Tale of the Tape

Good evening everyone. Markets were down BIG TIME. 📉

A bank sell-off and bearish remarks from the US Fed Reserve’s Christopher Waller saw the Sensex (-2.2%) and Nifty (-2.1%) post their worst single-day fall in over a year. Midcaps (-1.1%) and Smallcaps (-1.2%) didn’t escape the carnage. The advance-decline ratio was dominated by the bears (4:1). 🐻

Except for IT (+0.6%), all the other sectors ended in the red. Banks (-4.2%), Metals (-3%), Auto (-1.4%) and Real Estate (-1.4%) were the biggest losers. 😣

HDFC Bank (-8%) collapsed after disappointing Q3 results. Read our top story below. 📊

This smallcap PSU stock can give +75% returns from current levels. More details below. 🚀

Cochin Shipyard jumped 8% after PM Modi unveiled a new Rs 2,000-cr dry dock and repair facility at its premises. 🔥

Eicher Motors (-1%) was in focus after getting its 3rd downgrade in 3 days (Investec, Morgan Stanley and now CLSA). 👎

MAS Financial Services (+1%) approved a bonus issue in the ratio of 2:1. ✅

IREDA was up 4% after announcing a green co-financing deal with Indian Overseas Bank. 💸

Pricol (+3%) gained after 5.6% equity changed heads through seven block deals; reports claim Minda Corp and other PE investors were likely sellers. 🤝

PTC Industries (+1%) hit a record high intraday after signing a supply deal with Dassault Aviation. ✈️

Results reaction. ICICI Lombard gained 7% after reporting solid Q3 results. A 13% YoY bump in profit pushed L&T Technology Services stock up 3%. 💯

Here are the closing prints:

| Nifty | 21,572 | -2.1% |

| Sensex | 71,500 | -2.2% |

| Bank Nifty | 46,064 | -4.3% |

Kaboom!

HDFC Bank cracked 7% intraday after its Q3 results missed Street estimates. Deposit growth was soft, +2% QoQ. More importantly, it also lags behind overall loan growth (+5% QoQ). This means HDFC’s credit-deposit ratio is at a sector-high level of 110%. Put simply: deposits could be a constraint for growth moving forward, which is a NEGATIVE. 🚨

Net interest margins were flat at 3.4%. FYI – the bank’s unsecured book has also grown at a slower pace than the industry average. Finally, HDFC’s CASA (current account saving account) ratio for Q3 came in at 37.7% vs its long-term average of 42%. This, naturally, is not great. The bank’s management says it’s confident of increasing this as term deposit rates stabilise. 🤞

Here’s its Q3 report card:

- Net Interest Income: Rs 28,470 cr; +24% YoY (vs Est: Rs 29,079 cr)

- PAT: Rs 16,372 cr; +33% YoY (vs Est: Rs 15,693 cr)

- Gross NPA: 1.26% vs 1.23%

- Net NPA: 0.31% vs 0.33%

For the HDFC bulls: yes, the PAT looks great, but there are two key pieces of context. Firstly, there was a one-time tax rate gain that boosted the bottom line. That said, this was slightly tempered because the lender also had to make provisions of Rs 1,200 cr for its AIF book. So, on the whole, somewhat decent but still a muted performance on the profit front as well. 😣

Overall, it’s clear that the merger is still weighing heavily on HDFC’s books. FYI – a few brokerages have cut their target price on the stock (Nomura: Rs 1,750 p/sh –> Rs 1,625 p/sh, Antique Broking: Rs 2,050 p/sh → Rs 2,000 p/sh). 📉

HDFC Bank is down -3% over the last year.

Stocktwits Specials

Want to know the latest updates on Polycab? We’ve researched and analysed the latest news, fundamental analysis, and technical analysis, so you don’t have to. In less than 5 minutes, we’ll walk you through 5 updates about Polycab you must know – whether you currently own this stock or are considering buying.

To The Moon!

MSTC is on a red, hot streak! The stock is up nearly 3x over the last year, easily beating the Nifty Smallcap 100 index’s gains in the same period. We know what you’re thinking: what the hell is going on here? 🤯

About the company: MSTC is a PSU-run firm that conducts auctions on behalf of other PSUs, state govt and even some private firms. Its e-commerce platform allows auctions of everything from metal scraps & coal blocks to telecom spectrum & bank NPAs. FYI – its platform’s GMV (gross merchandise value) grew at a CAGR of 33% over the last five years to hit Rs 3.05 lakh cr in FY23! 📊

What’s popping? MSTC enjoys a near-monopoly on online auctions and has benefited big time from the GOI’s digital governance push. It also keeps its commission charges low (it took just 0.12% of its FY23 GMV home last year), which in turn boosts its competitive advantage. ✅

MSTC also has its fingers in other pies. One key positive trigger is its JV with the Mahindra Group for vehicle scrapping. The JV has set up India’s first collection and dismantling centre in Noida for ‘end of life vehicles’. The GOI’s vehicle scrappage policy came into effect in April 2022. Experts say that even if 30% of the 7 million vehicles that were sold in 2005-2008 have to be scrapped by FY26, MSTC could see a Rs 800 cr boost to its top line. 💰

Finally, MSTC is also burying some past sins. The PSU’s goods trading biz saw its receivables pile up from private sector clients over FY15-FY19. The firm has now started to downsize this vertical which resolves a legacy issue and clears the deck for future growth! 🔥

TL;DR: MSTC’s monopolistic platform is set for BIG growth. Other verticals like vehicle scrappage are also primed to take advantage of India’s green push. Legacy issues that hurt the balance sheet have also been taken care of. FYI – brokerage Monarch Networth Capital has a target price of Rs 1,726 p/sh; a whopping 76% increase from current levels! 🤑

Stocktwits Spotlight

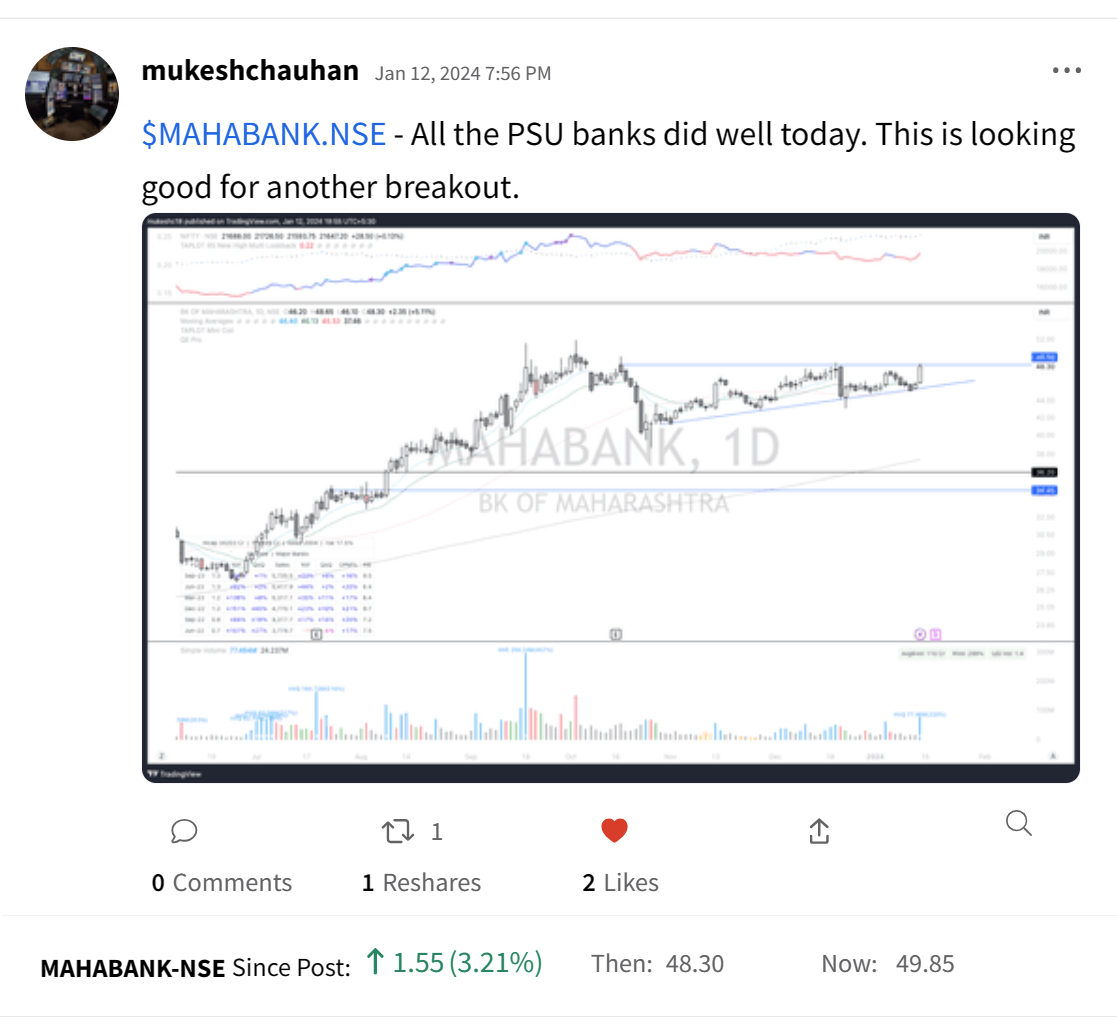

Maharashtra Bank is +5% this week despite overall weakness in the banking sector. Follow Mukesh Chauhan for more amazing trading insights and add $MAHABANK.NSE to your watchlist to track its performance. Here’s the link:

Disclaimer: Mukesh Chauhan is not a SEBI registered advisor and you should not construe any information discussed herein to constitute investment advice. Consult your financial advisor prior to making any actual investment or trading decisions.

Links That Don’t Suck

🍿 Is Polycab screwed? We’ve reviewed the stock in under 5 mins

🥇 Goldman Says More Global Money Will Flock To India Post Election

👀 OpenAI quietly removes ban on military use of its AI tools

🙏 Hyderabad Man Makes 1,265 Kg Laddu For Ayodhya Ram Mandir

🏆 Better Call Saul Deserved Better: 53 Emmy Nominations And Not A Single Win

⚽ Where next for Jose Mourinho after another third-year implosion at Roma?