The S&P 500 just logged its best January in four years, and the Nasdaq’s January gain was its best since 2001. Tomorrow’s Fed meeting will determine whether or not the market’s optimism is warranted. In the meantime, let’s see what you missed today. 👀

Today’s issue covers one tech stock hitting the SPOT while another SNAPs, earnings from semiconductor giants Samsung and AMD, and what a strong January could mean for the rest of the year. 📰

Check out today’s heat map:

Every sector closed green. Consumer discretionary (+2.29%) led, and utilities (+0.74%) lagged. 💚

In economic news, the employment cost index rose 1% in the fourth quarter, less than the 1.1% expected. It joins the growing group of inflation gauges that continue to trend lower. The housing market continues to cool, as the S&P Case-Shiller index experienced its fifth straight monthly decline in November, coming in at +7.7% YoY. And finally, the Chicago Purchasing Manager’s Index fell again in January, its fifth straight month in contraction territory. 🏭

Internationally, the eurozone’s Q4 GDP surprised to the upside, coming in at +0.1% vs. the -0.1% expected. European stocks also rallied sharply in January as optimism about the region’s economic outlook grew. And speaking of optimism…the International Monetary Fund updated this year’s outlook saying a global recession will probably be avoided. 🔺

Homebuilding stocks approached their year-to-date highs, led by Pulte Home Group. The company’s shares rallied 9% after reporting a fourth-quarter profit that rose 33%. 🏘️

General Motors shares jumped 8% after reporting a better-than-expected fourth-quarter profit and sharing a strong 2023 forecast. However, its executives say they don’t expect significant U.S. production of EVs until the second half of the year. 🚗

McDonald’s shares cooled by 1% after higher costs weighed on its quarterly profits. U.S. store traffic remains strong as inflation-impacted consumers trade down from full-service restaurants to cheaper alternatives. 🍟

Exxon Mobil rose 2% on the day after reporting a $56 billion net profit for 2022, sparking renewed scrutiny from fossil fuel critics. 🛢️

And Phillips 66 shares dropped 5% despite strong product demand. Declines in its refining margins caused its fourth-quarter earnings to miss expectations. ⛽

Other symbols active on the streams included: $MSGM (+13.69%), $GNS (+11.40%), $MULN (+5.33%), $WISA (-20.23%), $CNTX (+55.20%), $MGAM (+161.93%), and $AI (+21.78%). 🔥

Here are the closing prices:

| S&P 500 | 4,077 | +1.46% |

| Nasdaq | 11,585 | +1.67% |

| Russell 2000 | 1,932 | +2.45% |

| Dow Jones | 34,086 | +1.09% |

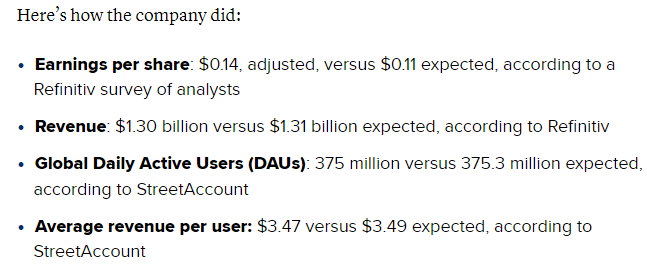

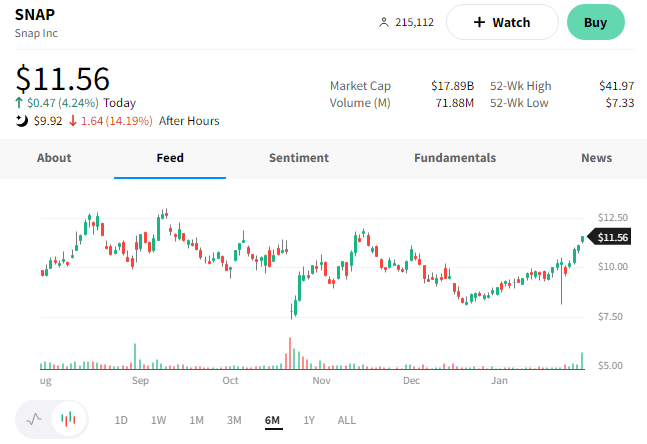

Another quarter, another post about Snap’s disappointing earnings results. In what seems to be a tradition at this point, the company missed revenue expectations but beat on earnings.

CNBC recaps the key numbers below:

The challenging macro environment has pressured ad sales and caused many companies, including Snap, to retrench and manage expenses. Given the macroeconomic headwinds, platform policy changes, and increased competition that executives blamed for current results aren’t going anywhere, it could be another tough year for the company. 😬

Additionally, the company declined to provide guidance for the third straight quarter. Instead, it told investors that it’s refocusing investments to concentrate on growing community and engagement, accelerating and diversifying its sales growth, and developing augmented reality technologies.

Essentially, that means they’re trying to run a better business. So far, investors are disappearing faster than the app’s messages, with $SNAP shares falling 14% after hours. 📉

Meanwhile, Spotify managed to deliver fourth-quarter results that were “music to investors’ ears.” 🎧🎶

The company’s loss per share of 1.40 euros was wider than the 1.27 euros expected. But revenues of 3.17 billion euros topped estimates by a hair.

However, what investors were focused most on was Spotify’s 489 million monthly active users, which was up 20% YoY. This included 33 million net additions in the quarter and 205 million paid subscribers, which is up 14% YoY.

Executives continue to cut costs and invest in advertising, with its ad-supported revenue growing to account for 14% of total revenue. That growth was driven by podcasting, an area in the company that’s recently struggled to gain traction in despite its significant investments. 🎙️

While the company still has work to do, investors seem to think it’s on the right path. $SPOT shares rose nearly 13% following the news. 📈

In addition to the above, several other tech names were on the move. 👀

Electronic Arts plunged more than 10% after its results and forecast were below consensus estimates. Executives expect layoffs and shelved mobile versions of two of its popular games.

Match Group fell nearly 10% after the company’s first-quarter forecast failed to impress.

Western Digital dropped nearly 6% after the company’s forecast fell short of expectations.

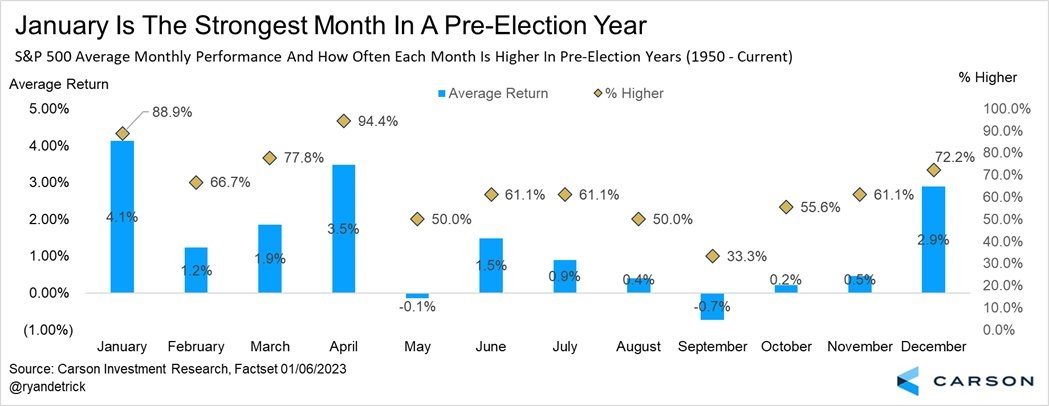

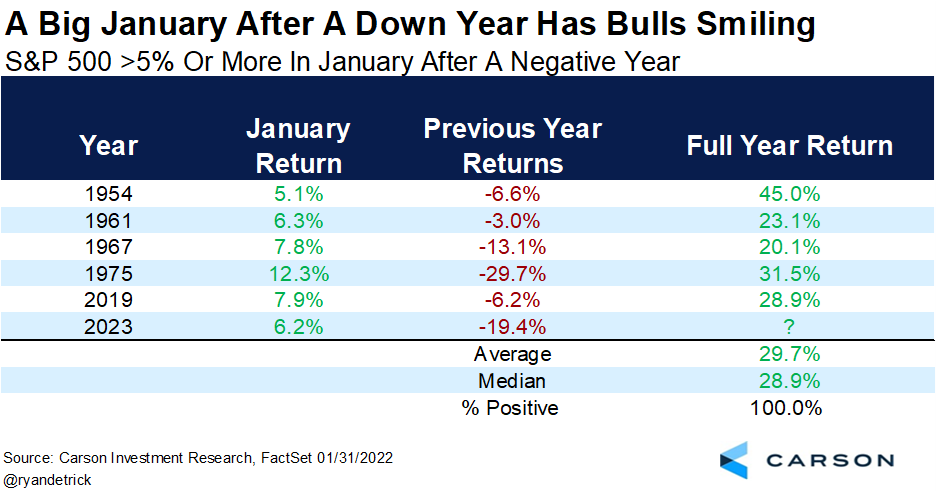

What is a bullish slingshot, and why should we care? Today we’re looking at three tweets from Ryan Detrick of the Carson Group, who is making a bullish case for stocks.

In his first tweet, Ryan noted that January is seasonally a strong month during a pre-election year. And this year didn’t disappoint, with the S&P 500 gaining 6.2% in January. That’s the index’s best January since 2019 (7.9%) and 1989 (7.1%). 📆

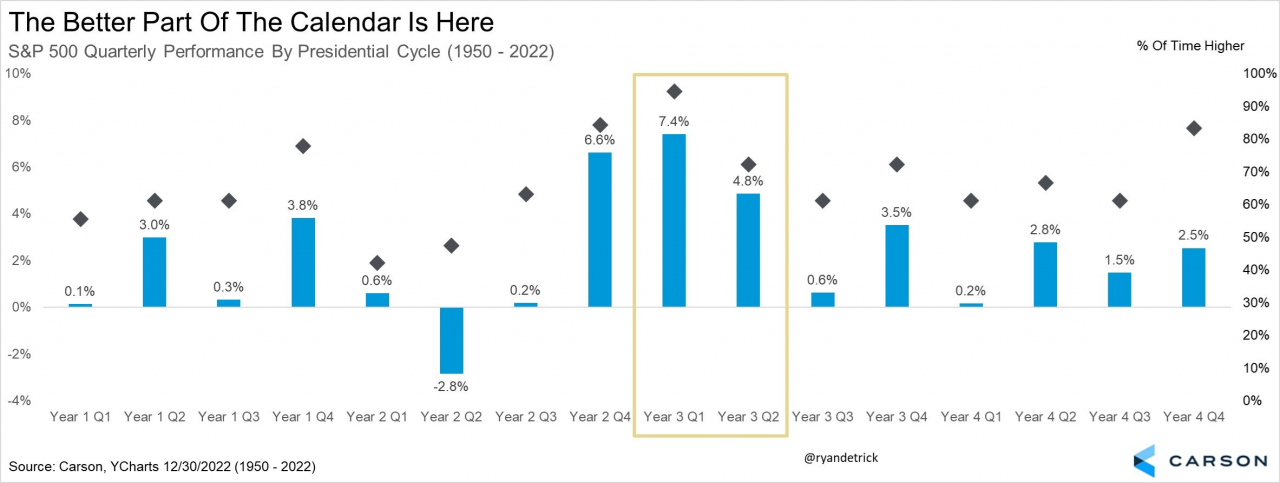

In his next tweet, he points out that pre-election years typically see strong first halves of the year as well. Combine that with many Wall Street professionals expecting the opposite, and you’ve got quite the contrarian case. 🐂

In his third tweet, Ryan brings it all home, where he points out that a strong January performance following a negative year has historically yielded impressive full-year returns.

He does note that the sample size is only five times, but all five have been positive, with a median return of 28.9%. 🤩

Much like the contrarian charts we discussed yesterday, it’s hard to decide on these data points alone. Whether or not we see the market truly “slingshot” higher remains to be seen. But at the very least, this historical context gives market participants something to think about as they approach the coming months. 🤔

Semiconductors remain a crucial focus for market participants as a leading indicator for the tech sector and global economy. As a result, when big names in the industry report earnings, they attract a lot of attention. 👀

Today we heard from Samsung Electronics, which saw its quarterly profits fall 69% to an 8-year low of $3.5 billion. Revenues also fell 8% to $57.3 billion. Analysts had expected the poor results given the company’s pre-earnings announcement earlier this month, but these were still difficult for investors to stomach. 🤢

Executives blamed a business environment that significantly deteriorated due to concerns over a global economic slowdown. Its mobile and personal computer (PC) segments suffered as customers adjusted their inventories to reflect the macro uncertainty.

The smartphone and PC weakness is something we’ve seen from most companies this quarter, so that’s not surprising. Unfortunately for Samsung, strength in other segments wasn’t enough to offset that decline. 🖥️

Analysts expect quarterly profits to remain pressured as demand stays soft and memory chip prices continue to fall. Shares of Samsung were down about 4% in U.S. trade. 🔻

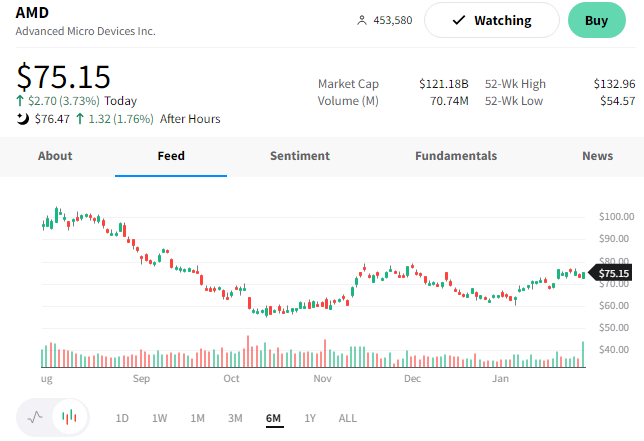

Meanwhile, Advanced Micro Devices managed to eke out an upside surprise, beating on the top and bottom lines. 😮

The company’s adjusted earnings per share of $0.69 beat the $0.67 expected. And revenues of $5.6 billion topped the $5.5 billion consensus estimate.

AMD is also facing slowing sales of its PC chips and graphics processors. Its client group segment saw a 51% YoY decline in revenue as its customers have too much inventory of its chips on hand. In addition, its gaming business was also down 7% YoY. However, its 42% YoY growth in data center revenue helped offset this weakness and boost results. ⛅

Executives expect $5.3 billion in sales for the current quarter. That’s slightly below estimates and represents a 10% QoQ decline. They also expect a key metric, adjusted gross margins, to be about 50% in the quarter.

Overall, its “better-than-its-peers” results were enough to keep its stock in the green. $AMD shares were up another 2% after hours. 👍

Bullets

Bullets From The Day:

❌ U.S. blocks Huawei’s export license renewals. China’s government is accusing the U.S. government of pursuing “technology hegemony” as it increases pressure on Chinese tech giant Huawei by blocking its access to U.S. suppliers. That’s because the Biden administration has recently stopped approving renewal licenses to several U.S. companies selling essential components to certain Chinese companies. Companies around the globe remain in the middle of the geopolitical conflict, leaving them to adjust their businesses around the regularly-changing regulatory environment. AP News has more.

✂️ Yet another tech company is announcing layoffs. Fintech favorite PayPal is cutting about 7% of its workforce, impacting about 2,000 employees in the coming weeks. Its CEO, Dan Schulman, noted that the cuts are part of the company’s efforts to address the challenging macroeconomic environment. Like other technology companies, PayPal has been forced to focus its resources on core priorities and rightsize its cost structure. However, work remains to be done. More from CNBC.

💰 Stripe is in talks to receive a multi-billion-dollar investment. Thrive Capital is reportedly committing $1 billion as part of a new investment that values the fintech company between $55 and $60 billion. Speculation was that the company sought to raise $2 billion, but new information suggests it could be closer to $2.5 to $3 billion. The company is expected to use the fresh capital to address the expiring restricted stock units of veteran employees and the significant employee tax bill associated with it. The new round would represent a roughly 40% haircut from the company’s last raise of $600 million at a $95 billion valuation in 2021. TechCrunch has more.

🕵️ Investigators rule that Apple infringed on worker rights. The National Labor Relations Board ruled that Apple has illegally imposed rules on its employees that prohibit them from discussing their wages and participating in other protected activities. The investigation found that various work rules, handbook rules, and confidentiality rules at the company break the law because they reasonably tend to interfere with, restrain, or coerce employees who try to assert their labor rights. As for the consequences, the NLRB cannot impose penalties but can mandate employers to implement “make-whole remedies.” More from CNN Business.

💉 Covid pandemic boosts Pfizer’s revenue to a record. The Pharmaceutical giant saw its sales surpass $100 billion in 2023, propelled by strength in its Paxlovid antiviral pill. The Covid vaccine generated $37.8 billion in sales (up 3% YoY), while Paxlovid sales rose to $18.9 billion in its first full year available as an antiviral treatment option. However, the last few years will make its forward comps very difficult, with executives expecting 2023 revenue to decline as much as 33% to a range of $67 to $71 billion as the pandemic continues to transition to endemic. CNBC has more.

Links

Links That Don’t Suck:

🔭 Bizarre ‘whirpool’ appears in night sky above Hawaii

👨💼 These jobs are most likely to be replaced by chatbots like ChatGPT

✈️ Boeing bids farewell to an icon, delivers last 747 jumbo jet

🤖 OpenAI releases tool to detect AI-generated text, including from ChatGPT

📰 Instagram’s co-founders introduce a new social app…for news reading

💊 AbbVie’s blockbuster drug Humira finally loses its 20-year, $200 billion monopoly

⛈️ Nearly 1,000 flights already canceled Tuesday as winter storm rolls through the U.S.

👍 Menarini shows Big Pharma how it’s done with first approval for oral SERD drug in breast cancer