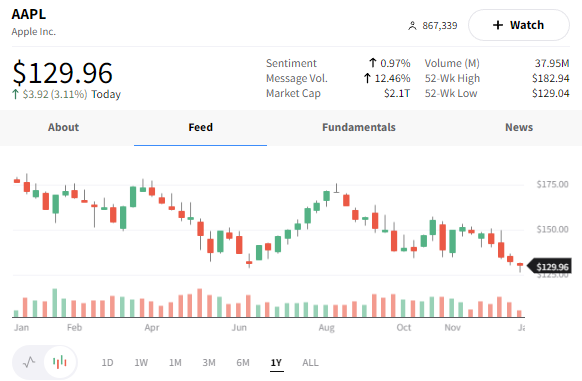

$AAPL, like the rest of the tech sector, has been hit hard in 2022. Selling pressure from sector exposure and the production slowdowns/shutdowns in China have weighed heavily on investors and Apple’s shares. 📊

But there is some reprieve coming. With China’s easing of lockdowns, J.P. Morgan analysts believe that the supply chain is likely to improve and is already showing signs of recovery.

The primary Foxconn factory has reportedly recovered to about 70% of its capacity, bringing hopes that the newest iPhone models will ship out sooner. J.P. Morgan reported that the wait time for the latest iPhone model is down to two weeks versus 30-40 days.

Apple is trading higher today at +3.14% at the time of writing. Technically, it is above yesterday’s open and is testing Tuesday’s close of $130.03 as resistance. 🍎