr; (+62% YoY)

- Tata Communications: Revenue: Rs 4,528 cr; (+8% YoY) | Net Profit: Rs 394 cr; (+1% YoY)

- Poonawalla Fincorp: Net Income Interest: Rs 464 cr; (+42% YoY) | Net Profit: Rs 182 cr; (+89% YoY)

- South Indian Bank: Net Interest Income: Rs 825 cr; (+44% YoY) | Net Profit: Rs 103 cr;

- Colgate-Palmolive: Revenue: Rs 1,292 cr; (+1% YoY) | Net Profit: Rs 243 cr; (-4% YoY)

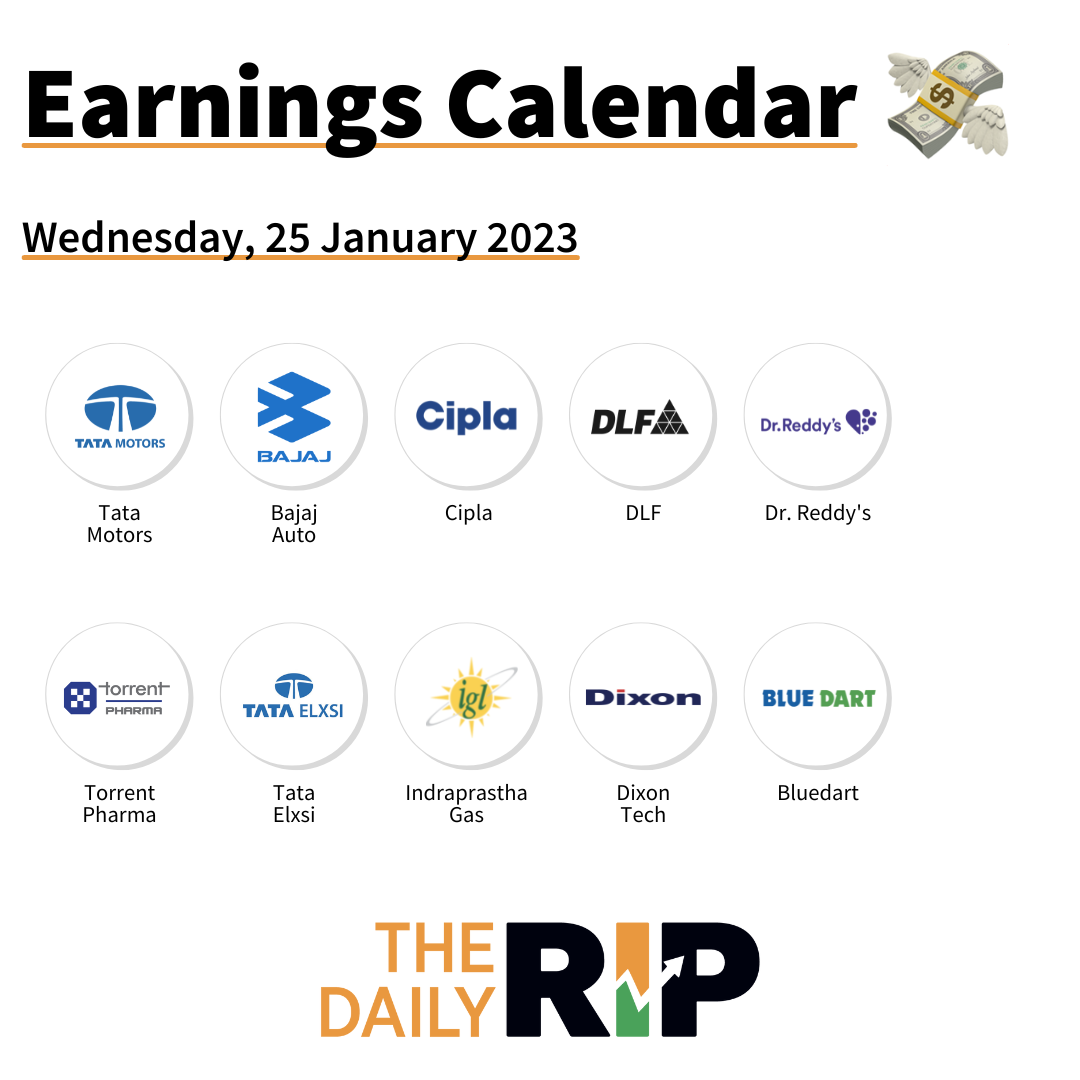

Calendar

A ton of companies will report their Q3 results tomorrow… Here are all the important earnings you don’t want to miss:

Links That Don’t Suck

😇 Budget 2023: A Stepping Stone For Middle Class’ Potential In Rising Bharat?

👨💻 Microsoft Announces New Multibillion-Dollar Investment In ChatGPT-maker OpenAI

🙏 Quitting 28-Yr-Long Career to Farm, Andhra’s ‘Millet Man’ Creates Empire Worth Crores

😤 ‘Gutka Lover!’ Man Asks Air Hostess To ‘Open Window’ To Spit In Viral Video; This Happens Next

🔥 The Last Of Us Does What No Show Has Done Before

😎 Arsenal Strut Past Manchester United With Unmistakable Aura Of Champions