The shortened holiday week has stocks drifting higher on light trading volumes, bringing back the trading community’s old adage, “never short a dull market.” 👀

Retail earnings continue to take center stage, so we’ll examine reports from Best Buy, Burlington, Abercrombie & Fitch, and Dick’s Sporting Goods in today’s issue. 📰

Check out today’s heat map:

Every sector closed green. Energy (+3.13%) led, and real estate (+0.47%) lagged. 💚

Gamestop shares were up marginally after reports that Carl Icahn still holds a large short position. 🎮

Dollar Tree fell 8% after issuing a soft full-year profit outlook on higher costs. 💵

In crypto news, Bankman-Fried’s FTX staff and parents bought Bahamas property worth $300 million. Meanwhile, bankrupt FTX still owes at least $3.1 billion but only has about $1.24 billion in cash. And crypto brokerage Genesis will reportedly warn of bankruptcy without securing additional funding. ₿

Other symbols active on the streams included: $MMAT (-6.02%), $DWAC (+5.72%), $MMTLP (-12.45%), $MULN (-11.50%), $SOFI (-4.72%), $PSNY (+20.49%), and $OBSV (+16.54%). 🔥

Here are the closing prices:

| S&P 500 | 4,004 | +1.36% |

| Nasdaq | 11,174 | +1.36% |

| Russell 2000 | 1,860 | +1.16% |

| Dow Jones | 34,098 | +1.18% |

Earnings

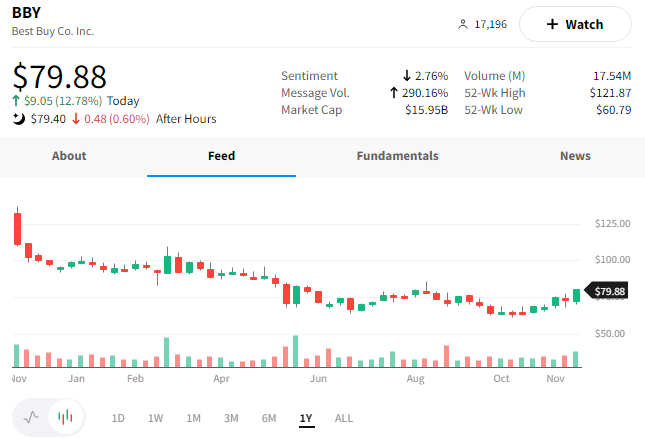

Best Buy’s Upbeat Holiday Outlook

Retailers selling discretionary items like electronics and appliances have struggled to satisfy investors after red-hot results during the pandemic. But, some signs are emerging that expectations might’ve gotten low enough, and results may be beginning to bottom out. 🤔

Today we heard from Best Buy, which reported adjusted EPS was $1.38 vs. the $1.03 expected and revenues of $10.59 billion vs. the $10.31 billion expected.

Sales continued to decline against most of its product categories, with the largest declines in computing and home theater. However, revenue is higher than pre-pandemic levels as shoppers spend more per item. Additionally, same-store sales declines of 10.4% were less than the 12.9% expected, giving investors hope that sales could be turning a corner.

Despite the uncertain macroeconomic environment and lack of clarity on consumer spending, the company is sticking by its holiday outlook. Granted, that forecast was already slashed this summer, but investors are cheering the lack of further reductions. Inventory levels are also returning to pre-pandemic levels, showing that the company may be positioned better than in previous quarters.

These positive improvements sent $BBY shares up 13% today. 👍

Sponsored

Nasdaq- “IBIT Enables Investors to Participate in or Hedge Crypto Downside”

Defiance ETFs is creating unique, transparent, portfolio-based products linked to disruptive technologies – including 5G, quantum computing and hydrogen – that will change the way we live, work, play and operate. Among its offerings is the Defiance Digital Revolution ETF (NFTZ), which provides long exposure to the blockchain and digital asset ecosystem.

Recently, the firm also launched the Defiance Daily Short Digitizing the Economy ETF (IBIT), which can be used as a tool to express a bearish view on the cryptocurrency ecosystem or hedge downside risk.

Some investors see cryptocurrencies, blockchain technology and digital assets as the wave of the future, others see them as a fad. Ultimately, differing viewpoints are what makes a market. But one cannot ignore the fact that bitcoin has lost about 70% of its value in 2022, and a host of companies that operate in the crypto space have se..”

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

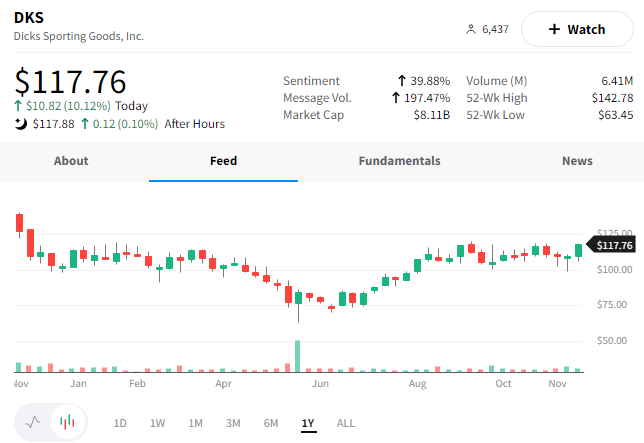

Dick’s Sticks The Landing

Dick’s Sporting Goods surprised investors today by reporting record third-quarter sales and raising its full-year guidance. 😮

The retailer saw comparable store sales rise 6.5%, with net sales rising 7.7% YoY. Its pre-tax income as a percentage of net sales was 10.3%, more than 2.5x results from the same quarter in 2019.

As for the future, the company raised its full-year 2022 comparable store sales guidance to -3.0% to -1.5%, up from -6.0% to -2.0%. It also raised its earnings guidance significantly as the structural changes to its strategy continue to play out.

Overall, the news sent $DKS shares higher by 10% and towards the top of their 1-year price range. 📈

You scratch our backs. We’ll scratch yours. 😉

Answer a quick 11-question survey to be entered into a random drawing to win one of five $100 American Express e-gift cards.

Your response will help improve the experience. You have until Friday, December 9th, at 11 am ET, to complete the survey. There is only one entry per participant. Good luck, and thank you for your participation.

Earnings

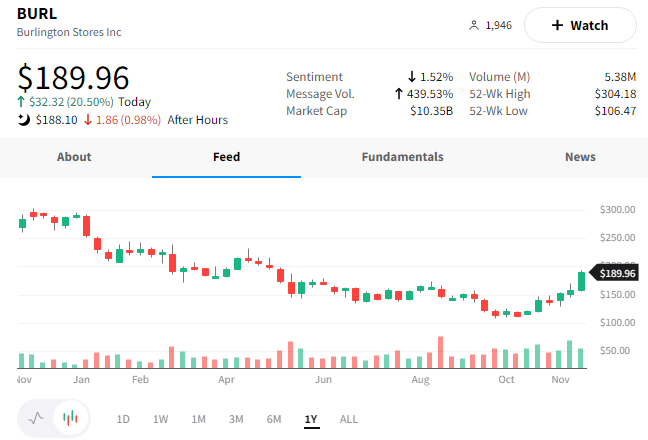

Cold Environment, Hot Results

Clothing retailers continue to surprise to the upside this quarter. Let’s take a look at today’s winners.

First is the off-price retailer Burlington Stores, which experienced a weak quarter but offered investors an upbeat 2023 outlook. 📆

The company said a challenging macroeconomic environment is a factor, noting its higher exposure to low-income consumers who are affected most by inflation. With that said, it also acknowledged some of its own missteps. CEO Michael O’Sullivan said it’s taking steps to improve its product mix and provide it an opportunity to raise prices and boost margins shortly.

Unlike its rivals, the company saw an uptick in sales in October and into November, allowing it to reaffirm its Q4 guidance. However, for next year it expects the improvements it’s making to result in stronger-than-previously-forecasted revenue and earnings.

Investors appear to be looking ahead, with $BURL shares rising over 20% today. 🔺

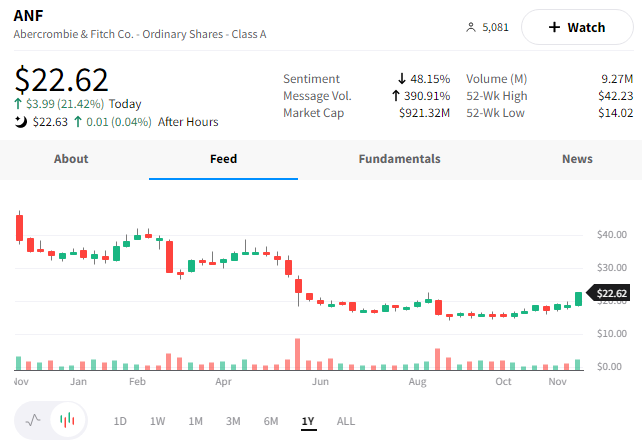

Meanwhile, mall retailer Abercombie & Fitch reported better-than-expected earnings and revenue.

The company’s $880.1 million beat expectations of $831.1 million, while a $0.01 in earnings beat the $0.14 loss expected.

Like other retailers, the company is cautiously optimistic about the holiday shopping season and says its inventory position is much better than last year’s. As a result of the improvements, it raised its full-year outlook to net sales of -2% to -3% vs. the mid-single-digit drop forecasted. 👍

Lastly, the company announced that Terry Burman is stepping down as Chairperson of the Board in January. The current director and chair of the Nominating and Board Governance Committee, Nigel Travis, will replace him.

Overall, the subtle improvements boosted $ANF shares by 22% today. 📈

Bullets

Bullets From The Day:

🛢️ U.S. oil companies’ secretive tax practices challenged. The international relief charity Oxfam filed shareholder resolutions against Exxon Mobil, Chevron, and ConocoPhillips, claiming that a lack of transparency over their global tax practices poses a material risk for long-term investors. They propose that the companies should publish reports detailing their tax practices in line with the tax standard of the Global Reporting Initiative. Several of these companies have pushed back, claiming that they follow all applicable disclosure rules in the countries they operate in. CNBC has more.

☁️ Amazon launched its second cloud region in India. The company is investing $4.4 billion through 2030 to set up its second Amazon Web Services (AWS) region in India as it looks to expand that business segment globally. Prime Minister Narendra Modi’s $1 Trillion Digital Economy vision will require a lot of expansion and innovation, leaving room for tech giants like Amazon to tap into this market to fuel future growth. This investment joins several multi-billion dollar investments Amazon has planned for Spain, Switzerland, Thailand, and the UAE. More from TechCrunch.

🔋 LG Chem builds a $3.2 billion U.S. cathode plant. The South Korean company will build a cathode materials plant for electric vehicle batteries in Tennessee. The plant will be the largest of its kind in the U.S., covering 420 acres and producing 120,000 tones of cathodes per year by 2027. That capacity will be enough to power 1.2 million pure electric vehicles. The company chose this location due to its proximity to key customers, ease of transporting materials, and government cooperation. Barron’s has more.

🏘️ Investor interest in homes drops 30% as the market cools. Real estate brokerage Redfin claims that investor home purchases dropped over 30% in Q3, marking the biggest drop since the Great Recession. Higher interest rates and record-high prices have seen homebuyer demand dry up, but now higher financing costs and stagnating rental/selling prices are also causing institutional investors to pause. Additionally, a higher risk-free rate gives investors another place to park cash that would have otherwise been used to purchase and renovate properties. More from CNBC.

❌ Paramount scraps plans to sell Simon & Schuster. The media giant is abandoning its plan to sell its book publisher to competitor Penguin Random House after a federal judge rejected the merger several weeks ago. Although this $2.2 billion deal is off the table, Paramount will collect a roughly $200 million termination fee from Penguin. And the company says it is still exploring other options to unload Simon & Schuster. CNBC has more.

Links

Links That Don’t Suck:

📈 Black Friday Sale: Subscribe to IBD Digital for the lowest price ever—just $1 for an entire month*

💰 This many Americans retire with a million dollars

🏦 ‘Anti-woke’ bank shuts down after less than 3 months

⏸️ Biden administration will extend student loan debt repayment holiday to June

⚽ Cristiano Ronaldo to leave Manchester United ‘with immediate effect’

🗺️ This map shows where Americans have the highest – and lowest – credit scores

🪑 Chips for Charity is next week, have you secured your seat at the table?

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.