It was a slow summer Monday in the markets — here’s what you missed.

Trading volumes were very light, leading to a mixed trading session at the index level. Meanwhile, earnings news continues to move individual names, and ‘meme stocks’ continue their rally. 📈

We discuss those topics and Nvidia’s earnings preannouncement in our main stories. 👇

Here’s today’s heat map.

7 of 11 sectors closed green, with real estate (+0.78%), materials (+0.54%), and communication services (+0.54%) leading. 💚

In economic news, the New York Fed’s survey showed that consumer inflation expectations fell significantly alongside gasoline prices. China posted a record $101 billion trade surplus, with exports being helped by a weaker currency and strong demand from Southeast Asia, Europe, and Russia.

In an update to Friday’s rumors, Pfizer confirmed it’s buying Global Blood Therapeutics in a $5.4 billion deal. 💰

SoftBank reported a record loss in its fiscal first quarter, losing $23.4 billion on its Vision Fund. SoftBank’s founder Masayoshi Son says that the company has been “more selective in making investments” after becoming too emotionally invested in the tech sector. 📉

Carlyle Group shares fell 6.23% today on reports that its CEO Kewsong Lee will step down immediately and leave the firm at the end of the year. 🔻

Elon Musk is back to tweeting, this time touting that he is willing to finish the Twitter buyout under the original terms. He said, “If Twitter simply provides their method of sampling 100 accounts and how they’re confirmed to be real, the deal should proceed on original terms. However, if it turns out that their SEC filings are materially false, then it should not.” 💭

In crypto news, crypto-mixing service Tornado Cash was blacklisted by the U.S. Treasury because North Korean hackers allegedly used it to launder stolen crypto funds. ₿

Other symbols active on the streams included: $SOS (+43.37%), $ILAG (+41.11%), $BNSO (+58.16%), $NVAX (-5.01%), $BLUE (+13.42%), $MEGL (+20.62%), and $HLBZ (+114.64%). 🔥

Here are the closing prices:

| S&P 500 | 4,140 | -0.12% |

| Nasdaq | 12,644 | -0.10% |

| Russell 2000 | 1,941 | +1.01% |

| Dow Jones | 32,833 | +0.09% |

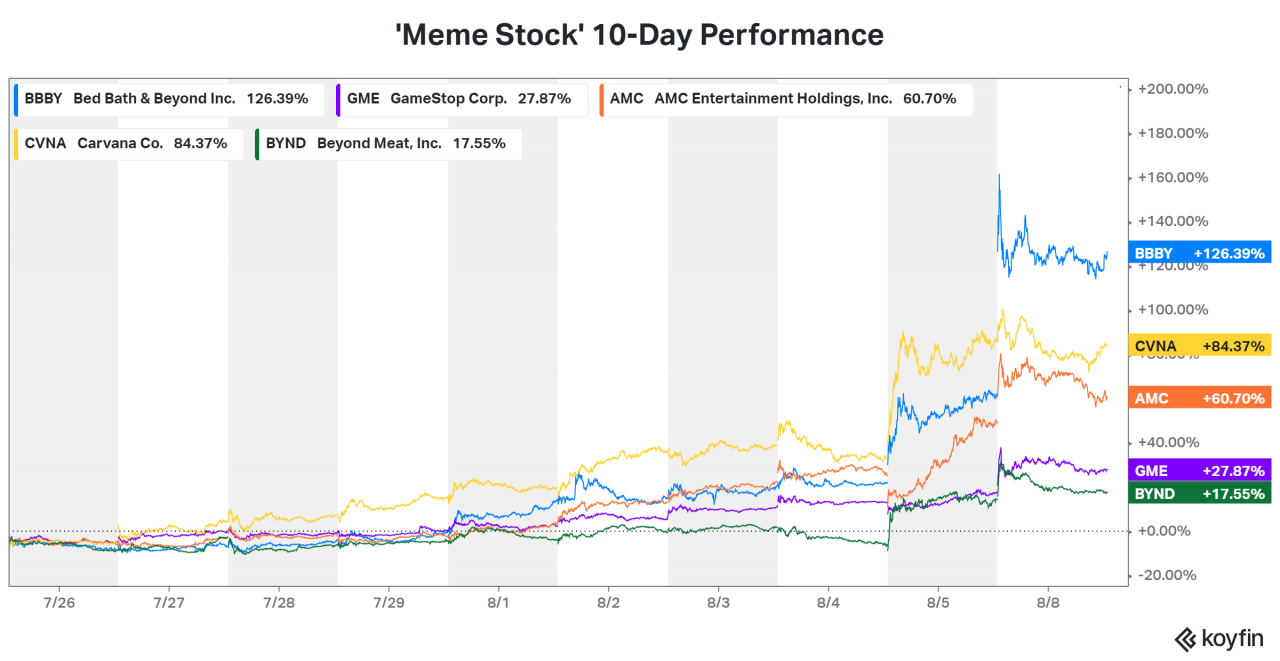

You didn’t drink too much this weekend and wake up in 2020 or 2021. It’s August 2022, and the classical meme stocks are still doing their thing. 🗓️

Despite lackluster (or straight-up bad) earnings reports from Bed Bath & Beyond, AMC, Carvana, and Beyond Meat, the stocks are squeezing to the upside. 📈

Below is a chart of their performance over the last ten days since their upward moves began.

While a lot of the mania we saw in past years has died down along with the overall market’s performance, there’s still plenty of craziness happening (as there always is). 🤪

How long these moves will last is anyone’s guess, but the message is clear. Anyone that thought retail trading activity and collaboration on social media and other platforms was entirely going away may have to eat their words at this point… 🤷♂️

Are you trading any of these stocks or avoiding the madness? Let us know. 💭

Earnings

Earnings Recap – 08/08/22

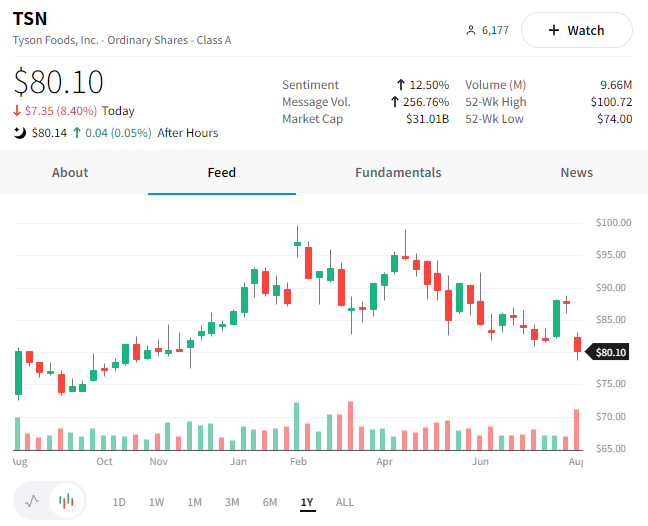

First, let’s start with Tyson Foods, which did not bring home the bacon for investors. Instead, the multinational food company reported weaker than expected earnings and revenues.

The company warned that supply constraints and reduced demand for high-priced beef would continue to pressure its earnings.

$TSN shares were down 8.40% as it joins many other companies citing a tougher macro environment and inflation as major headwinds. 🔻

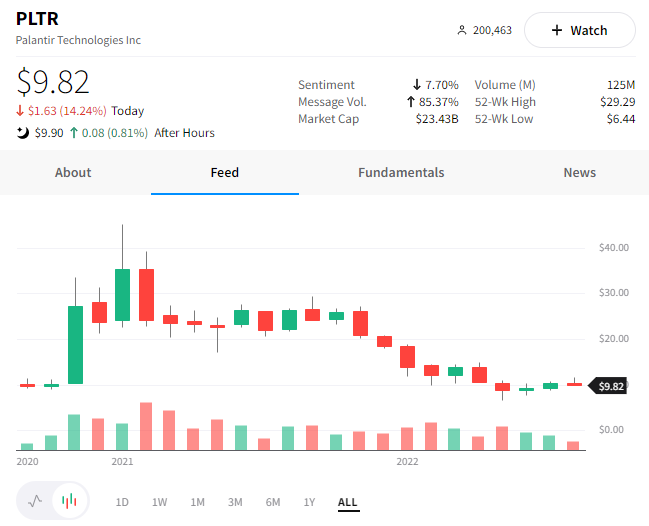

Shares of popular tech stock Palantir plummeted 14.24% after reporting weaker than expected earnings but slightly beating on revenue.

The company’s CFO said that the earnings miss was primarily due to a decline in investments and marketable securities and that its commercial revenue remains strong, growing 46% YoY. 💪

Overall, investors appear focused on the company’s weak guidance, which it says is due to the “lumpiness” of government work.

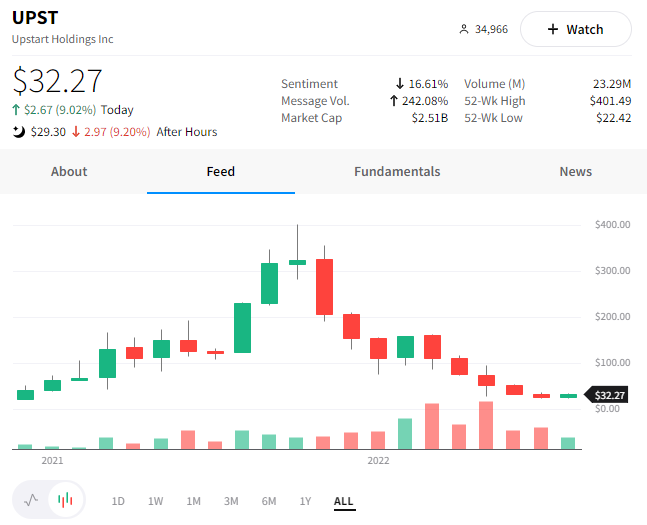

Lastly, another retail favorite, Upstart, rallied 9% ahead of its earnings before giving it all back (and more) after the report. 👎

Despite the optimism from investors throughout the day, the company missed earnings and provided Q3 guidance below consensus estimates.

The lending platform’s co-founder and CEO, Dave Girouard, was singing a familiar tune: “This quarter’s results are disappointing and reflect a difficult macroeconomic environment that led to funding constraints in our marketplace…”

There were some positive earnings too, but these stood out to us. Check out the Stocktwits earnings calendar to keep track of them all. 🗓️

Earnings

Taking Some Chips Off The Table

It has been a wild ride for semiconductors over the last year, but it seems the short-term tide has shifted from chip shortages to a demand slowdown. 👎

Below we’ve got a chart of the iShares Semiconductor ETF and a few of its largest components. After a massive run through the end of last year, they’ve all gone from big gains to big drawdowns. 🔻

So far this earnings season, we’ve heard mixed results from companies like Taiwan Semiconductor, Micron, Intel, and others. They’ve spoken about slowing demand in the gaming market, PC and tablet sales, and even a slowdown in mobile device sales.

And today, Nvidia added to the evidence that this slowdown is industry-wide by preannouncing its Q2 2023 earnings. The company said it expects revenue to be approximately $6.70 billion vs. its previous guidance of $8.10 billion. The driver of this miss was primarily weaker than expected gaming revenue, which came in at $2.04 billion, down 33% YoY and 44% MoM. 📉

Below is a chart from the release highlighting some key data points.

The company joins a variety of firms citing challenging macro conditions and supply chain disruptions as major issues.

$NVDA shares were down 6.30% today at the close and put pressure on its peers as investors cope with the fact that this highly-cyclical sector is likely in the midst of a broader slowdown. 😨

Bullets

Bullets From The Day:

⚖️ Tesla beefs up its legal team with a key hire. The company has hired former Hewlett Packard Enterprise Co lawyer Derek Windham to lead its in-house corporate and securities legal team. The company and its founder, Elon Musk, are often in the headline and crosshairs of various lawsuits, so investments in its legal team are probably a good call… Reuters has more.

🎮 99% of Netflix users haven’t tried its games. As the company diversifies its content bets to gaming, it’s facing one problem…nobody is playing its games. Netflix’s games reportedly average 1.7 million daily users, which is less than 1% of its 221 million global subscribers. It’s still early in the process, and the company looks to have 50 games available by the end of the year, but it will need a lot more progress to make up for the slowing growth in its subscriber base. More from The Verge.

📰 Axios sells itself for $525 million. A family-owned conglomerate, Cox Enterprises, will be purchasing Axios for roughly five times its projected 2022 revenue. The company was founded in 2017 and is known for its bulletin-style reporting of politics, business, and tech news. The communications software business Axios HQ will become an independent company majority-owned by Axios co-founders, and Cox Enterprises will be the sole minority investor. Reuters has more.

📱 Major tech company infiltrated through an SMS phishing scam. A company’s security is only as good as its weakest link. And in many cases, people are the weakest link. If you have a phone with text messaging, you probably receive a lot of spam, including phishing scams designed to socially engineer sensitive information from you. That’s what happened to two Twilio employees who gave these hackers information needed to access to the company’s systems and some customer data. More from TechCrunch.

🤝 Taxing times in the tech world mean more deals for private equity firms. The tech downturn has been bad for some companies but great for others, especially cash-rich private equity firms, as we see another major deal crossing the tape. Vista Equity Partners will acquire the automated tax compliance company Avalara for $8.4 billion, with the deal expected to close by the end of 2022. TechCrunch has more.

Links

Links That Don’t Suck:

📈 Prep your summer portfolio with premium investing resources from IBD Digital—just $15 for 6 weeks*

🔬 COVID sewage surveillance labs join the hunt for monkeypox

⚡ Gigantic supercharged lightning bolt jets mapped for first time – study

🚗 Tata Motors to buy Ford India’s manufacturing plant for $91 million

✈️ Airlines asked its senior executives to temporarily help as airport baggage handlers

⚖️ Google is suing Sonos over patent infringement once again

💣 WW2 bomb revealed in drought-hit waters of Italy’s River Po

🍦 Ketchup, mayo ice cream flavors being offered to London consumers

🎙️ Olivia Newton-John, beloved ‘Grease’ actress & singer, dies at 73

*this is a sponsored post