The gravy train continued as stocks and bonds rallied despite Powell’s attempts to talk the markets down. Let’s recap today’s biggest stories and movers. 👀

Today’s issue covers the Fed’s 25 basis point rate hike and outlook, what’s got Peloton’s wheels spinning again, and Zuckerberg’s “Meta-than-expected” earnings report. 📰

Check out today’s heat map:

10 of 11 sectors closed green. Technology (+2.37%) led, and energy (-1.91%) lagged. 💚

In international news, South Korea posted its worst trade deficit in its history in 2022 at $47.5 billion. Falling semiconductor prices and rising prices of its energy imports proved to be a double-whammy for the world’s tenth-largest economy. Meanwhile, the OPEC+ Joint Ministerial Monitoring Committee committee held its virtual meeting and did not change its recommendation for members to maintain their current production output policy. 🌏

FedEx rallied 4% on the news that it’s expanding cost-cutting measures by laying off more than 10% of its officer and director team. Joining the club was Rivian, which cut 6% of its workforce, and DraftKings, which cut 140 jobs. Intel is taking another approach to reducing expenses after a disastrous quarter, reducing the compensation of its management teams between 5% and 15%. ✂️

T-Mobile U.S. shares rose 1.11% after posting mixed results and forecasting a slower rate of postpaid-customer growth in 2023. 📱

Altria shares jumped 5.55% after beating earnings estimates and approving a $1 billion share buyback program. 🚬

Chipmaker Qorvo gave back today’s gains after reporting earnings. It beat top and bottom-line estimates but provided weaker-than-expected guidance. 🏭

Healthcare behemoth McKesson is up 2% in extended hours after beating earnings and revenue expectations. 🏥

In crypto news, the U.K.’s new plans to regulate the crypto industry include strengthening the rules around crypto lending, which was one of the leading contributors to the fall of FTX. On a related front, Shark Tank’s Kevin O’Leary welcomes regulation of the industry, saying there is a 100% chance of another crypto debacle as unregulated exchanges experience massive outflows. ₿

Other symbols active on the streams included: $MSGM (+72.66%), $BGXX (+171.77%), $GMBL (+8.16%), $IVDA (+33.50%), $VS (+172.09%), $EBET (+43.79%), $MGAM (+44.19%), and $SBET (+42.57%). 🔥

Here are the closing prices:

| S&P 500 | 4,119 | +1.05% |

| Nasdaq | 11,816 | +2.00% |

| Russell 2000 | 1,961 | +1.49% |

| Dow Jones | 34,093 | +0.02% |

Earnings

Meta-Than-Expected Results

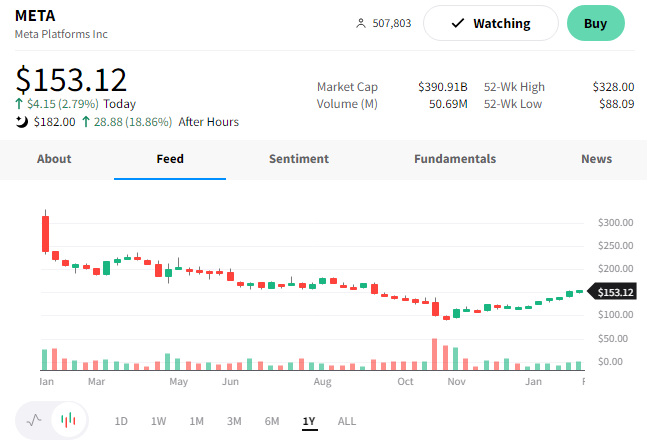

Don’t look now, but Meta’s stock has doubled over the last three months. Part of that move is coming after hours, where the tech giant released better-than-expected results. 😮

It reported adjusted earnings per share (EPS) of $1.76, missing the $2.22 analyst estimate. Partially driving that weakness was restructuring charges of over $4 billion incurred during the fourth quarter. However, total costs and expenses rose 22% YoY to $25.8 billion, so it’s hard to blame restructuring solely. 🔻

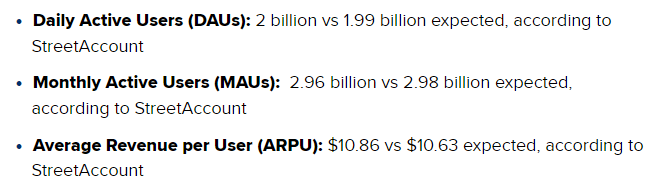

Overshadowing the earnings miss were revenue and user metrics.

The company reported $32.17 billion in revenue vs. the $31.53 billion expected. The 4% YoY decline marked the third straight quarter of declining sales. However, it reported the following key metrics as Zuckerberg highlighted community growth and strong engagement. 👍

With that said, Zuckerberg emphasized that the company’s 2023’s management theme is the ‘year of efficiency,’ with a renewed focus on becoming a stronger and more nimble organization.

As a result, the company expects full-year expenses of $89 to $95 billion in 2023, lower than its previous outlook of $94 to $100 billion. Driving that is slower payroll expense and cost of revenue growth. It’s also lowered its capital expenditure estimates from $34-$37 billion to $30-$33 billion. ✂️

On the sales front, it expects first-quarter revenue of $26-$28.5 billion. Last year’s numbers were $27.9 billion, and analysts expect $27.1 billion.

The company is still betting heavily on the metaverse as its next major growth driver. However, it’s taking steps to restart growth in its core advertising business and is “getting its fiscal house in order” by reducing costs where it can.

On top of that, the company is “buying the dip” in its own shares. It authorized a $40 billion buyback program, helping send shares of $META up 20% after hours to a 7-month high. 📈

Since the December meeting, commentary from the Fed’s members hinted at smaller rate hikes ahead, as did the economic data. The remaining questions were how high would the Fed take rates before pausing and how long will it need to leave them there before inflation makes a sustained move towards the 2% target?

As a result of that information, the bond market was pricing in a 25 bp hike at today’s meeting, another in March, and then a pause at the May meeting. And today, Jerome Powell and the Federal Open Market Committee (FOMC) unanimously delivered exactly what was expected.

So what, if anything changed? And why did the market react the way it did?

To help answer question one, we turn to Nick Timiraos of The Wall Street Journal. As usual, he did a great job outlining what’s changed via Twitter and a follow-up article. But we’ll cover the main points below.

FOMC decision:

25 bps increase (approved unanimously)

FOMC statement:

Minimal changes to the forward guidance

“Ongoing increases” language is retained pic.twitter.com/RUFCV2HEc8— Nick Timiraos (@NickTimiraos) February 1, 2023

The redline version of the statement reiterated that not much has changed since the last meeting.

The key takeaway is that the Fed maintained its “ongoing increases” language, which means all eyes turned to Powell’s press conference. As usual, reporters probed and prodded Powell on the release’s language and recent economic events.

In return, Powell did his best to tow the hawkish line, with phrases such as: “We are talking about a couple more rate increases…”, “The job is not fully done…” and “It would be worse to get close to getting on top of inflation and then find out in six or 12 months that we didn’t do enough…”

Yet despite his efforts, stocks, bonds, and other risk assets continued to rally. And while there are many drivers of today’s rally, two stick out the most.

The first is that as the pace of hikes slows, it removes uncertainty and volatility from the market. Secondly, and arguably more important, financial conditions continue to ease because expectations are that inflation will fall faster than the Fed anticipates.

And that’s the critical point. Just as the bond market anticipated inflation better than the Fed on the way up, it’s betting it will also do so on the downside. A faster decline in inflation means the Fed could pause or reverse its tightening policy sooner rather than later. And lower rates are a positive for stocks.

Essentially, the market is playing a game of chicken with the Fed. And whoever is right about inflation’s path will be right about the appropriate level of interest rates.

All we can do now is see who flinches first. But while we wait for that to happen, let’s quickly recap today’s economic data dump.

January’s employment data is released this week, giving the Fed another reading on the labor market. While wage growth has slowed, the labor market remains tight by historical standards.

First up today was the ADP payroll number. January’s report indicated that private companies added 106,000 new workers, well below the 190,000 expected. Strength in the services sector continued, with the hospitality industry responsible for roughly 95,000 new jobs. Additionally, larger companies fared better than smaller firms in attracting workers, likely due to their ability to pay higher wages. 🔻

Expectations for the Job Openings and Labor Turnover Survey (JOLTS) were for a continued decline in job openings. Instead, December’s report showed a sharp rise to 11.01 million, outpacing the 10.25 million expected by analysts. The accommodation and food services industries led the charge in hiring efforts, followed by retail trade and construction. Layoffs climbed about 4.1% MoM, and the number of workers quitting their job was about flat. 🔺

The number of job openings to available workers ratio ticked back up to 1.9 after falling in October and November.

Moving onto manufacturing activity, the Institute for Supply Management (ISM) indicated that the manufacturing Purchasing Manager’s Index (PMI) fell from 48.4 to 47.4 in December. This represents the third straight monthly contraction, with the index settling at its lowest since May 2020. The U.S. manufacturing sector represents 11.3% of the U.S. economy, and any readings below 50 indicate a contraction in activity. 🏭

Meanwhile, some analysts speculate that a trough in the eurozone’s manufacturing activity has already occurred. S&P Global’s final manufacturing PMI for January rose to 48.8, up from 47.8 in December. While that value is still in contraction territory, it marks a five-month high in activity. Elsewhere, the world’s second-largest economy’s (China) reading edged up to 49.2, its sixth month in contraction territory.

Whether or not the recent uptick in manufacturing activity is a genuine turning point or a blip within its downward trend remains to be seen. But what is clear is that the labor market remains strong, and that’s keeping the Fed aggressive in their policy decisions as they fight inflation.

And in the face of that aggressive stance, the market is front-running the Fed once again and loosening financial conditions. All we can say is that bulls better hope they’re right on inflation’s path (and the Fed’s subsequent moves), or things could turn ugly very quickly. 😬

Peloton investors have certainly been taken for a ride over the last two years but may finally be seeing a return on their pain.

Let’s see what has everyone, including the stock, so pumped. 👀

Before the opening bell, the company reported a loss per share of $0.98 per share. While that is wider than the expected $0.64 per share loss and its eighth straight quarter without a profit, it was a narrower decline than the prior year.

While that news is marginally positive, its revenue and subscriber numbers were the show’s real stars. Its revenues of $792.7 million blew away the $710 million consensus estimate and the company’s $700 to $725 million expected range. Although revenue is still down 30% YoY, the company ended the quarter with 6.7 million total members and 3.03 million connected fitness subscriptions. That represents a 10% YoY jump. 👍

One concern for analysts remains that the company continues to lose money on hardware, with gross equipment margins of -11.2%. However, subscription gross margins of 67.6% helped drive total gross margin up significantly YoY to 29.7%. Executives see the hardware loss as a cost of customer acquisition since they know profits on its subscriptions will offset the upfront losses…as long as they keep that customer.

Its CEO Barry McCarthy referred to this quarter’s results as a “potential turning point” for the business, which has been on the turnaround path for over a year. When he joined, the priority was proving the viability of the business and improving free cash flow and profitability. But now that many of the company’s initiatives are producing results, the priority has shifted back towards growing the business well into the future. 📈

That positive sentiment translated to a strong first-quarter outlook. The company expects sales of $690 to $715 million and a total gross margin of about 39%. Wall Street had expected $692.1 million in sales. 💪

The remaining questions for investors are how fast can it grow? Where is that growth coming from? And what level of portability can the company achieve? Executives say they hope to begin answering those questions in the coming quarters.

$PTON shares pumped 26% on the news. It joins the likes of other tech companies, like Spotify and Meta, which have surprised to the upside this week. 🤩

Bullets

Bullets From The Day:

🤪 Cathie’s crazy 2023 predictions include a robot takeover at Amazon. ARK Invest has released its annual “Big Ideas” report this week, with the 153-page document delivering thoughts on everything from hypersonic flight to molecular biomarkers for cancer detection. What’s capturing headlines is that the firm expects this category of “disrupters” to experience super-exponential growth to reach a value of $200 trillion by 2030. It also mentions some company-specific forecasts. One of those is regarding Amazon. She says that the company is currently adding about a thousand automated robots to its operations each day, which will drastically impact its workforce mix in the coming years. Yahoo Finance has more.

💳 Biden administration takes aim at U.S. credit card fees and app charges. The U.S. and other western governments continue to push policies that intend to promote competition in consumer markets. The latest efforts include the Consumer Financial Protection Bureau proposing a rule to ban “excessive” credit card fees, capping late fees at $8, much lower than the current average of $31. They’re also looking to reign in “junk fees” that raise the costs of consumer services like accommodation, mobile plans, air travel, and more. Lastly, the Commerce Department’s recent report denounced the dominance of Apple and Google in the app economy, which it says drives up costs and limits innovation. More from Reuters.

📺 New Netflix password-sharing rules require you to visit home more often — or pay for your own subscription. The streaming service rolled out its latest efforts to balance password sharing within a household while minimizing usage by outsiders. It’s testing extra membership fees for account sharing in Chile, Costa Rica, and Peru by asking people to define a primary location through their TV. Once that’s selected, any device on that network will be able to sign into the same Netflix account. After the location is set, every user will need to launch the app at the primary location at least once every 31 days to maintain access. TechCrunch has more.

⚡ Disappointing returns have oil giant BP reconsidering its green-energy strategy. The company’s Chief Executive Officer, Bernard Looney, is reportedly looking to narrow the company’s investments and strategy in green energy. Sources suggest he intends to focus less on environmental, social, and governance (ESG) goals going forward as he attempts to convince shareholders that the company’s efforts in this area will not reduce its focus on maximizing the profitability of its oil and gas business. More from MoneyControl.

❌ Adani abandons $2.5 billion share sale following market plunge. The flagship firm reversed its share offering after U.S. short-seller Hindenburg Research’s report wiped billions in value from its value. To protect the interests of its investors and try to restore confidence in the marketplace, it’s returning the proceeds raised and will revisit its capital market strategy once the market stabilizes. Executives say that this will not impact its existing operations or future plans. CNBC has more.

Links

Links That Don’t Suck:

❌ Gawker is shutting down for a second time

🏈 This time, Tom Brady announced his retirement on his own terms

🤑 Dad lets 6-year old play with his phone, and he orders $1k worth of GrubHub

🗳️ Biden to remake economic team with Brainard, Bernstein poised for top roles

🍪 Junk food companies say they’re trying to do good. A new book raises doubts

🪫 How ‘modern-day slavery’ in the Congo powers the rechargeable battery economy

😩 ‘Big Short’ legend Michael Burry issues a grave warning to investors with a one-word tweet: ‘Sell.’