The Dow Jones Industrial Average may be the most boring and unloved of the major U.S. indexes. But in October, it gave people a lot to cheer about.

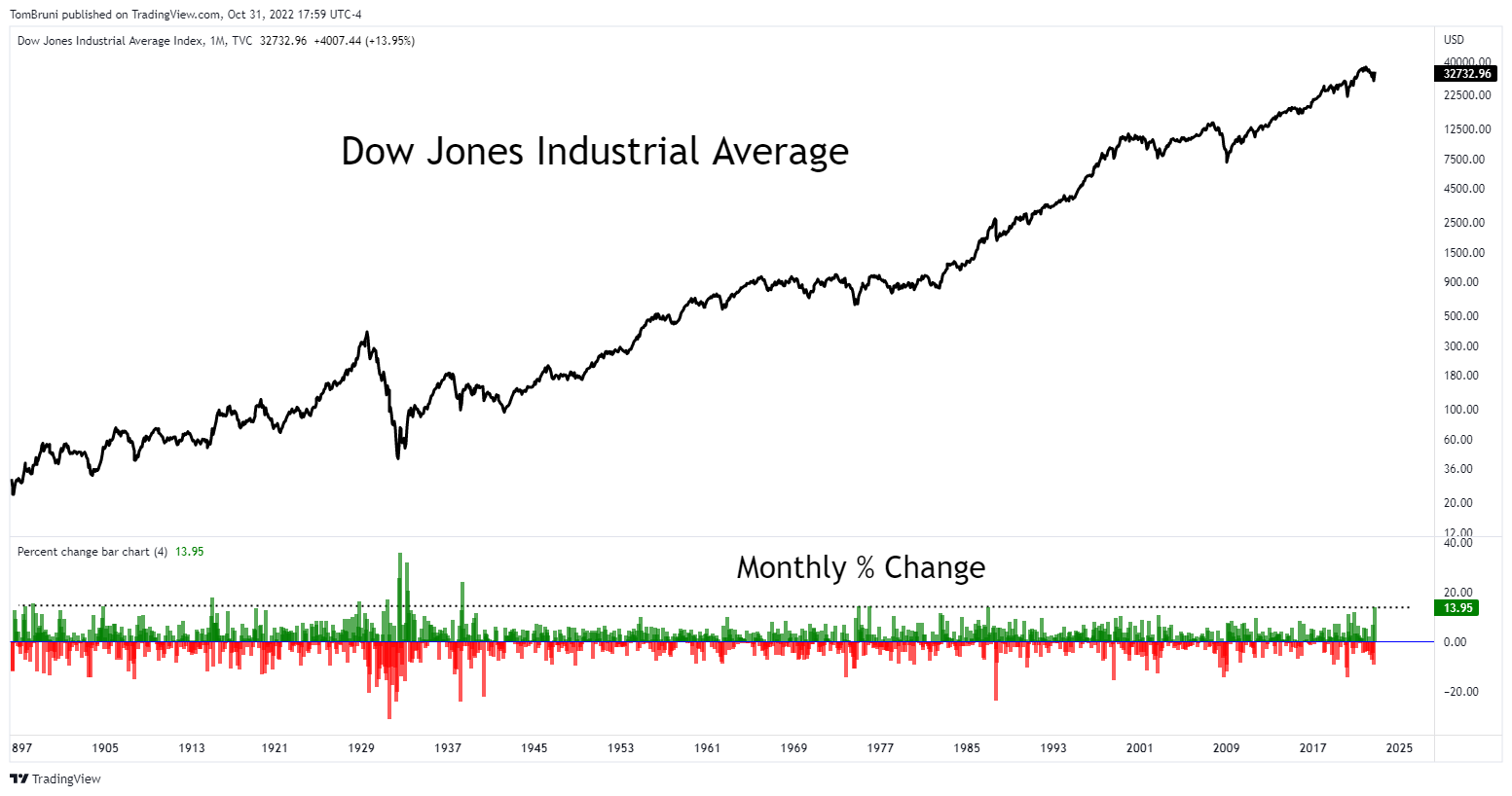

Below is a monthly line chart from the early 1900s, with a bar chart below showing the percentage gains and losses.

As we can see, October’s 14% gain was the largest going back to 1976 and one of the biggest in the index’s history. With that said, it’s also worth noting that many of the largest bars in that graph came during market drawdowns, as this one did.

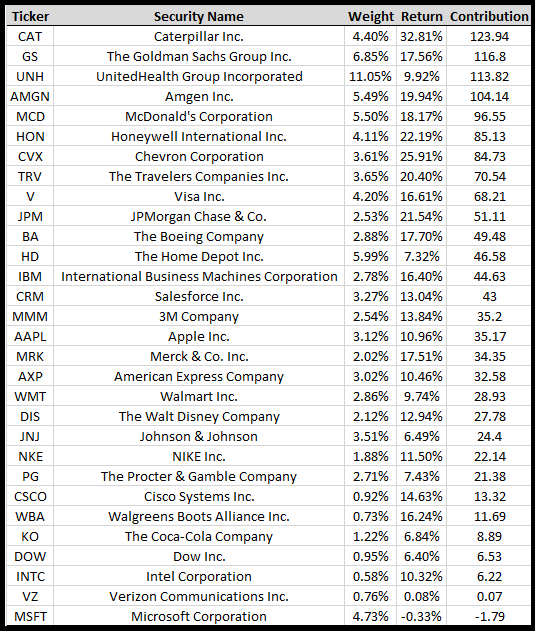

It’s also interesting to see what drove this rally. It wasn’t the large tech stocks moving the needle this month. Instead, it was “real economy” type companies and defensive names like McDonald’s.

We’re still in one of the market’s largest drawdowns as we head into the end of the year’s final two months. So we’ll just have to wait and see whether or not this month’s rally was the start of a meaningful bottom or just another bear market rally that’ll eventually fade.

Hop on over to the $DIA stream and let us know your thoughts! 💭