Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 41 in 2021.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 41:

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 tip-toed higher in Week 41.

18 of 25 stocks registered gains.

Generac Holdings gained 11% as the list’s biggest gainer. It’s a Winner below.

Moderna managed a positive week. $MRNA is 57% ahead of $DVN in the YTD race.

Three Freshmen made the list. The companies are Simon Property Group, Interpublic Group, and CBRE Group.

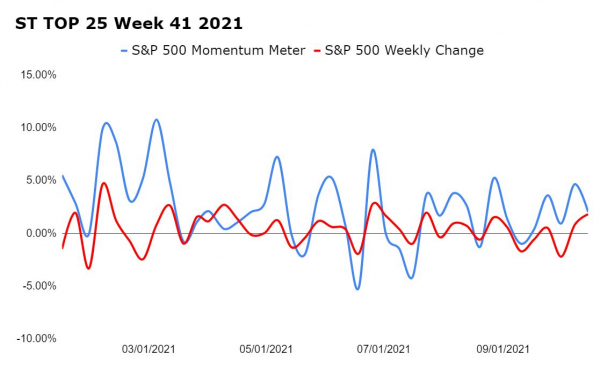

The Stocktwits Top 25 S&P 500 Momentum Meter ascended 2.03% while the S&P 500 added 1.82%. The 0.21% differential suggests the top-stocks were a bit stronger than the full index.

Nasdaq-100

The Big Cap Nasdaq 100

The ST Top 25 N100 List is a green machine.

23 names closed positive.

CrowdStrike stole the spotlight – $CRWD climbed 11.47% as a Freshman. Check it out below.

$CRWD, $WBA, $AMD, $ADBE, and $ADP are the list’s Freshmen.

The ST Top 25 Nasdaq 100 Momentum Meter flew 3.40% while the full Nasdaq 100 rose 2.20%. The 1.20% difference shows top stocks were stronger than the full index.

Russell 2000

Small-Cap Russell 2000

The ST Top 25 R2K List posted a respectable performance.

16/25 stocks finished green.

$OCGN grew 22.5% and took the 8th spot. Ocugen Inc is this week’s Top Dawg.

$LPI had a rough one in Week 41. The energy company leaked 17.6% and earned a spot on the Sinners list.

The list’s Freshmen are Asana Inc, Senseonics Holdings, and The One Group Hospitality Inc.

The ST Top 25 R2K Momentum Meter moved up 1.36% while the Russell 2000 index increased 1.46%. The 0.10% differential in favor of the full index shows top stocks underperformed.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 41, 2021 is #8 R2K – Ocugen Inc.

Ocugen ascended 22.5% this week and improved 12 spots from #20 to #8 on the ST Top 25 R2K List. $OCGN is now up 373% YTD.

Here’s the daily chart:

$OCGN exploded 18.5% on Tuesday after Bharat Biotech’s COVID-19 vaccine, Covaxin, was authorized by the Indian government for children aged two to eighteen. Ocugen is a partner of Bharat Biotech.

A day later, India’s NDTV claimed that the vaccine is likely to be approved by the World Health Organization shortly which fueled the stock even more.

📈📈📈

The Winners 📈

△ #6 S&P 500 – Generac Holdings was the top gainer on the ST Top 25 S&P 500 List, rising 11%. The equipment manufacturing company is now ranked #6.

$GNRC registered gains four days this week and finished with a bang. The stock expanded 4.2% on Friday after receiving a buy rating with a $500 price target from Truist.

Here’s the weekly chart, less than 0.5% from record highs:

$GNRC is up 98.7% YTD.

△ #15 N100 – CrowdStrike Holdings debuted as a Freshman on the ST Top 25 N100 List. The cybersecurity company is now ranked 15th.

On Tuesday, CrowdStrike released Falcon XDR, a service that delivers real-time detection and automated response across the entire security stack.

Here are a few highlights from the release:

- Extended detection and response across environments.

- Visualized context-rich detections across domains.

- Improved Efficiency and Efficacy.

- Accelerated Full-Cycle Response.

$CRWD catapulted 7% on Wednesday and eased higher in the week’s end. Here’s the daily chart:

$CRWD is up 28.9% YTD and sits 5% below all-time highs.

△ #1 R2K – AMC Entertainment Holdings has the ball rolling again. The stock finally managed a gain after closing negative four weeks in a row.

$AMC is forming a series of higher lows as it completes a 4-month consolidation pattern. Here’s a daily chart to display the higher lows:

Will $AMC pick a direction in the coming weeks? Place your bets…

$AMC is up 1,821% YTD and sits comfortably in first on the ST Top 25 R2K List.

📉📉📉

The Sinners 📉

▼ #23 R2K – Laredo Petroleum languished 17.6% and became this week’s biggest loser. The energy company descended 12 spots from #11 to #23 on the ST Top 25 R2K List.

$LPI sold off from Monday’s opening bell. The stock finished red every day while crude oil climbed higher.

Here’s the daily chart:

$LPI is still up 278.2% YTD.

▼ #12 S&P 500 – Occidental Petroleum was by far the poorest stock on the ST Top 25 S&P 500 List. Shares of Occidental Petroleum slid 5.86%, demoting its ranking to #12 from #6.

$OXY inked a deal with Kosmos Energy and Ghana National Petroleum Corp on Wednesday to sell its interests in two Ghana offshore fields for $750 million. This is part of Occidental’s plan to reduce the debt incurred when purchasing Anadarko Petroleum.

$OXY is up 82.9% YTD.

See Y’all Next Week 🤙