Stocks rose from the dead in October, with the Dow notching its best month since 1976 — let’s see what you missed on the final day of Spooktober. 👀

Today’s issue covers the Dow’s best month since 1976, semiconductor issues, and more! 📰

Check out today’s heat map:

Only one sector closed green. Energy (+0.84%) led, and communication services (-1.67%) lagged. 🟢

Self-driving truck startup TuSimple fell 45%, firing its CEO for improper ties to a Chinese firm. ❌

Shopify is acquiring Remix to bolster its storefront design tools, and Netflix is acquiring Seattle-based cozy games developer Spry Fox. 🤝

In crypto news, today marks the 14th anniversary of Bitcoin’s whitepaper. Increased adoption of Ethereum staking is pushing yields down. Hong Kong announced a plan to launch a mainstream crypto ETF. And another stablecoin bites the dust as Huobi’s HUSD stablecoin dropped over 60%. ₿

Other symbols active on the streams included: $ROOT (+9.64%), $MMTLP (+7.03%), $META (-6.09%), $MULN (-7.92%), $ABNB (-7.20%), $ATNM (+39.16%), $GETY (+34.65%), and $LLAP (+2.34%). 🔥

Here are the closing prices:

| S&P 500 | 3,872 | -0.75% |

| Nasdaq | 10,988 | -1.03% |

| Russell 2000 | 1,847 | -0.00% |

| Dow Jones | 32,733 | -0.39% |

Economy

A Boatload Of International News

There was a lot of international news today and over the weekend, so let’s quickly recap. 📰

First, Hong Kong’s economy shrank 4.5% YoY in Q3, which is a scary picture for China and APAC-region economies. The region continues to struggle with political and economic instability but blamed weak external demand and cross-boundary land cargo operations disruptions for the slowdown. It’s also dealing with offshoots from China’s property market, which remains in crisis.

Meanwhile, COVID shutdowns continue to hamper China’s factory and service activity, with a prime example this week as workers leave Foxconn’s iPhone plant amid lockdown fears. The trend of onshoring production by Western countries continues as political tensions heat up and global supply chains remain in a vulnerable state. 🏭

The Bank of Japan spent a record $42.8 billion in October to prop up the Yen. Given its efforts had mixed results, one can only imagine how low the Yen would’ve fallen without any intervention.

Eurozone inflation hit a new record of 10.7%, as its preliminary Q3 GDP reading recorded a marginally positive reading of +0.2%. Rising food and energy prices remain a major concern, especially as the region heads into a winter season without clear long-term solutions for its reliance on Russian energy. ❄️

And lastly, Brazil’s presidential election ended in a major upset. Lula da Silva will return as the country’s president after beating Jair Bolsonar’s far-right administration by a narrow margin. 🗳️

Sponsored

Why Investors Are Bringing the Bourbon Boom into Their Portfolios

Bourbon is considered one of the most compelling places to put your money today. Why? America’s native spirit has experienced constant growth over the past decade, driven by increasing demand within the U.S. and abroad. Distilleries can’t keep up with consumer thirst. Plus, it’s a tangible good that naturally grows in value over time. Think about it. Old bourbon generally costs more than young bourbon. The longer the spirit is left to age, the more it gains in flavor, which commands a higher price.

Speak to CaskX, the world leader in bourbon investment, to learn more about current offerings that are available now.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Stocks

Holy Dow What A Month…

The Dow Jones Industrial Average may be the most boring and unloved of the major U.S. indexes. But in October, it gave people a lot to cheer about.

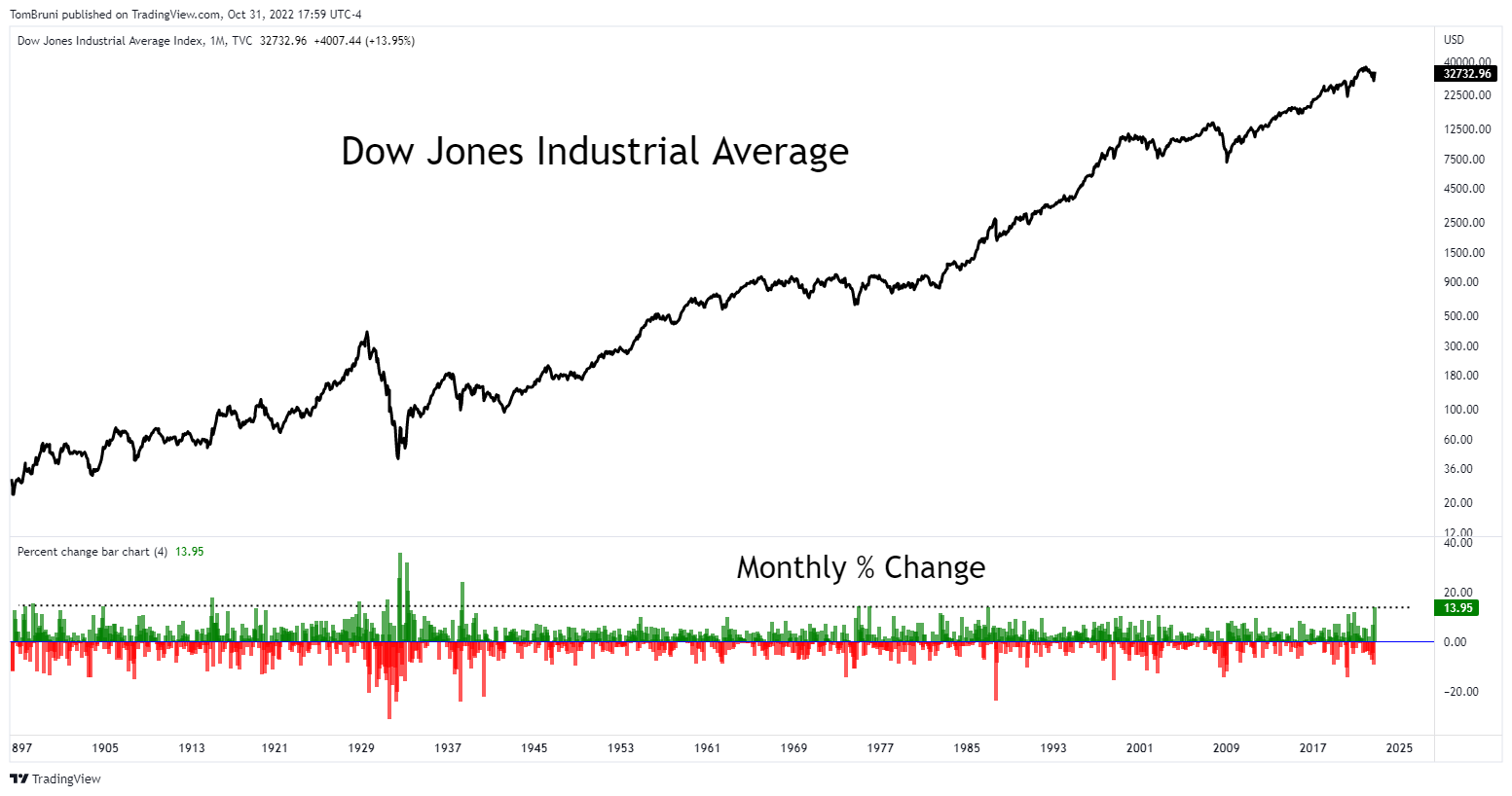

Below is a monthly line chart from the early 1900s, with a bar chart below showing the percentage gains and losses.

As we can see, October’s 14% gain was the largest going back to 1976 and one of the biggest in the index’s history. With that said, it’s also worth noting that many of the largest bars in that graph came during market drawdowns, as this one did.

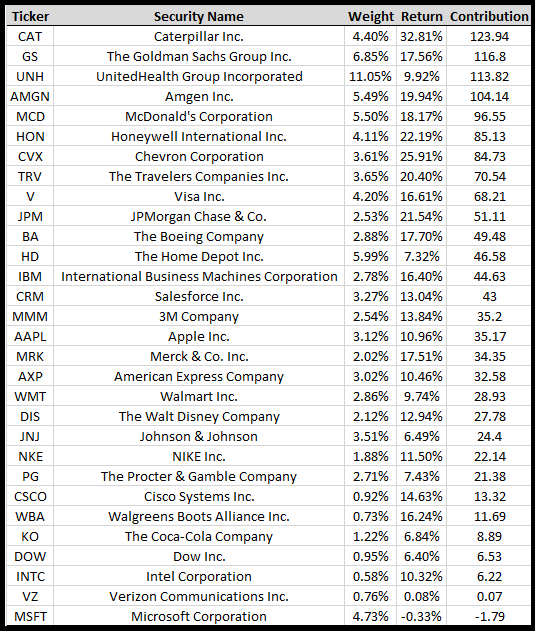

It’s also interesting to see what drove this rally. It wasn’t the large tech stocks moving the needle this month. Instead, it was “real economy” type companies and defensive names like McDonald’s.

We’re still in one of the market’s largest drawdowns as we head into the end of the year’s final two months. So we’ll just have to wait and see whether or not this month’s rally was the start of a meaningful bottom or just another bear market rally that’ll eventually fade.

Hop on over to the $DIA stream and let us know your thoughts! 💭

Earnings

The Semiconductor Crunch Is $ON

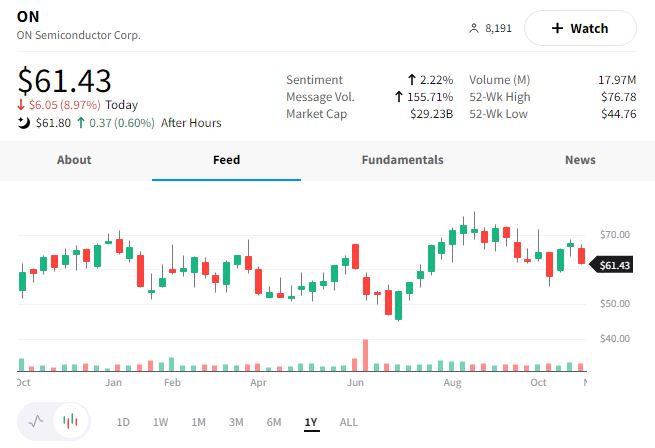

The pressure is $ON for companies like On Semiconductor. The company reported 26% revenue growth in Q3, with strength in its electric vehicle and industrial end markets. ⚡

However, like many other companies in the space, it saw guidance fall short of expectations. It now expects Q4 revenue between $2.01 to $2.14 billion vs. the $2.10 billion expected. Its non-GAAP earnings per share expectation are $1.18 to $1.34 vs. the $1.25 consensus expectation.

While certain segments of the semiconductor industry are seeing solid demand, there’s clearly a broader slowdown in progress. The magic question remains how deep will the downturn be and how long will it last… 🤷

For now, investors send $ON shares down 8.97% today due to its weak guidance.

Bullets

Bullets From The Day:

🏘️ Homebuilders warn the worst is yet to come. Industry executives say 2023 will bring an even sharper move lower in the market as high-interest rates and poor affordability keep buyers at bay. Analysts and industry experts expect housing to experience a hard landing, especially if the Federal Reserve achieves the higher levels of unemployment that it’s looking for. While the lagging measures of housing affordability have begun to cool down, steeper declines in once-red-hot markets have already begun. CNBC has more.

💳 JPMorgan unveils plan to disrupt rental payments. For many of us, there are only a few things we use checks for nowadays…and one of those is rent. Now, Chase bank is looking to create a platform for property owners and managers to automate the invoicing and receipt of online rent payments. Executives hope that offering users valuable data and analytics insights will help entice the adoption of the pilot platform. More from CNBC.

💰 Credit Suisse reveals details of its $4 billion capital raise. The Swiss bank is looking to raise the funds it desperately needs to tackle the most significant issue in its 166-year history. New investors have committed to buying 462 million new shares for $3.83, and the Saudi National Bank is buying another 307.6 million shares. That allows existing investors to buy 889 million shares at 2.52 francs per share. If shareholders reject the proposed plan, it will issue 1.8 billion new shares at 2.27 francs each, allowing it to raise the 4 billion francs it needs. Reuters has more.

☑️ Get ready to pay for Twitter verification. Twitter verification was pretty challenging to obtain before, but now it could become as easy as paying $20 per month. One of Elon Musk’s first orders of business as its new owner is revising the user verification process. The initial plan would raise the price of the existing Twitter Blue service while expanding its services to include verification and other benefits. More from Reuters.

🤝 Blackstone braves ice-cold deal market with a $14 billion LBO. 2022 has been a frigid year for deal makers, but Blackstone is taking a crack at a $14 billion deal with Emerson Electric Co. The company will sell a majority stake in its climate technologies unit to the private equity firm, receiving an upfront payment of about $9.5 billion. Emerson will retain about a 45% stake in the climate tech unit, and Blackstone will have co-investors, including the Abu Dhabi Investment Authority and Singapore state fund GIC. Yahoo Finance has more.

Links

Links That Don’t Suck:

⚖️ Supreme Court considers bringing an end to affirmative action in college admissions

💵 Corporate America watches as New York’s salary transparency begins tomorrow

🌐 The bond that broke the internet

✈️ Holiday flights will be pricey and packed. Here are 5 things to know before you book

🌬️ Massachusetts wind power project ‘no longer viable’ without contract adjustments, says developer